- China

- /

- Auto Components

- /

- SHSE:688155

Undiscovered Global Gems To Explore In March 2025

Reviewed by Simply Wall St

As global markets face heightened volatility, with U.S. consumer confidence dropping and growth stocks underperforming, investors are increasingly cautious amid persistent inflation and policy risks. In this environment, identifying undiscovered gems—stocks that show potential for resilience and growth despite broader market challenges—can be a strategic approach to navigating uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 0.80% | 18.00% | ★★★★★★ |

| Shanghai SK Automation TechnologyLtd | 41.33% | 36.10% | 2.28% | ★★★★★☆ |

| Hefei Gocom Information TechnologyLtd | 1.53% | 9.89% | -9.49% | ★★★★★☆ |

| Xinlei Compressor | 10.18% | 6.62% | 1.44% | ★★★★★☆ |

| Keli Motor Group | 21.66% | 9.99% | -12.19% | ★★★★★☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 31.26% | 0.80% | 0.71% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 25.89% | 19.10% | -30.70% | ★★★★☆☆ |

| Yuan Cheng CableLtd | 112.32% | 6.17% | 58.39% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Shanghai Smith Adhesive New MaterialLtd (SHSE:603683)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Smith Adhesive New Material Co., Ltd specializes in the manufacture and sale of adhesive tapes and adhesives in China, with a market capitalization of CN¥3.19 billion.

Operations: Shanghai Smith Adhesive New Material Co., Ltd generates revenue primarily from the sale of adhesive tapes and adhesives. The company's market capitalization stands at CN¥3.19 billion, reflecting its position in the Chinese market.

Shanghai Smith Adhesive New Material Ltd, a promising player in the adhesive sector, has demonstrated robust earnings growth of 106.4% over the past year, significantly outpacing the chemicals industry's -5.4%. The company's debt to equity ratio has risen from 43.7% to 51.5% over five years, yet its net debt to equity remains satisfactory at 34.9%. Interest payments are well covered by EBIT at 6.1x coverage, reflecting strong financial health despite negative free cash flow trends recently observed. With high-quality earnings and solid interest coverage, Shanghai Smith seems poised for continued resilience in its niche market segment.

- Take a closer look at Shanghai Smith Adhesive New MaterialLtd's potential here in our health report.

Shanghai SK Automation TechnologyLtd (SHSE:688155)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai SK Automation Technology Co., Ltd focuses on the research, development, production, and sale of intelligent manufacturing equipment for both new energy and fuel vehicles, with a market capitalization of CN¥5.74 billion.

Operations: Shanghai SK Automation Technology Co., Ltd generates revenue primarily from the sale of intelligent manufacturing equipment tailored for new energy and fuel vehicles. The company's financial performance is characterized by its net profit margin, which reflects the efficiency of its operations in converting revenue into profit.

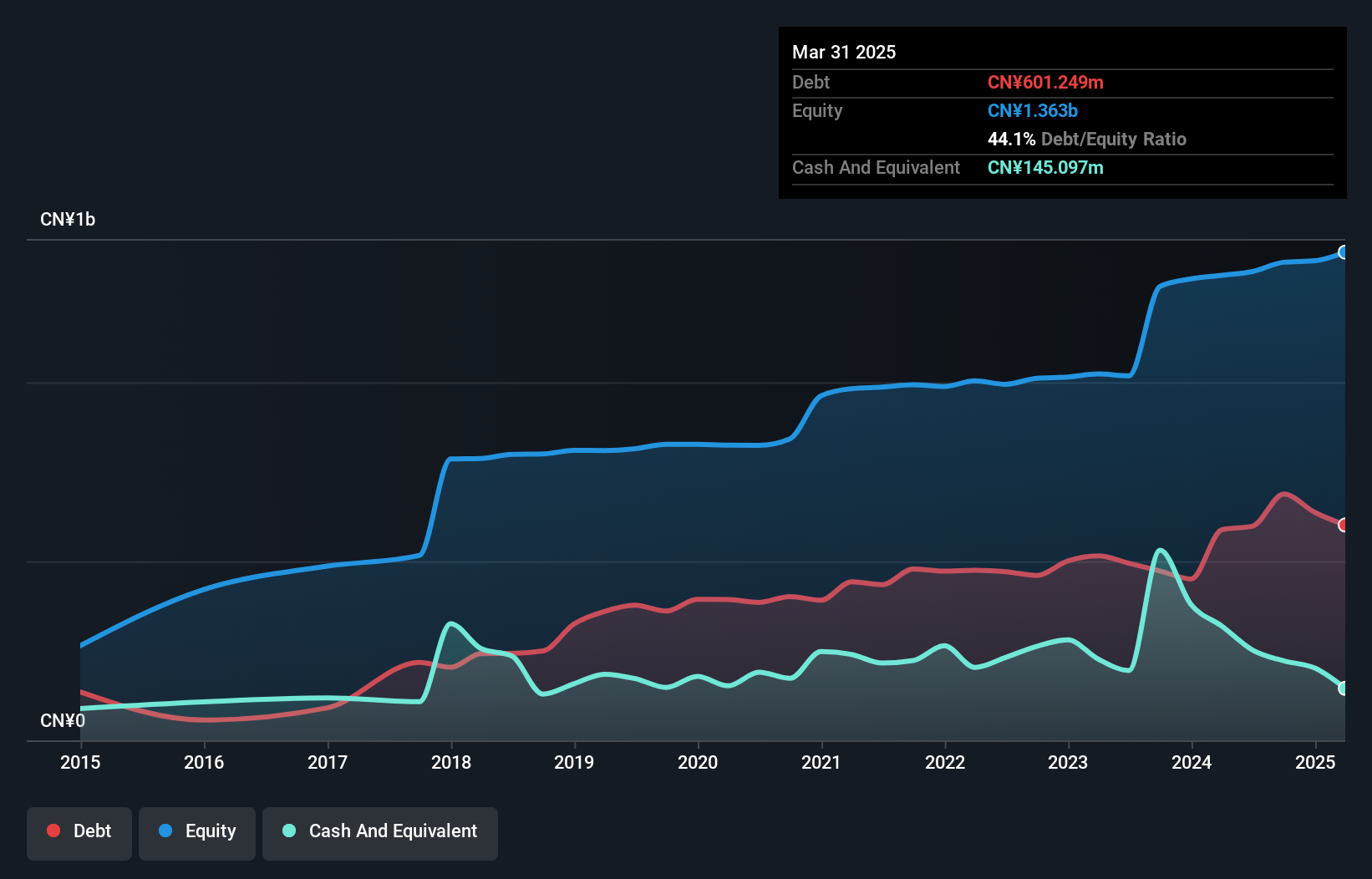

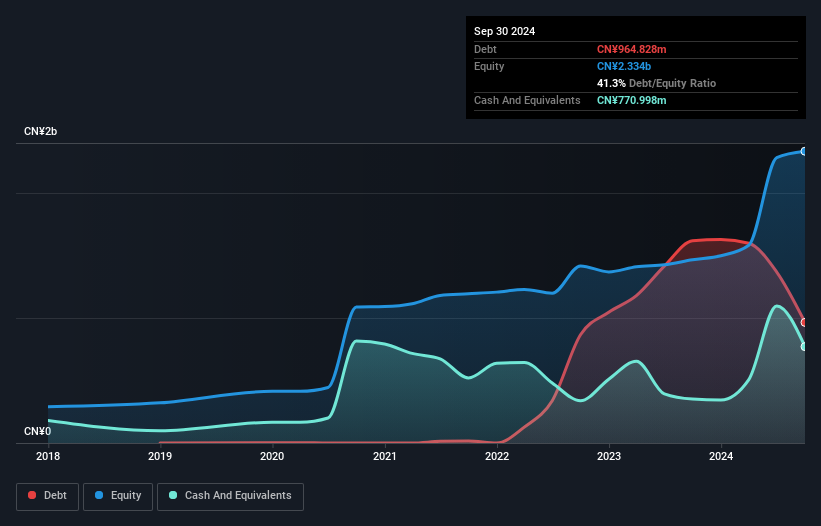

Shanghai SK Automation Technology has been making waves with its impressive financial performance. Over the past year, earnings skyrocketed by 457%, far outpacing the Auto Components industry's growth of 11.6%. The company's net income jumped to CNY 222.64 million from CNY 39.95 million the previous year, reflecting a significant improvement in profitability. Its net debt to equity ratio stands at a satisfactory 8%, indicating prudent financial management, while interest payments are well covered by EBIT at an impressive 11 times coverage. Trading at about 46% below estimated fair value, it presents a compelling opportunity for investors seeking undervalued prospects in automation technology.

Namura Shipbuilding (TSE:7014)

Simply Wall St Value Rating: ★★★★★★

Overview: Namura Shipbuilding Co., Ltd. operates globally in the manufacture and sale of ships, machinery, and steel structures, with a market capitalization of ¥136.19 billion.

Operations: Namura Shipbuilding generates revenue primarily from its New Ship segment, contributing ¥123.30 billion, followed by the Repair Ship segment at ¥23.35 billion and Steel Structure/Machinery at ¥6.07 billion.

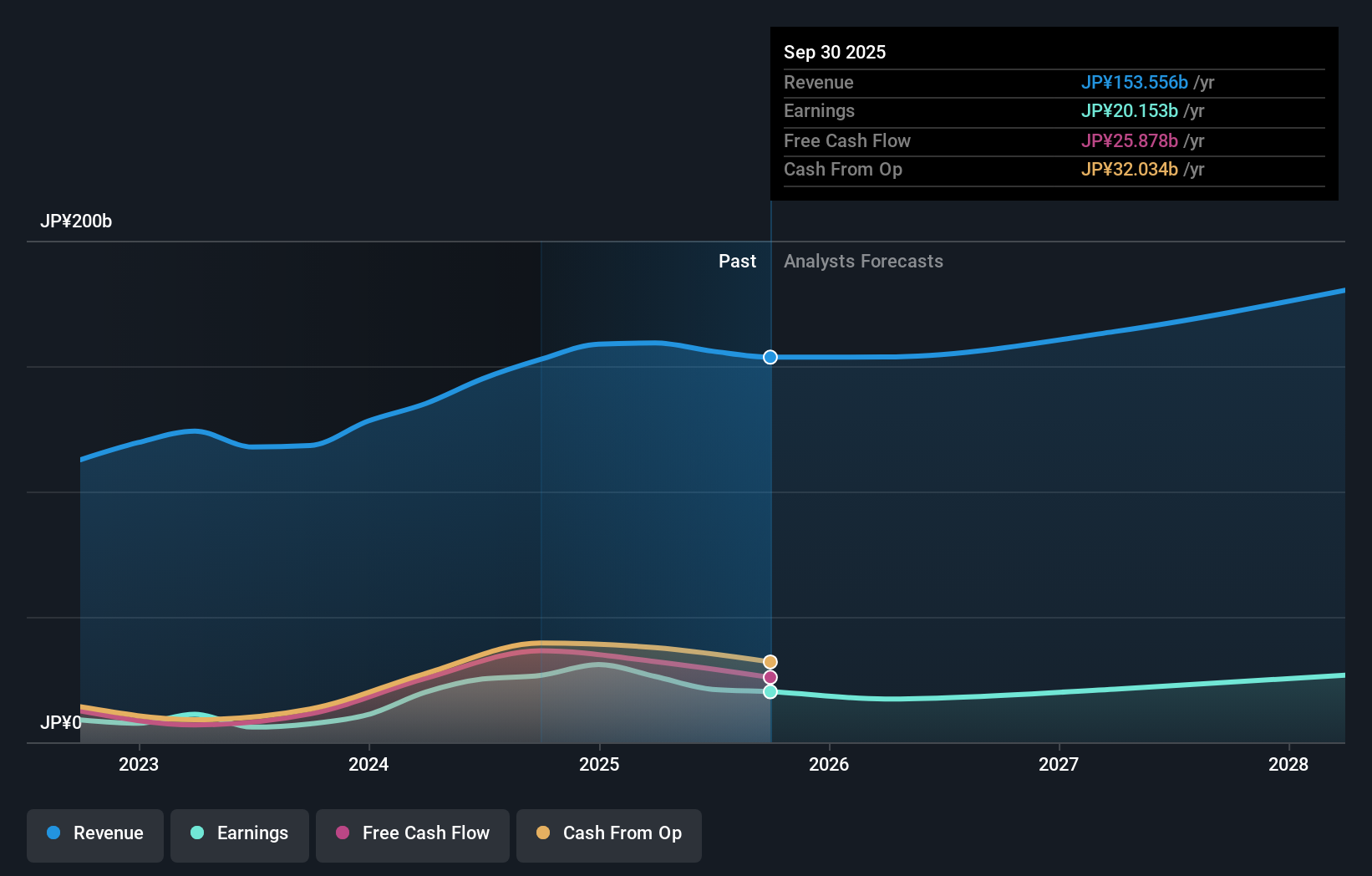

Namura Shipbuilding, a smaller player in the industry, showcases impressive earnings growth of 180.7% over the past year, outpacing the broader machinery sector's 4%. This growth is underpinned by high-quality earnings and a reduced debt-to-equity ratio from 28.9% to 11.6% over five years, indicating stronger financial health. Trading at a significant discount of 79.1% below estimated fair value, it offers potential upside for investors seeking undervalued opportunities. Despite recent share price volatility, Namura remains profitable with positive free cash flow and more cash than total debt, suggesting robust operational efficiency ahead of its upcoming earnings release on February 13th.

Seize The Opportunity

- Get an in-depth perspective on all 3193 Global Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688155

Shanghai SK Automation TechnologyLtd

Engages in the research, development, production, and sale of intelligent manufacturing equipment for new energy vehicles and fuel vehicles.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives