Discover Nitto Kogyo And Two Other Dividend Stocks To Consider

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainty, global markets experienced notable declines, with U.S. stocks facing broad-based losses despite a late-week rally. Amidst these turbulent conditions, investors are increasingly looking towards dividend stocks as potential sources of stability and income in their portfolios. As we explore Nitto Kogyo alongside two other dividend-paying companies, it's essential to consider how consistent dividends can offer some reassurance during periods of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.85% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.71% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1933 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Nitto Kogyo (TSE:6651)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nitto Kogyo Corporation manufactures and sells electric and mechanical equipment worldwide, with a market cap of ¥108.95 billion.

Operations: Nitto Kogyo Corporation generates revenue through its Electronic Parts Related Manufacturing Business at ¥14.32 billion, Electricity / Information Infrastructure Related Distribution Business at ¥52.16 billion, and Electrical and Information Infrastructure Related Manufacturing, Construction and Service Business at ¥108.18 billion.

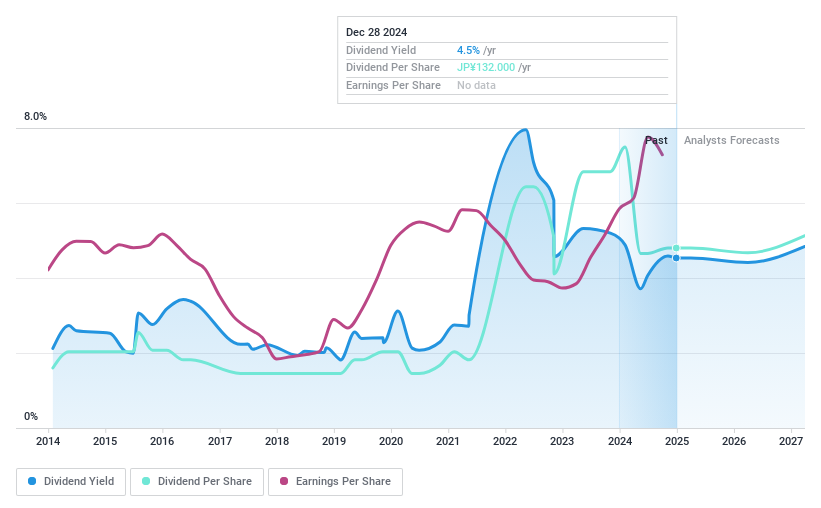

Dividend Yield: 4.5%

Nitto Kogyo's dividend yield of 4.54% is among the top 25% in Japan, but it faces challenges as dividends are not covered by free cash flows and have been volatile over the past decade. Recent guidance indicates a significant reduction in dividends for fiscal year ending March 2025, from JPY 158 to JPY 68 per share. Despite trading below estimated fair value, the sustainability of its dividend remains questionable due to insufficient earnings coverage.

- Get an in-depth perspective on Nitto Kogyo's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Nitto Kogyo shares in the market.

Globeride (TSE:7990)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Globeride, Inc. manufactures and sells sports and leisure products worldwide, with a market cap of ¥44.05 billion.

Operations: Globeride, Inc. generates revenue from various regions: ¥81.19 billion in Japan, ¥15.80 billion in Europe, ¥13.29 billion in the Americas, and ¥48.24 billion in Asia and Oceania.

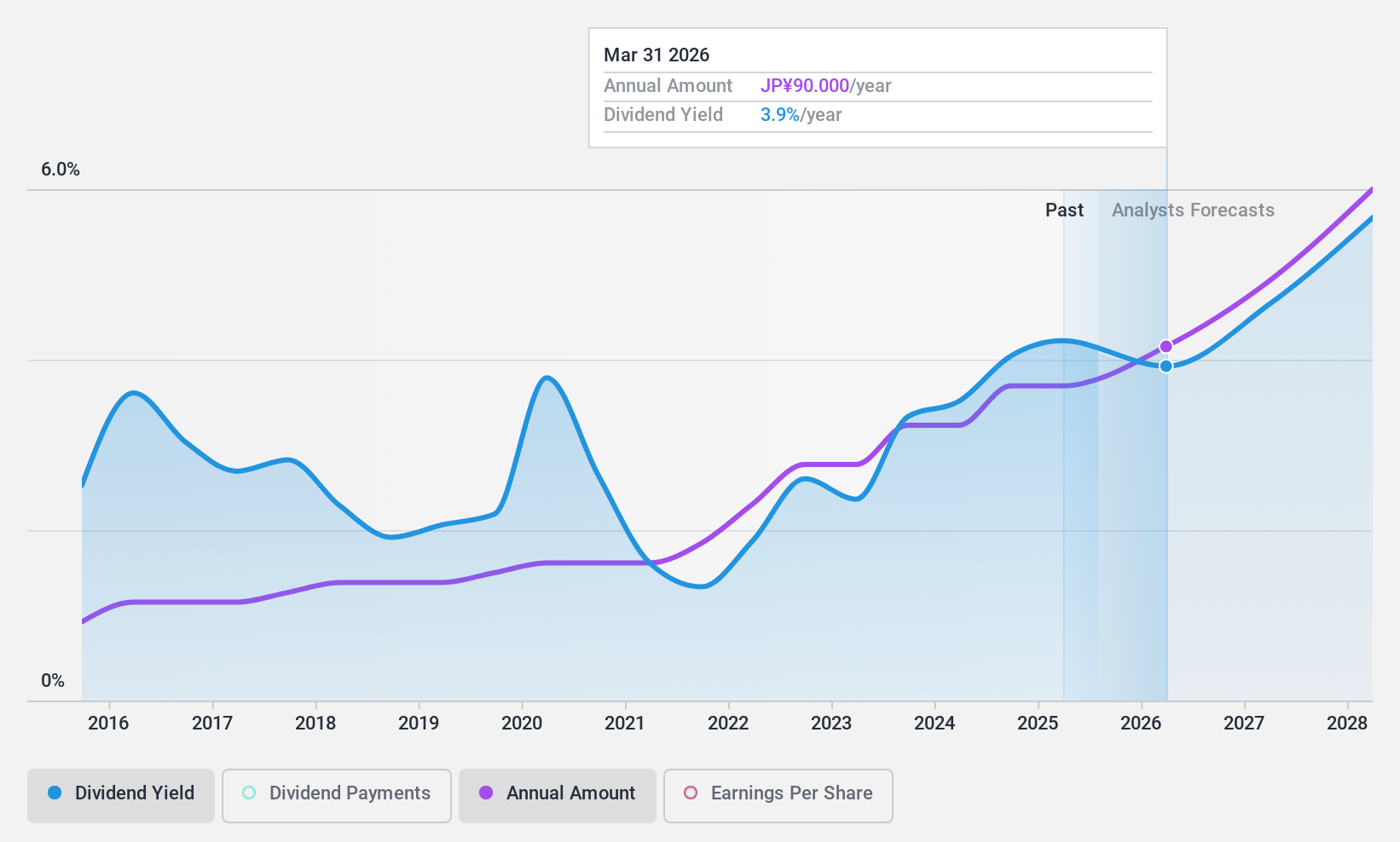

Dividend Yield: 4.1%

Globeride's dividend yield of 4.14% ranks in the top 25% in Japan, supported by a low payout ratio of 45.2%, indicating earnings coverage despite inadequate free cash flow support with a high cash payout ratio. The company has consistently increased and maintained stable dividends over the past decade, recently raising its quarterly dividend from JPY 35 to JPY 40 per share for fiscal year ending March 2025, highlighting its commitment to returning value to shareholders.

- Unlock comprehensive insights into our analysis of Globeride stock in this dividend report.

- Our expertly prepared valuation report Globeride implies its share price may be lower than expected.

Kimura Unity (TSE:9368)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Kimura Unity Co., Ltd. operates in Japan offering logistics, car, information, and staffing services with a market cap of ¥31.91 billion.

Operations: Kimura Unity Co., Ltd.'s revenue is primarily derived from its Logistics Service Business at ¥44.40 billion, followed by the Mobility Service Business at ¥14.70 billion, Information Service Business at ¥2.24 billion, and Human Resource Service Business at ¥1.79 billion.

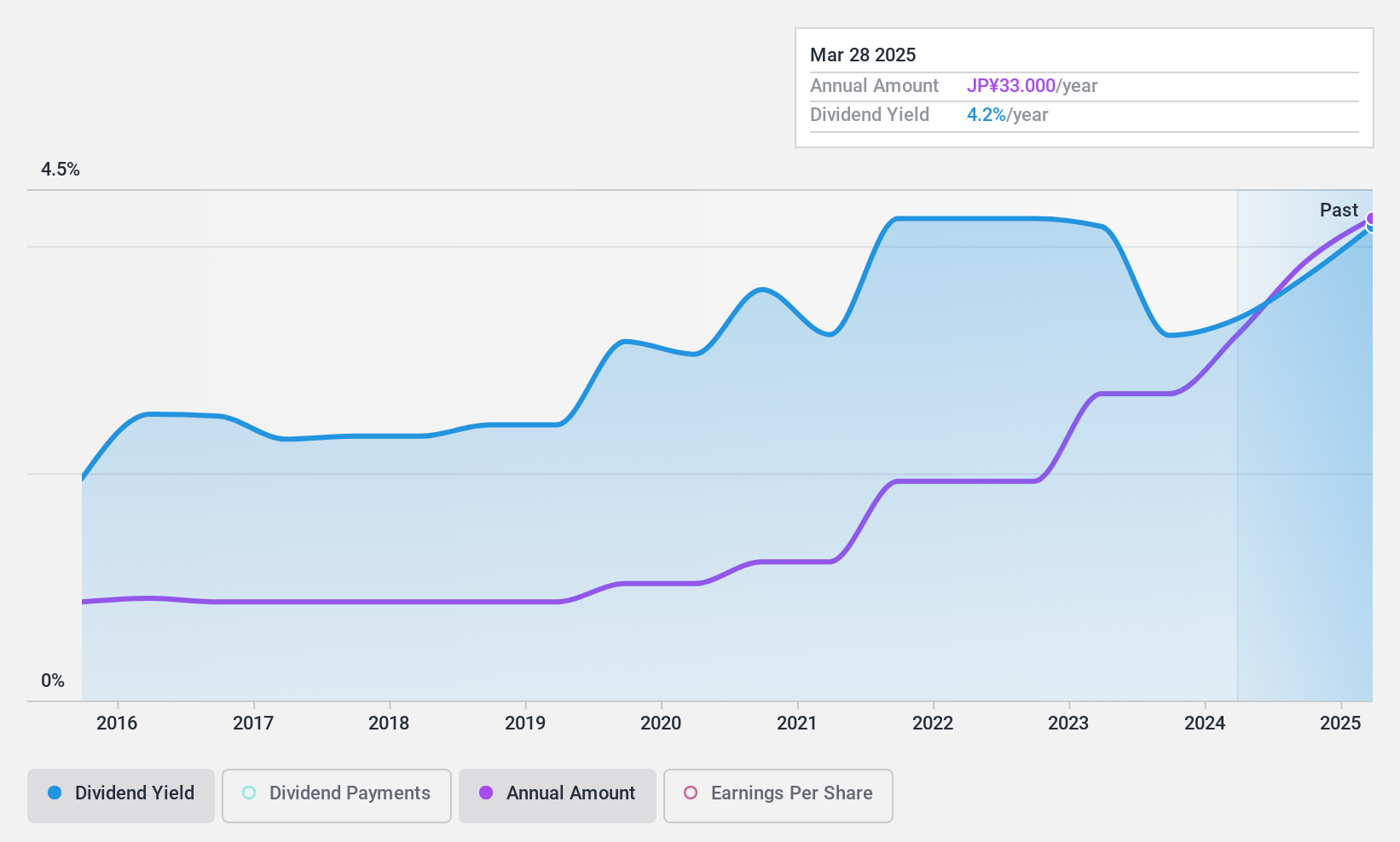

Dividend Yield: 4%

Kimura Unity offers a dividend yield of 4.03%, placing it in the top 25% of Japanese dividend payers, with a sustainable payout ratio of 39%. Its dividends have been stable and growing over the past decade, backed by strong earnings growth and cash flow coverage (30.5%). The recent completion of a share buyback program for ¥1,546.28 million enhances shareholder returns and capital efficiency, reflecting the company's commitment to rewarding investors.

- Navigate through the intricacies of Kimura Unity with our comprehensive dividend report here.

- According our valuation report, there's an indication that Kimura Unity's share price might be on the cheaper side.

Taking Advantage

- Embark on your investment journey to our 1933 Top Dividend Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Globeride, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7990

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives