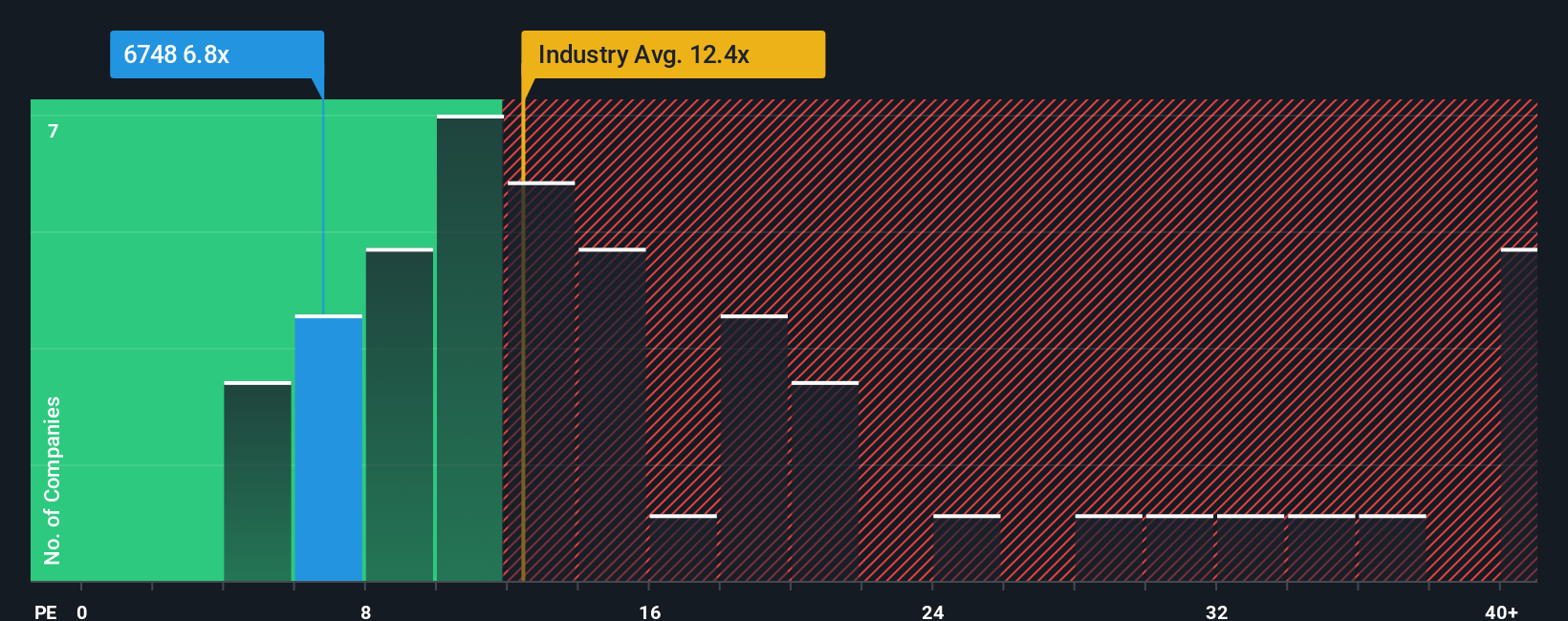

Seiwa Electric Mfg. Co., Ltd.'s (TSE:6748) price-to-earnings (or "P/E") ratio of 6.8x might make it look like a strong buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 15x and even P/E's above 22x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's exceedingly strong of late, Seiwa Electric Mfg has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Seiwa Electric Mfg

How Is Seiwa Electric Mfg's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Seiwa Electric Mfg's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 63% last year. Pleasingly, EPS has also lifted 220% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 11% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Seiwa Electric Mfg is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Seiwa Electric Mfg revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Seiwa Electric Mfg that you should be aware of.

If you're unsure about the strength of Seiwa Electric Mfg's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6748

Seiwa Electric Mfg

Provides information display systems, industrial lighting equipment, road and tunnel lighting equipment, EMC products, LED module products for lighting, and wire protection devices in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives