Market Cool On Nippon Thompson Co., Ltd.'s (TSE:6480) Earnings Pushing Shares 27% Lower

The Nippon Thompson Co., Ltd. (TSE:6480) share price has fared very poorly over the last month, falling by a substantial 27%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 16% share price drop.

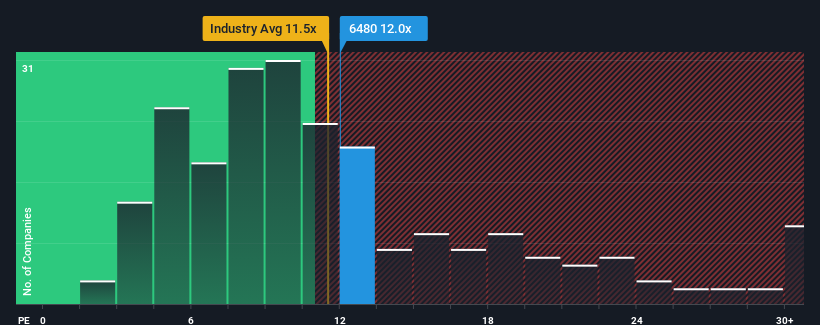

In spite of the heavy fall in price, it's still not a stretch to say that Nippon Thompson's price-to-earnings (or "P/E") ratio of 12x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Nippon Thompson's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for Nippon Thompson

Is There Some Growth For Nippon Thompson?

In order to justify its P/E ratio, Nippon Thompson would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 64%. Still, the latest three year period has seen an excellent 1,188% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 16% per year during the coming three years according to the two analysts following the company. With the market only predicted to deliver 9.6% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Nippon Thompson's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Nippon Thompson's P/E?

With its share price falling into a hole, the P/E for Nippon Thompson looks quite average now. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Nippon Thompson's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 3 warning signs for Nippon Thompson that you should be aware of.

Of course, you might also be able to find a better stock than Nippon Thompson. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Thompson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6480

Nippon Thompson

Develops, manufactures, and sells needle roller bearings, linear motion rolling guides, precision positioning tables, and machine components under the IKO brand in Japan and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives