In the midst of a global market landscape characterized by mixed performances and cautious optimism, smaller-cap indexes have shown resilience, even as broader indices like the S&P 500 and Dow Jones Industrial Average exhibit fluctuations. With the Federal Reserve holding rates steady amid persistent uncertainty and economic indicators revealing both challenges and opportunities, investors are increasingly seeking out potential undiscovered gems that can thrive in such dynamic environments. Identifying promising stocks often involves looking for companies with strong fundamentals that can navigate economic shifts while capitalizing on unique growth opportunities within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 32.83% | 39.29% | ★★★★★★ |

| Soft-World International | NA | -1.24% | 5.77% | ★★★★★★ |

| Donpon Precision | 45.58% | 2.76% | 46.41% | ★★★★★★ |

| Chongqing Machinery & Electric | 25.60% | 7.97% | 18.73% | ★★★★★☆ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 13.81% | -0.34% | -27.47% | ★★★★★☆ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

| Li Ming Development Construction | 158.65% | 19.65% | 25.78% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Zhou Liu Fu Jewellery (SEHK:6168)

Simply Wall St Value Rating: ★★★★★☆

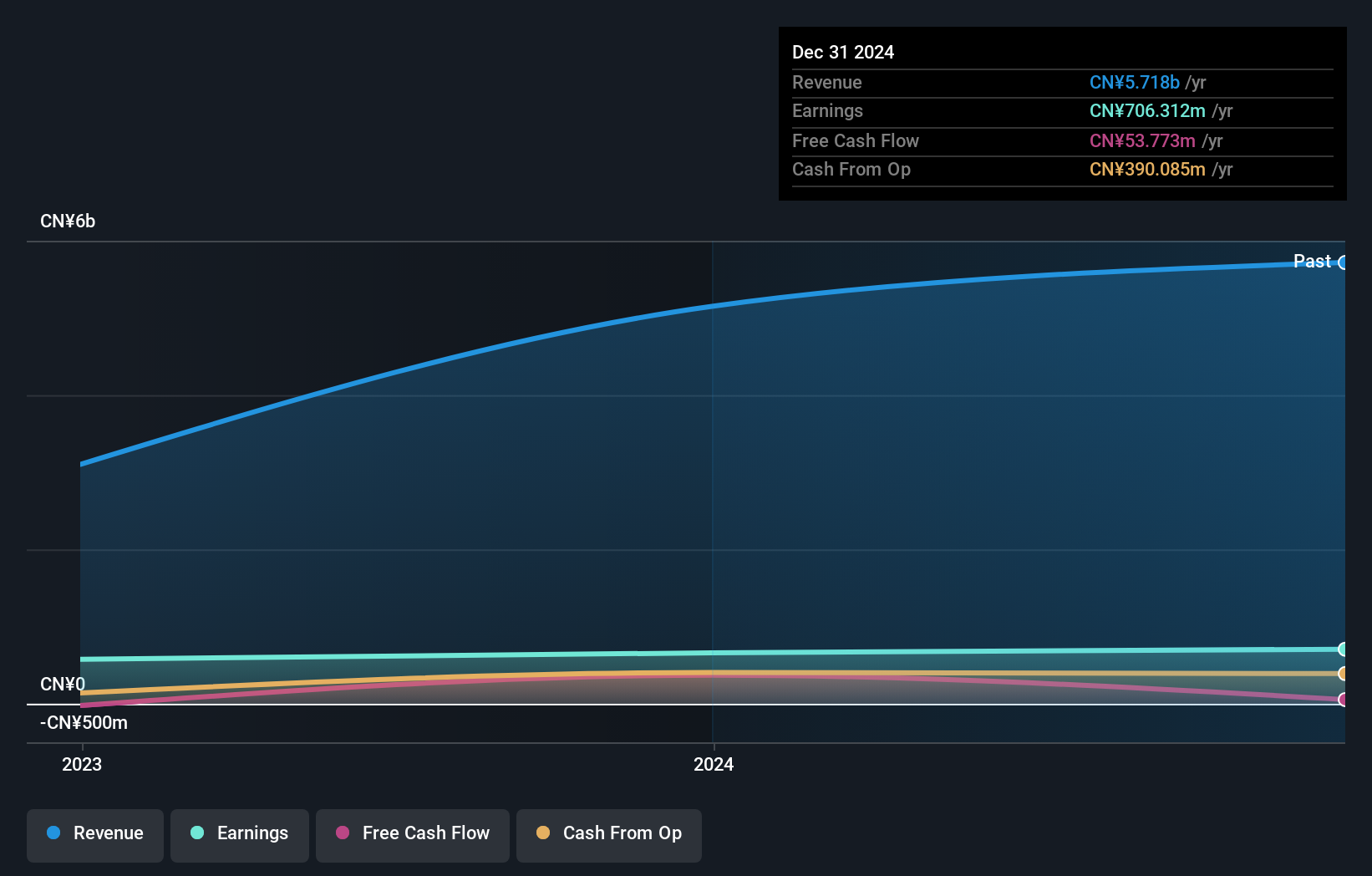

Overview: Zhou Liu Fu Jewellery Co., Ltd. operates in China, focusing on the research, design, development, manufacture, and retail of jewelry with a market capitalization of approximately HK$8.95 billion.

Operations: Zhou Liu Fu Jewellery generates revenue primarily from its jewelry segment, which reported CN¥5.72 billion. The company's financial performance is highlighted by a focus on this single revenue stream within the Chinese market.

Zhou Liu Fu Jewellery, a small player in the luxury market, has shown robust performance with earnings growth of 7.1%, outpacing the industry's 4.1%. The company reported net income of CNY 706.31 million for 2024, up from CNY 659.69 million the previous year, reflecting strong operational efficiency with EBIT covering interest payments by a staggering 455 times. Despite an increase in debt to equity ratio from 2.1% to 26.5% over five years, its net debt to equity remains satisfactory at just under 3%. This financial health is complemented by positive free cash flow and high-quality non-cash earnings.

Xiamen Kingdomway Group (SZSE:002626)

Simply Wall St Value Rating: ★★★★★★

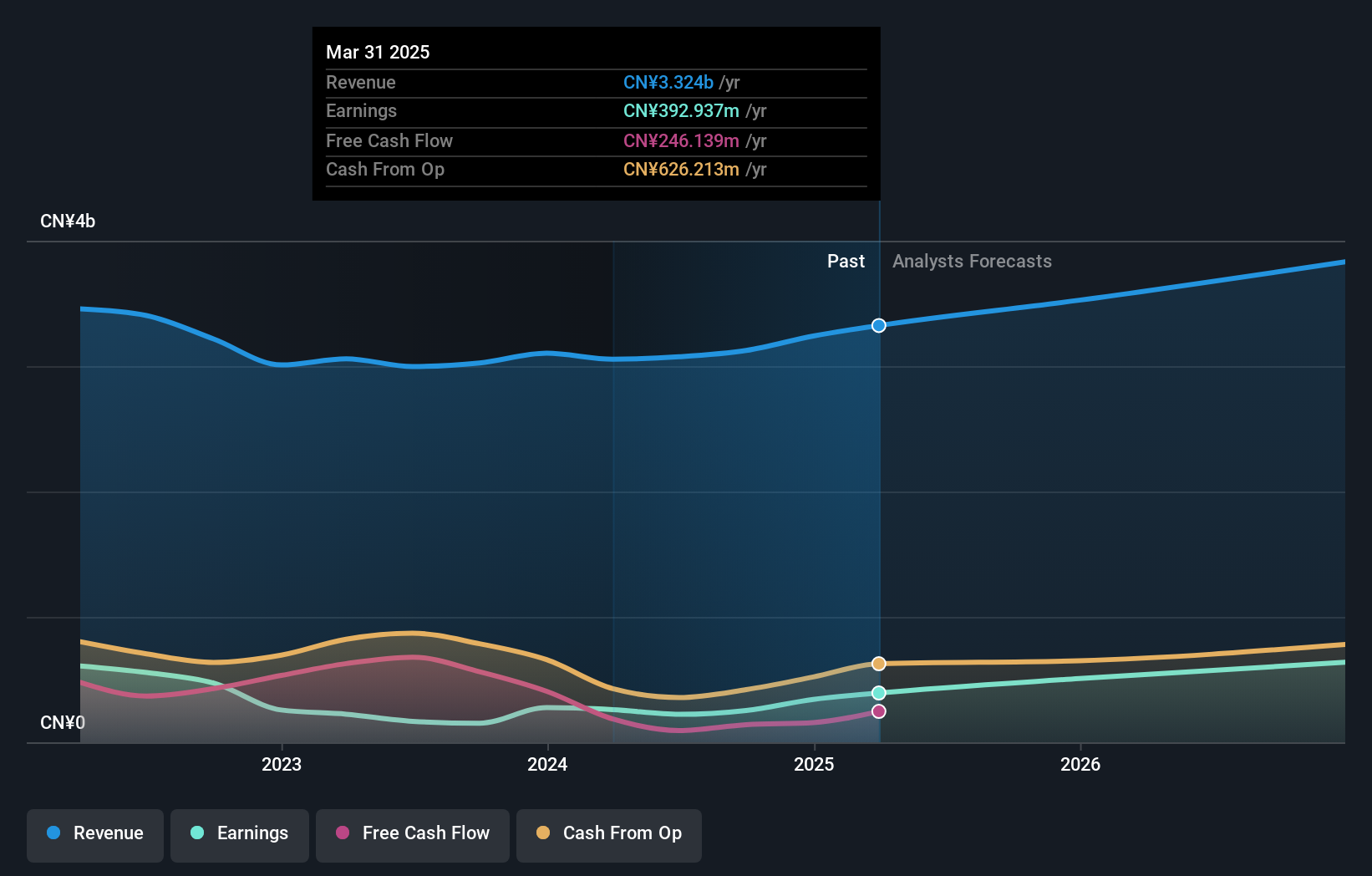

Overview: Xiamen Kingdomway Group Company is involved in the manufacturing and sale of nutrition and health products both in China and internationally, with a market cap of CN¥11.31 billion.

Operations: Xiamen Kingdomway Group generates revenue primarily from the manufacturing and sale of nutrition and health products. The company's financial performance includes a focus on managing costs to optimize profitability, with particular attention to its gross profit margin.

Xiamen Kingdomway Group, a notable player in its sector, has demonstrated robust financial health with earnings growing by 50.8% over the past year, outpacing the broader pharmaceuticals industry. The company's debt to equity ratio has improved from 39.3 to 33.1 over five years, indicating prudent financial management. With net income reaching CNY 341.99 million for 2024 and a price-to-earnings ratio of 31.7x below the CN market average of 38.7x, it presents an attractive valuation proposition within its market context. Recent board changes and dividend increases further reflect strategic initiatives aimed at shareholder value enhancement.

- Dive into the specifics of Xiamen Kingdomway Group here with our thorough health report.

Assess Xiamen Kingdomway Group's past performance with our detailed historical performance reports.

Namura Shipbuilding (TSE:7014)

Simply Wall St Value Rating: ★★★★★★

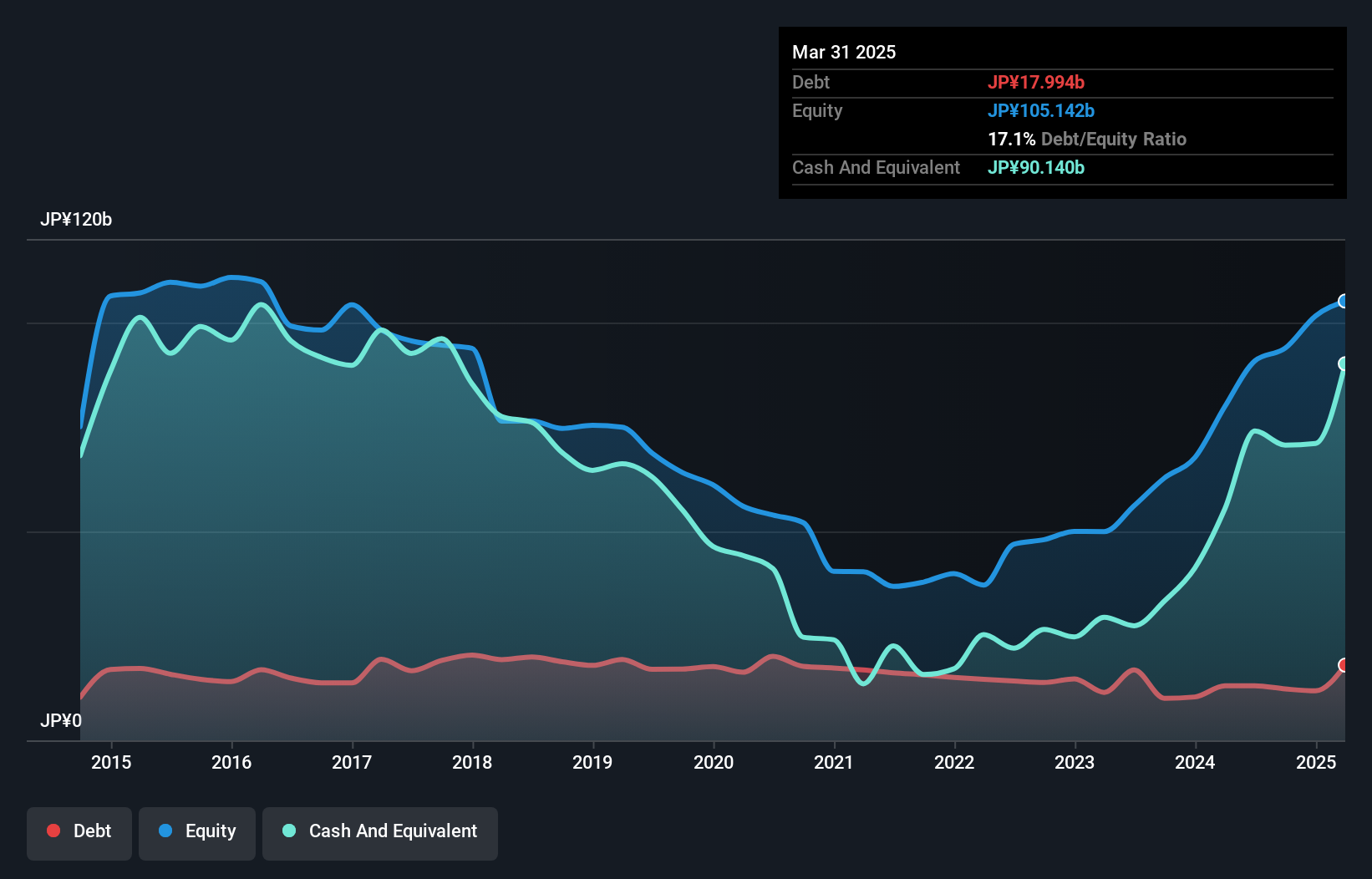

Overview: Namura Shipbuilding Co., Ltd. operates globally in the manufacture and sale of ships, machinery, and steel structures, with a market capitalization of ¥187.87 billion.

Operations: Namura Shipbuilding generates revenue primarily from new ship construction, which accounts for ¥122.88 billion, followed by ship repairs at ¥23.04 billion, and steel structures/machinery at ¥6.23 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability and efficiency in managing costs relative to its revenue streams.

Namura Shipbuilding, a smaller player in the industry, has shown remarkable financial health with earnings climbing 31.5% over the past year, outpacing the Machinery sector's 10.6%. Its debt situation is looking better too, with a debt-to-equity ratio dropping from 29.1% to 17.1% over five years, and it holds more cash than total debt. Despite recent share price volatility, it's trading at a substantial discount of nearly 79% below fair value estimates. However, while revenue is expected to grow by about 6%, earnings might dip slightly by an average of 0.9% annually for the next three years.

Turning Ideas Into Actions

- Navigate through the entire inventory of 3193 Global Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002626

Xiamen Kingdomway Group

Engages in the manufacturing and sale of the nutrition and health products in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives