- China

- /

- Medical Equipment

- /

- SZSE:301363

Asian Market's Top 3 Stocks Possibly Trading Below Fair Value In December 2025

Reviewed by Simply Wall St

As the Asian markets continue to navigate a landscape marked by technological advancements and economic shifts, investors are increasingly focused on identifying opportunities that may be trading below fair value. In this context, understanding what constitutes a potentially undervalued stock—such as strong fundamentals or growth potential not fully reflected in current prices—becomes essential for making informed investment decisions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥153.00 | CN¥303.17 | 49.5% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥81.78 | CN¥161.83 | 49.5% |

| Meitu (SEHK:1357) | HK$7.48 | HK$14.55 | 48.6% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.33 | CN¥20.20 | 48.9% |

| KoMiCo (KOSDAQ:A183300) | ₩85500.00 | ₩166235.75 | 48.6% |

| KIYO LearningLtd (TSE:7353) | ¥705.00 | ¥1381.47 | 49% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩29500.00 | ₩57186.86 | 48.4% |

| Japan Eyewear Holdings (TSE:5889) | ¥1965.00 | ¥3848.28 | 48.9% |

| H.U. Group Holdings (TSE:4544) | ¥3410.00 | ¥6592.59 | 48.3% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥27.57 | CN¥53.26 | 48.2% |

We're going to check out a few of the best picks from our screener tool.

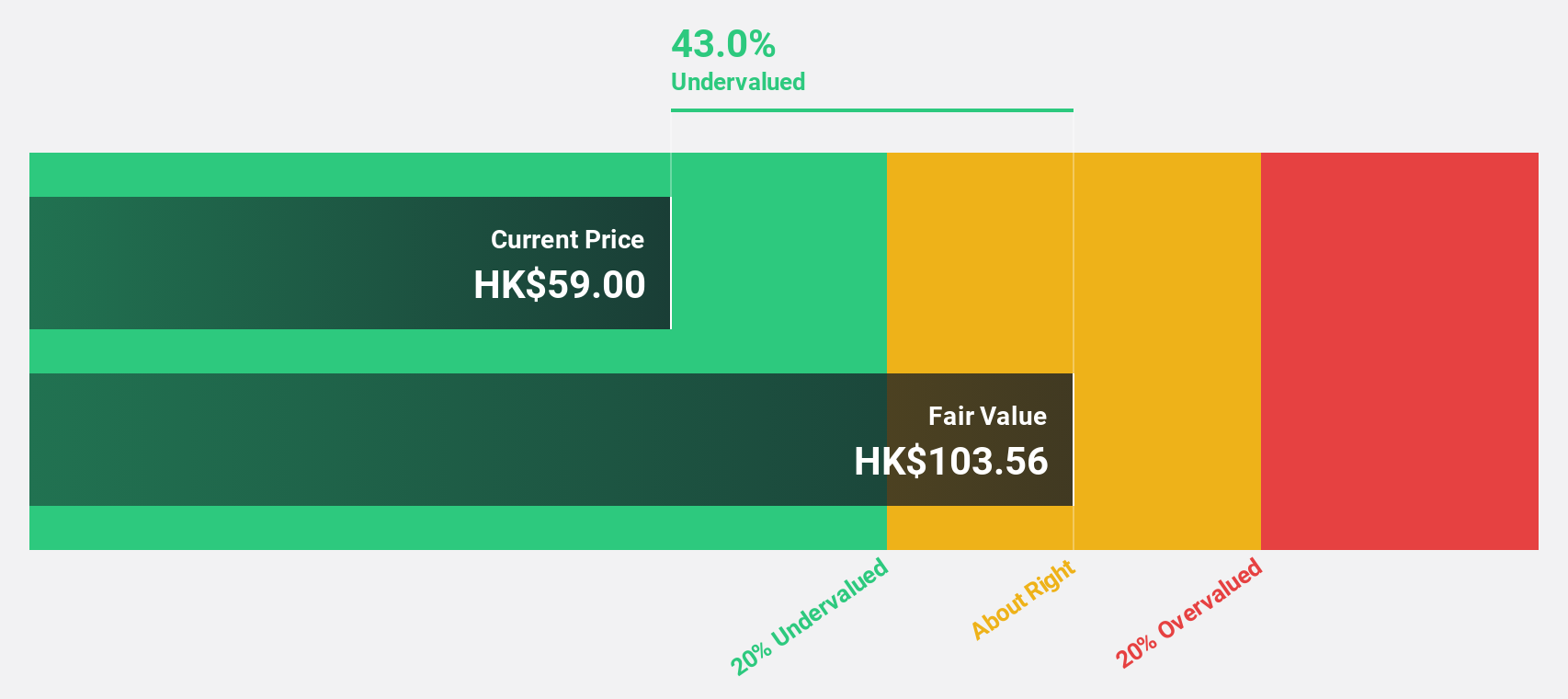

Giant Biogene Holding (SEHK:2367)

Overview: Giant Biogene Holding Co., Ltd. is an investment holding company that designs, develops, manufactures, and sells skin treatment products featuring recombinant collagen in the People’s Republic of China, with a market cap of approximately HK$40.57 billion.

Operations: The company's revenue primarily comes from its Personal Products segment, generating CN¥6.11 billion.

Estimated Discount To Fair Value: 39.4%

Giant Biogene Holding, trading at HK$37.88, is significantly undervalued compared to its estimated fair value of HK$62.54, presenting a good relative value in the market. Despite earnings growth not being classified as significant, they are projected to increase at 16.7% annually, outpacing the Hong Kong market's average growth rate of 12.1%. Additionally, revenue is expected to grow faster than the market at 17.5% per year, supporting its undervaluation narrative based on cash flows and potential future performance.

- Insights from our recent growth report point to a promising forecast for Giant Biogene Holding's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Giant Biogene Holding.

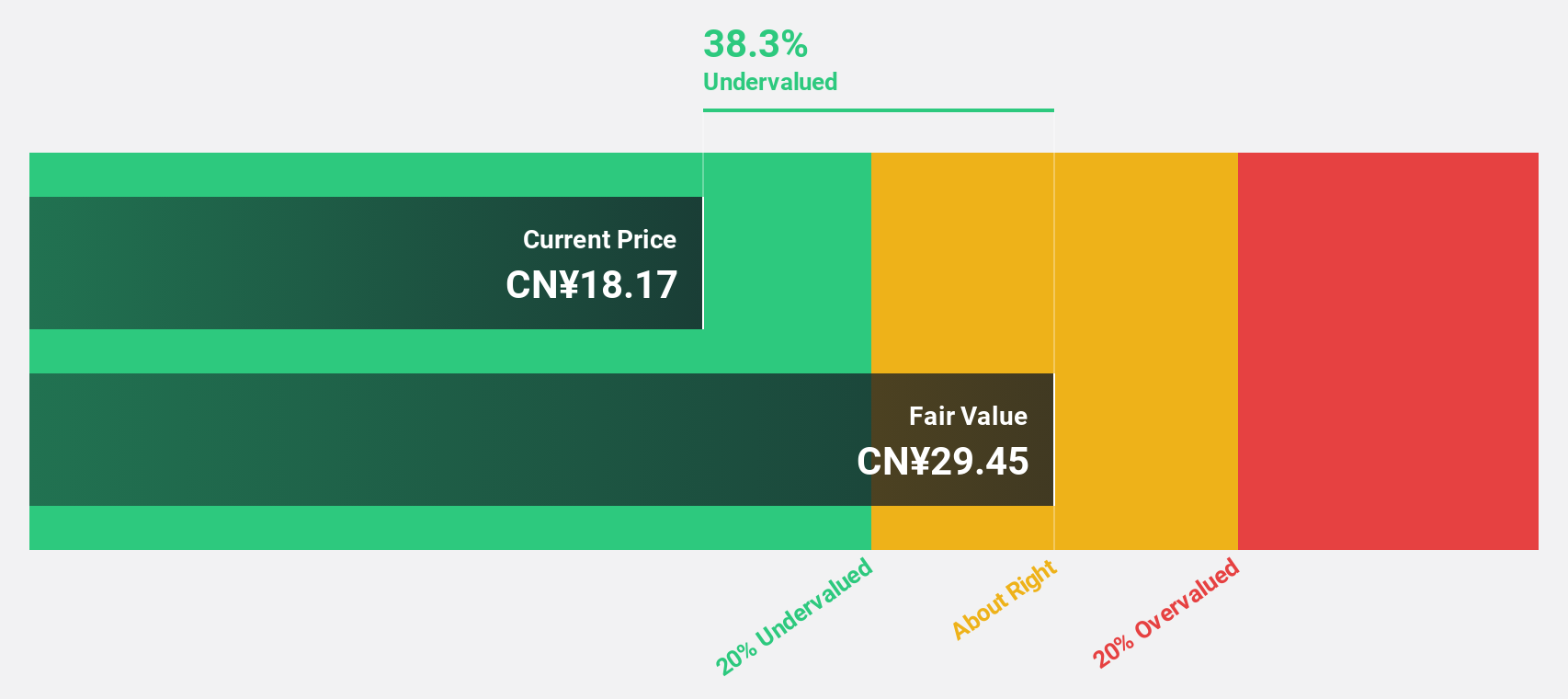

MeHow Innovative (SZSE:301363)

Overview: MeHow Innovative Ltd. designs, develops, manufactures, and sells precision medical device components and products in China and internationally, with a market cap of CN¥12.20 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 11.7%

MeHow Innovative, trading at CNY 21.52, is undervalued relative to its estimated fair value of CNY 24.36, offering a modest discount for investors focusing on cash flow analysis. Despite recent earnings decline to CNY 208.2 million from CNY 257.85 million last year, revenue growth remains robust with a forecasted annual increase of 22.5%, outpacing the Chinese market's average growth rate of 14.6%. However, earnings are expected to grow slower than the market average at 27.1% annually versus the market's 27.5%.

- Our expertly prepared growth report on MeHow Innovative implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of MeHow Innovative with our comprehensive financial health report here.

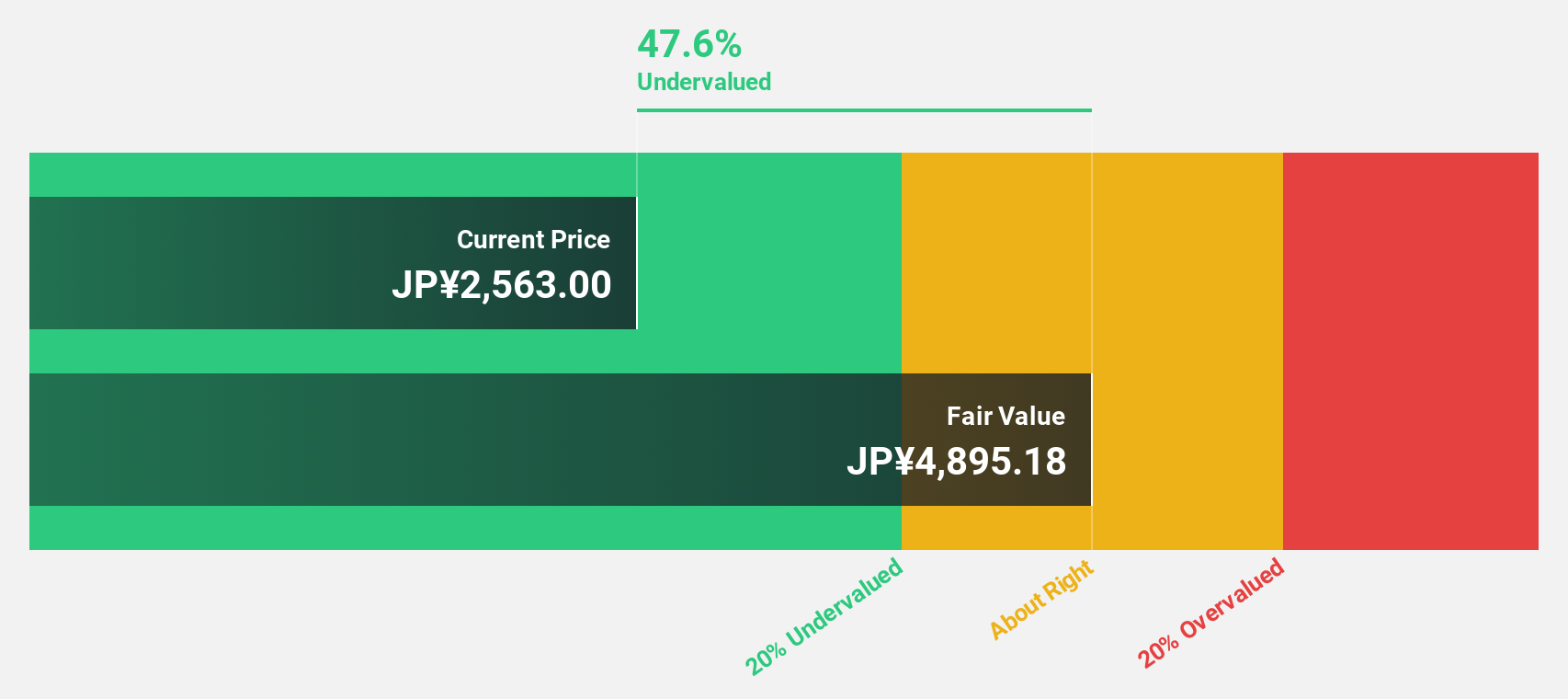

IDEC (TSE:6652)

Overview: IDEC Corporation operates in the human-machine interface, industrial relays and components, automation and sensing, safety and explosion protection, and systems sectors across various global regions with a market cap of ¥82.92 billion.

Operations: IDEC's revenue is derived from its operations in Japan (¥35.57 billion), the Americas (¥14.88 billion), the Asia-Pacific region (¥19.17 billion), and Europe, the Middle East, and Africa (EMEA) (¥16.68 billion).

Estimated Discount To Fair Value: 43.7%

IDEC, priced at ¥2808, is significantly undervalued compared to its fair value estimate of ¥4985.25, trading 43.7% below this benchmark. While revenue growth is projected at 8.9% annually—slower than the ideal high-growth threshold—it surpasses the JP market's average of 4.5%. Earnings are expected to grow substantially at 36.3% per year, outpacing the market's 8.3%. However, dividend sustainability remains a concern as payouts are not well covered by earnings or free cash flows.

- According our earnings growth report, there's an indication that IDEC might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of IDEC.

Key Takeaways

- Navigate through the entire inventory of 269 Undervalued Asian Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301363

MeHow Innovative

Designs, develops, manufactures, and sells precision medical device components and products in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026