- Japan

- /

- Electrical

- /

- TSE:6622

DAIHEN Corporation's (TSE:6622) Shares Leap 31% Yet They're Still Not Telling The Full Story

DAIHEN Corporation (TSE:6622) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 33% in the last twelve months.

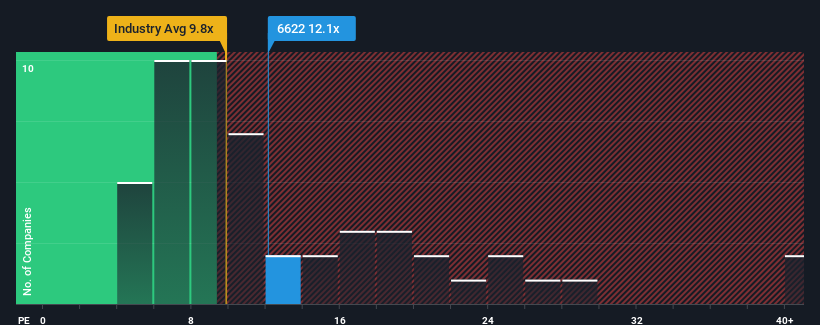

Although its price has surged higher, there still wouldn't be many who think DAIHEN's price-to-earnings (or "P/E") ratio of 12.1x is worth a mention when the median P/E in Japan is similar at about 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

DAIHEN could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for DAIHEN

Is There Some Growth For DAIHEN?

The only time you'd be comfortable seeing a P/E like DAIHEN's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 17%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 6.7% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 13% over the next year. Meanwhile, the rest of the market is forecast to only expand by 9.7%, which is noticeably less attractive.

In light of this, it's curious that DAIHEN's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now DAIHEN's P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of DAIHEN's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for DAIHEN with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on DAIHEN, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6622

DAIHEN

Manufactures, sells, and repairs transformers, welding machines, industrial robots, and power sources.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives