- Japan

- /

- Electrical

- /

- TSE:6504

Fuji Electric (TSE:6504): Examining Share Valuation After Recent Market Moves

Reviewed by Simply Wall St

Most Popular Narrative: 0.6% Undervalued

According to the most widely followed narrative, Fuji Electric is considered slightly undervalued, with the current share price trading just below its calculated fair value. This assessment is built on analyst expectations for the company's future earnings power and profitability improvements.

A surge in orders and revenue from Energy Management and Power Supply and Facility Systems, driven by increased demand for grid stabilization, storage battery systems, and data centers, positions Fuji Electric for multi-year growth as electrification and infrastructure upgrades accelerate globally. This is likely to support rising top-line revenue and improved operating margins as high-value projects ramp up.

Big claims surround Fuji Electric's outlook. The market's value hinges on demand booms, upgraded infrastructure, and ambitious bottom-line projections that promise transformation. Curious which numbers are fueling this tight valuation, and what assumptions analysts are betting on? The critical growth levers and bold profit bets behind this price target could turn heads. Are you ready to find out?

Result: Fair Value of ¥9,654.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent reliance on the Japanese market and rising costs could affect Fuji Electric’s long-term growth prospects if overseas momentum fails to improve.

Find out about the key risks to this Fuji Electric narrative.Another View: Market Multiple Tells a Different Story

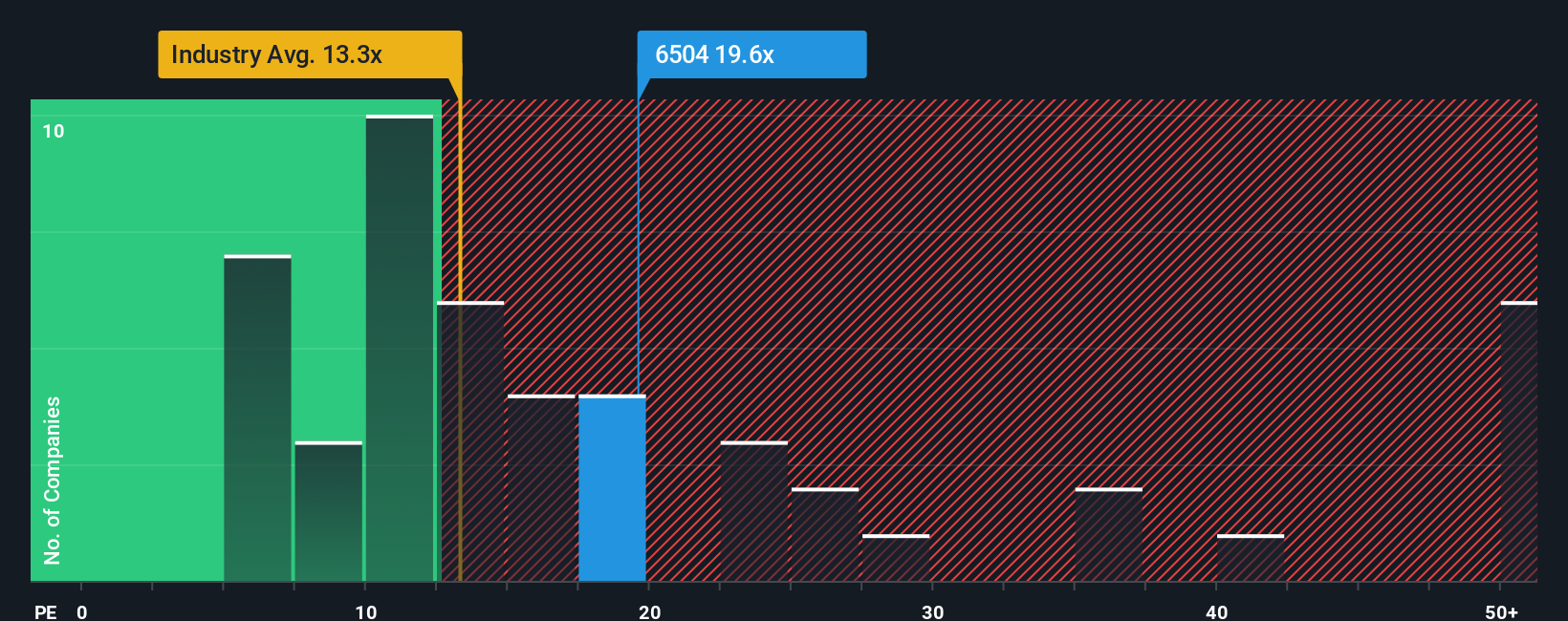

While analyst forecasts see upside, another perspective comes from comparing Fuji Electric’s market value to industry averages. By this measure, the shares look pricey relative to peers in the sector. Could the market be overestimating future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fuji Electric Narrative

If these analyses don’t match your perspective, you can quickly sift through the data and craft your own market story in minutes, your way. Do it your way.

A great starting point for your Fuji Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always have an edge by staying on top of the freshest opportunities in the market. Don’t let great ideas slip by. Put Simply Wall Street’s screeners to work uncovering your next standout pick.

- Tap into the explosive potential of startups shaking up entire industries by searching for penny stocks with strong financials that boast robust financials and growth momentum.

- Unlock tomorrow’s tech leaders by following AI penny stocks with real breakthroughs in artificial intelligence poised to transform the way we live and invest.

- Supercharge your returns by targeting undervalued stocks based on cash flows poised for upside, identified by strong fundamentals and attractive price tags.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:6504

Fuji Electric

Develops power semiconductors and electronics solutions in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives