- Japan

- /

- Electrical

- /

- TSE:6622

There's Reason For Concern Over DAIHEN Corporation's (TSE:6622) Massive 32% Price Jump

DAIHEN Corporation (TSE:6622) shares have continued their recent momentum with a 32% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 93%.

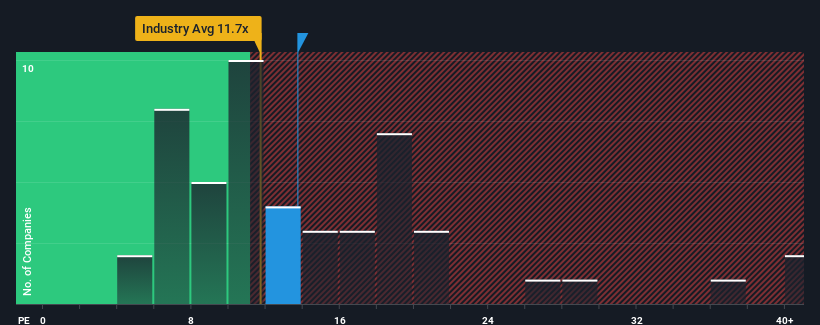

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about DAIHEN's P/E ratio of 13.7x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been advantageous for DAIHEN as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for DAIHEN

How Is DAIHEN's Growth Trending?

The only time you'd be comfortable seeing a P/E like DAIHEN's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 30% gain to the company's bottom line. The latest three year period has also seen an excellent 95% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 8.3% as estimated by the five analysts watching the company. With the market predicted to deliver 11% growth , that's a disappointing outcome.

With this information, we find it concerning that DAIHEN is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Key Takeaway

Its shares have lifted substantially and now DAIHEN's P/E is also back up to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that DAIHEN currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for DAIHEN that you should be aware of.

If you're unsure about the strength of DAIHEN's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6622

DAIHEN

Manufactures, sells, and repairs transformers, welding machines, industrial robots, and power sources.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives