- Japan

- /

- Electrical

- /

- TSE:6594

Assessing Nidec’s (TSE:6594) Valuation in Light of Recent Share Price Weakness

Reviewed by Simply Wall St

If you follow Nidec (TSE:6594), you might be wondering what is behind the recent share price weakness. While there has not been a major headline event to explain it, the steady downward drift in the stock price could have investors questioning whether this is simply a market signal or something more. Sometimes, it is the absence of news that sparks the toughest decisions. After all, is this a quiet patch in the company’s story, or the start of a deeper realignment?

Taking a step back, Nidec’s shares have had a challenging ride over the past year. Momentum has been subdued, with the stock down 12% since the start of the year and 12% lower over the past twelve months. Over a longer period, returns have been even weaker, and recent months have shown little sign of a turning point despite steady revenue growth and double-digit profit increases on the books. For investors, that raises a key question about how the market is assessing the company’s long-term growth versus the risks currently priced in.

With the stock still trading below where it started this year, is the market giving investors a true bargain, or is it reflecting realistic expectations for Nidec’s future prospects?

Most Popular Narrative: 31.6% Undervalued

According to the most widely followed narrative, Nidec appears significantly undervalued relative to its estimated fair value. The narrative argues that the company’s future potential, underpinned by specific industry catalysts, is not being fully reflected in today’s share price.

Nidec is positioned to capitalize on surging global demand for advanced motor solutions in data centers, particularly with its expanding water cooling module and nearline HDD motor businesses. The company highlighted strong order inquiry trends from major data center markets (U.S., China, Japan) and expects portfolio expansion and market penetration to further accelerate. This supports sustained revenue growth and margin expansion as the AI and cloud infrastructure cycle evolves.

Want to know what is behind this bold valuation call? The secret sauce is a rare blend of profitable growth and ambitious future profit multiples that typically spark investor excitement. Interested in the real drivers hidden within these projections? Explore the numbers and strategy that analysts believe could shape Nidec’s story.

Result: Fair Value of ¥3,617.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent regulatory investigations and tough restructuring challenges could still hinder the company’s progress and create further pressure on its share price.

Find out about the key risks to this Nidec narrative.Another View: The Market’s Pricing Signal

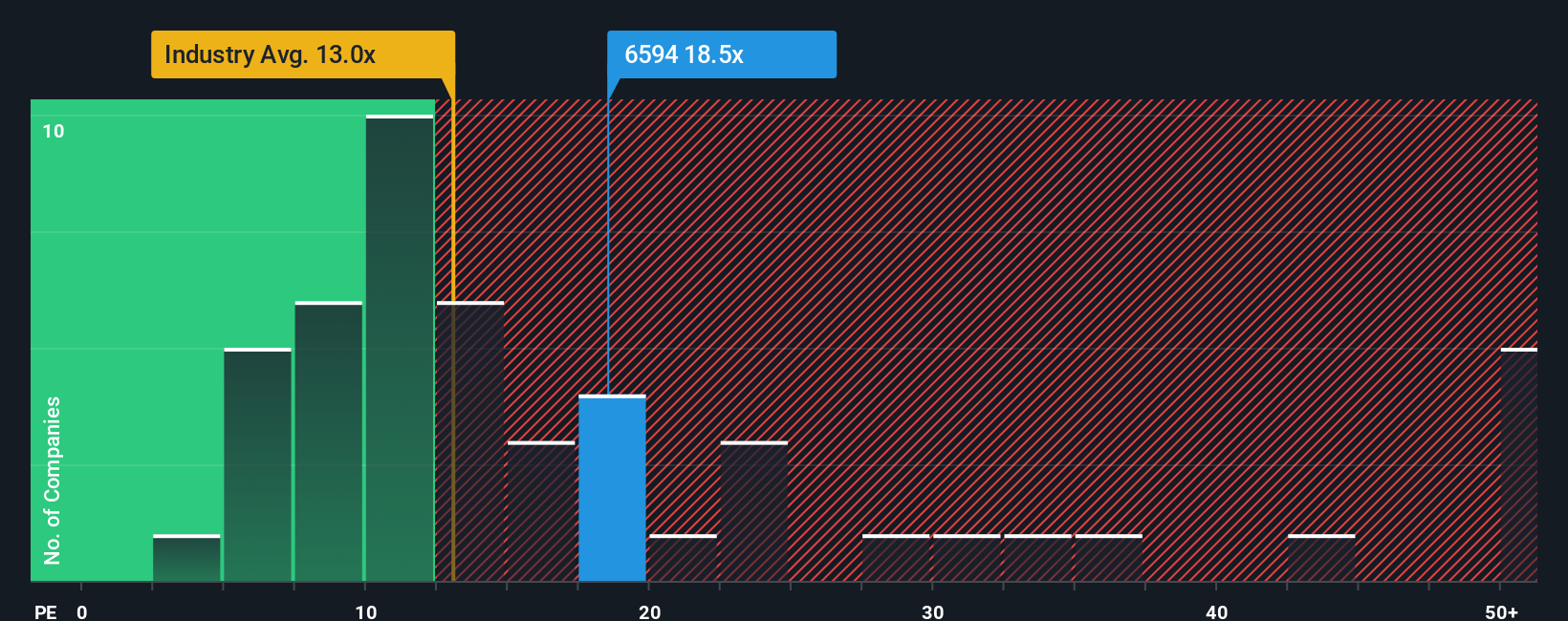

Looking from another angle, the current market price compared to the broader industry suggests Nidec may actually be priced higher than similar companies. This raises real questions about whether future growth is already factored in.

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Nidec to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Nidec Narrative

If you see the story differently, or would rather draw your own conclusions, you can shape your own view in just a few minutes. Do it your way.

A great starting point for your Nidec research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunities pass you by. Use the Simply Wall Street Screener to spot tomorrow’s strongest stocks and sharpen your portfolio’s edge.

- Find tomorrow’s trendsetters by scouting AI penny stocks and see which innovative companies are transforming industries with artificial intelligence breakthroughs.

- Unlock potential growth stories by targeting overlooked gems through undervalued stocks based on cash flows that the market may be missing.

- Boost your passive income strategy and stability with top picks in dividend stocks with yields > 3%, focusing on reliable companies paying out yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nidec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:6594

Nidec

Develops, manufactures, and sells motors, electronics and optical components, and other related products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives