- Japan

- /

- Electrical

- /

- TSE:6594

3 Stocks Estimated To Be Up To 26.7% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets show signs of recovery with major U.S. indexes approaching record highs and economic indicators like jobless claims hitting favorable levels, investors are increasingly on the lookout for opportunities amidst ongoing geopolitical uncertainties. In this environment, identifying undervalued stocks—those trading below their intrinsic value—can offer potential avenues for growth, especially when broad-based gains suggest a supportive climate for strategic investments.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.53 | CN¥30.89 | 49.7% |

| SeSa (BIT:SES) | €75.10 | €149.67 | 49.8% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩201500.00 | ₩402771.51 | 50% |

| PLAIDInc (TSE:4165) | ¥1597.00 | ¥3193.25 | 50% |

| EnomotoLtd (TSE:6928) | ¥1473.00 | ¥2932.52 | 49.8% |

| Winking Studios (Catalist:WKS) | SGD0.27 | SGD0.54 | 49.7% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.96 | THB9.87 | 49.7% |

| SK Biopharmaceuticals (KOSE:A326030) | ₩95400.00 | ₩190022.03 | 49.8% |

| Cavotec (OM:CCC) | SEK17.55 | SEK35.07 | 50% |

| Snap (NYSE:SNAP) | US$11.42 | US$22.72 | 49.7% |

Let's dive into some prime choices out of the screener.

Prysmian (BIT:PRY)

Overview: Prysmian S.p.A., along with its subsidiaries, manufactures, distributes, and sells power and telecom cables and systems globally under the Prysmian, Draka, and General Cable brands, with a market cap of approximately €17.89 billion.

Operations: The company's revenue segments include Digital Solutions (€1.28 billion) and Electrification - Other (€428 million).

Estimated Discount To Fair Value: 14.1%

Prysmian is trading at €61.92, below its estimated fair value of €72.1, suggesting it may be undervalued based on cash flows. Its earnings are forecast to grow significantly at 20.65% per year, surpassing the Italian market's growth rate of 7.3%. Recent earnings reports show increased sales and net income compared to last year, while a collaboration with TechnipFMC aims to enhance offshore wind capabilities, potentially boosting future cash flows despite a high debt level and recent shareholder dilution.

- Upon reviewing our latest growth report, Prysmian's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Prysmian's balance sheet health report.

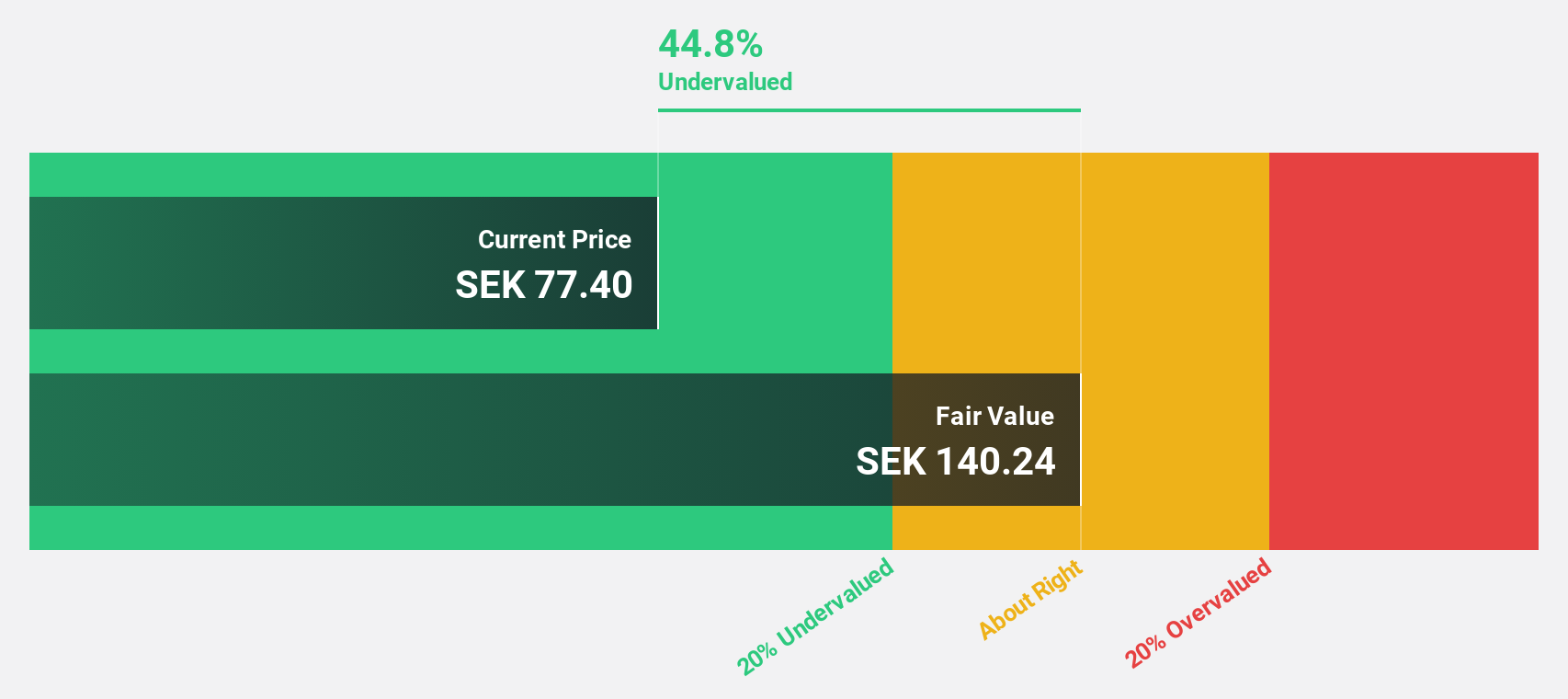

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Overview: Telefonaktiebolaget LM Ericsson (publ) offers mobile connectivity solutions for telecom operators and enterprise customers across multiple regions including North America, Europe, Latin America, the Middle East, Africa, North East Asia, South East Asia, Oceania, and India with a market cap of approximately SEK297.07 billion.

Operations: Ericsson's revenue is primarily derived from its Networks segment at SEK156.41 billion, followed by Cloud Software and Services at SEK62.74 billion, and Enterprise at SEK25.47 billion.

Estimated Discount To Fair Value: 26.7%

Telefonaktiebolaget LM Ericsson, trading at SEK89.16, is considered undervalued with a fair value estimate of SEK121.67. The company's earnings are projected to grow significantly over the next three years as it transitions to profitability, outpacing average market growth. Recent strategic alliances and product innovations in 5G technology could enhance cash flows despite challenges like unsustainable dividend coverage and slower revenue growth compared to high benchmarks.

- According our earnings growth report, there's an indication that Telefonaktiebolaget LM Ericsson might be ready to expand.

- Unlock comprehensive insights into our analysis of Telefonaktiebolaget LM Ericsson stock in this financial health report.

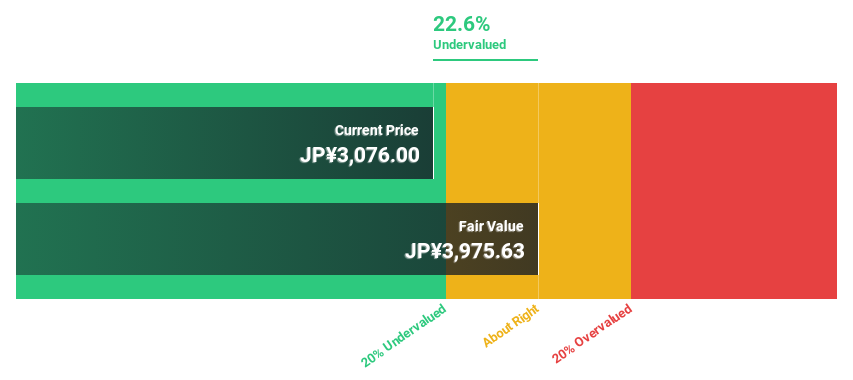

Nidec (TSE:6594)

Overview: Nidec Corporation, along with its subsidiaries, is engaged in the development, manufacturing, and sale of motors, electronics and optical components, and related products both in Japan and globally; it has a market cap of ¥3.28 trillion.

Operations: The company's revenue segments include motors at ¥1.50 trillion, electronics and optical components at ¥500 billion, and related products at ¥300 billion.

Estimated Discount To Fair Value: 25.9%

Nidec, trading at ¥2858, is undervalued with a fair value estimate of ¥3855.9. Earnings are expected to grow significantly at 22.7% annually, surpassing market averages despite slower revenue growth of 6.1%. A strategic collaboration with Renesas on an innovative E-Axle system for EVs could bolster future cash flows by reducing costs and component size in vehicle design. However, projected low return on equity remains a concern for potential investors.

- In light of our recent growth report, it seems possible that Nidec's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Nidec.

Where To Now?

- Explore the 919 names from our Undervalued Stocks Based On Cash Flows screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nidec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6594

Nidec

Develops, manufactures, and sells motors, electronics and optical components, and other related products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.