- Japan

- /

- Electrical

- /

- TSE:6592

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In a week where global markets experienced mixed performances, with the Nasdaq Composite reaching new heights while other major indexes faced declines, investors are closely watching central banks' rate adjustments and economic indicators for guidance. Amidst these fluctuations, dividend stocks remain a compelling option for those seeking stability and income in their portfolios. As markets navigate these dynamic conditions, selecting strong dividend-paying stocks can provide a reliable source of returns and help cushion against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.26% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.00% | ★★★★★★ |

| Shaanxi International TrustLtd (SZSE:000563) | 3.16% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.25% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

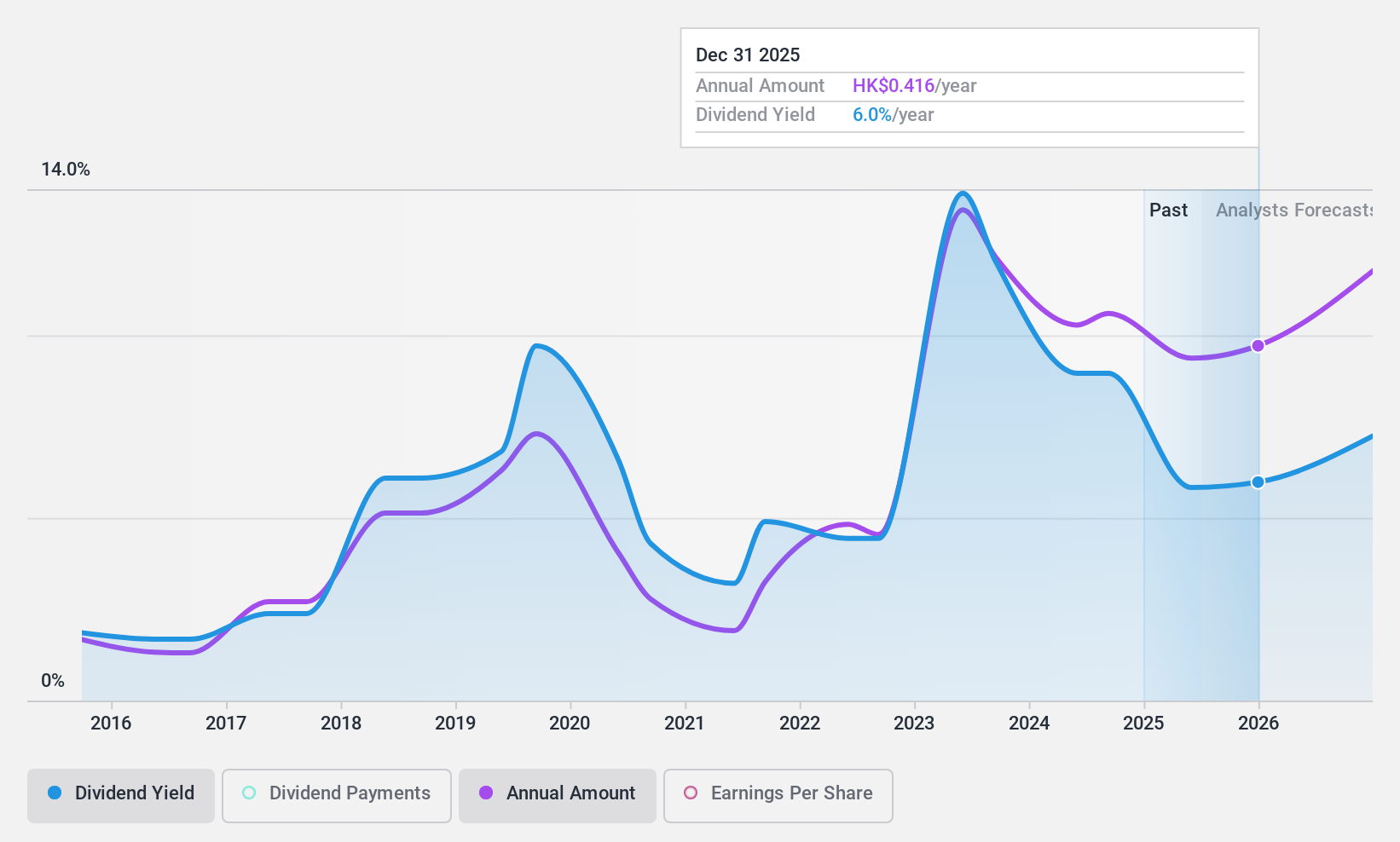

Fufeng Group (SEHK:546)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fufeng Group Limited is an investment holding company that manufactures and sells fermentation-based food additives, biochemical, and starch-based products in China and internationally, with a market cap of approximately HK$13.11 billion.

Operations: Fufeng Group Limited's revenue segments are comprised of CN¥13.85 billion from Food Additives, CN¥9.00 billion from Animal Nutrition, CN¥2.09 billion from Colloid, and CN¥2.22 billion from High-End Amino Acid products.

Dividend Yield: 8.3%

Fufeng Group offers a dividend yield of 8.33%, ranking in the top 25% of Hong Kong's market, but its sustainability is questionable due to high cash payout ratios and volatile past payments. Despite trading at a good value, with shares repurchased for HKD 68.31 million recently, dividends are not well covered by free cash flows. Although earnings growth is forecasted at 8.78% annually, dividend reliability remains uncertain over the long term.

- Get an in-depth perspective on Fufeng Group's performance by reading our dividend report here.

- Our expertly prepared valuation report Fufeng Group implies its share price may be lower than expected.

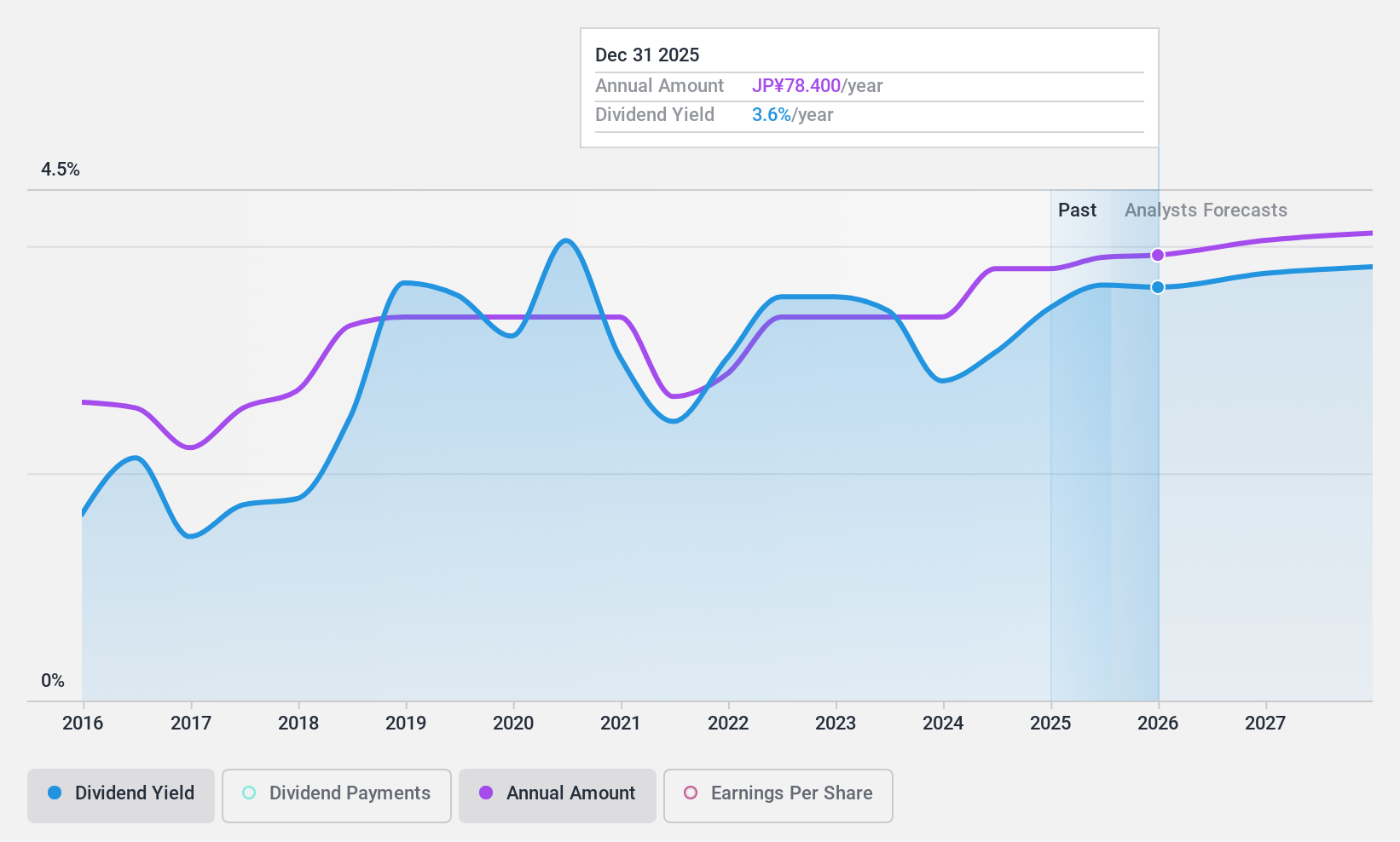

Mabuchi Motor (TSE:6592)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mabuchi Motor Co., Ltd. manufactures and sells small electric motors, with a market capitalization of ¥2.78 billion.

Operations: Mabuchi Motor Co., Ltd.'s revenue is derived from several regions, with Asia contributing ¥185.58 million, Japan ¥121.27 million, Europe ¥46.05 million, and the United States of America ¥41.25 million.

Dividend Yield: 3.4%

Mabuchi Motor's dividend payments have grown over the past decade, yet they remain volatile and unreliable, with a payout ratio of 51.1% indicating coverage by earnings. The cash payout ratio of 47.3% suggests dividends are well covered by cash flows, though the yield is below Japan's top tier at 3.35%. Recent share buybacks totaling ¥2.99 billion may signal management's confidence in future performance despite past instability in dividend payments.

- Delve into the full analysis dividend report here for a deeper understanding of Mabuchi Motor.

- According our valuation report, there's an indication that Mabuchi Motor's share price might be on the cheaper side.

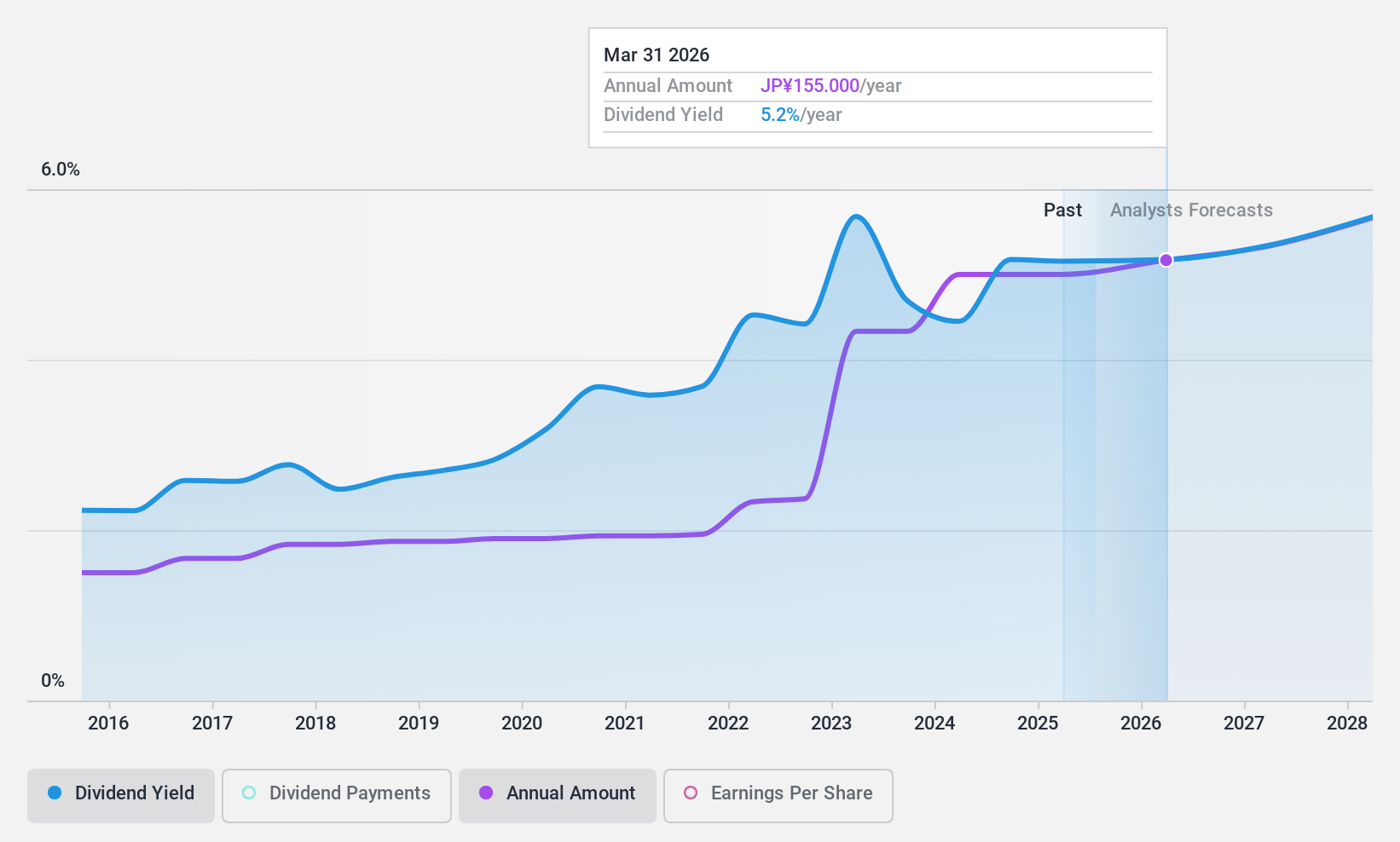

Sangetsu (TSE:8130)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Sangetsu Corporation, with a market cap of ¥165.85 billion, operates in the planning, development, manufacture, sale, and installation of interior decorating products both in Japan and internationally through its subsidiaries.

Operations: Sangetsu Corporation's revenue is derived from its core activities in the interior decorating sector, which include planning, development, manufacturing, sales, and installation services both domestically and abroad.

Dividend Yield: 5.3%

Sangetsu's dividends are well-supported by earnings, with a low payout ratio of 36.2%, and cash flows, indicated by a cash payout ratio of 68.9%. The dividend yield stands at an attractive 5.26%, placing it in the top quartile among Japanese dividend payers. Recent increases in quarterly dividends from ¥65 to ¥75 per share highlight a commitment to rewarding shareholders, supported by stable and growing profits over the past decade.

- Click here and access our complete dividend analysis report to understand the dynamics of Sangetsu.

- Our valuation report unveils the possibility Sangetsu's shares may be trading at a discount.

Where To Now?

- Unlock our comprehensive list of 1970 Top Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6592

Mabuchi Motor

Manufactures and sells of small electric motors Japan, Europe, and North America.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives