- Japan

- /

- Industrials

- /

- TSE:6501

A Fresh Look at Hitachi (TSE:6501) Valuation Following Recent Share Price Moves

Reviewed by Simply Wall St

Hitachi (TSE:6501) saw its shares slip about 1% today. Investors are watching the stock’s recent moves and considering its longer-term growth performance, particularly after steady returns over the past month and solid revenue gains recently.

See our latest analysis for Hitachi.

Hitachi’s share price has notched an impressive 18.8% gain over the past month, and while today’s slight dip caught some attention, the company’s one-year total shareholder return still sits at nearly 17%. This kind of momentum, paired with multi-year gains, points to steady confidence in Hitachi’s growth prospects even as sentiment shifts around earnings and new deals.

If the recent action in Hitachi has you rethinking your watchlist, consider this a great time to discover fast growing stocks with high insider ownership.

As Hitachi’s valuation climbs, investors are left to ponder whether the stock still offers room for further upside or if robust growth expectations are now fully reflected in its current price. Is there still a buying opportunity here, or has the market already anticipated what is ahead?

Most Popular Narrative: 4.3% Undervalued

With Hitachi's last close at ¥4,678, the most-followed narrative suggests shares still have modest upside, citing a fair value estimate of ¥4,887. The difference points to just enough potential to merit a closer look at the forecasts behind the number.

Strengthening global mandates for sustainability and decarbonization are resulting in record order backlogs in energy transmission and control systems. This is positioning Hitachi as a critical supplier in green transformation projects, which directly benefits both topline growth and supports strategic pricing.

Curious which long-term trends justify this price estimate? The real story is all about recurring profits, digital transformation, and ambitious margin projections. Want to see what financial calculations propel this target? The details might surprise you.

Result: Fair Value of ¥4,887 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued global competition or ongoing impacts from U.S. tariffs could restrain earnings growth and present a challenge to the current upbeat outlook.

Find out about the key risks to this Hitachi narrative.

Another View: Market Ratios Flash a Warning

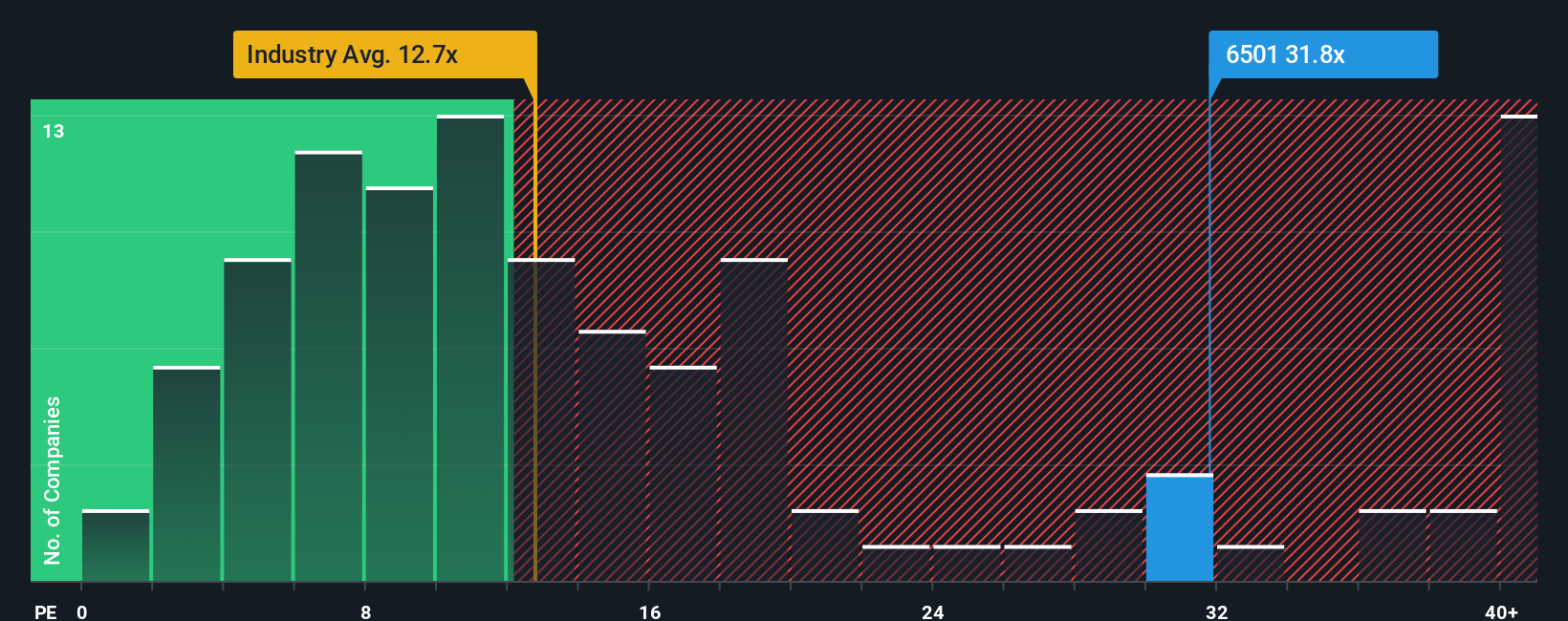

While the fair value estimate points to some upside, the current price-to-earnings ratio stands at 33.6x. This is much higher than both the Asian Industrials industry average of 12.6x and Hitachi’s peer average of 15.5x. Even when compared to the fair ratio of 38.5x, there is premium risk if expectations shift.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hitachi for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hitachi Narrative

If you see the numbers differently or would rather dig in personally, you can analyze the data and build a complete case. Your own perspective is just a few clicks away, so Do it your way.

A great starting point for your Hitachi research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't just watch from the sidelines while others build smarter portfolios. Make the most of market opportunities before the crowd catches on with these timely stock ideas:

- Uncover income potential by tapping into these 20 dividend stocks with yields > 3% that consistently deliver attractive yields above 3% to boost your returns.

- Secure your place in tomorrow’s tech by targeting these 26 AI penny stocks set to benefit from the rapid advances in artificial intelligence.

- Fuel your strategy with value plays by checking out these 868 undervalued stocks based on cash flows backed by strong cash flows and priced for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hitachi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6501

Hitachi

Provides digital system and services, green energy and mobility, and connective industry solutions in Japan and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives