MINEBEA MITSUMI (TSE:6479) Eyes Growth with Slovakia Expansion and Strong PT Segment Performance

Reviewed by Simply Wall St

MINEBEA MITSUMI (TSE:6479) has recently showcased its strategic initiatives and financial performance, highlighted by a presentation at the Nomura Investment Forum 2024 on December 3. The company is actively considering capital expansion for its subsidiary, Minebea Slovakia s.r.o., as discussed in the board meeting on November 29, 2024. With record-high net sales and operating income, alongside strong performance in the PT segment, MINEBEA MITSUMI's market position is bolstered by its unique capabilities. However, challenges such as declining profit margins and competitive pressures remain. The company report covers key areas like growth opportunities in the aircraft business and innovations in Access Solutions.

Unlock comprehensive insights into our analysis of MINEBEA MITSUMI stock here.

Unique Capabilities Enhancing MINEBEA MITSUMI's Market Position

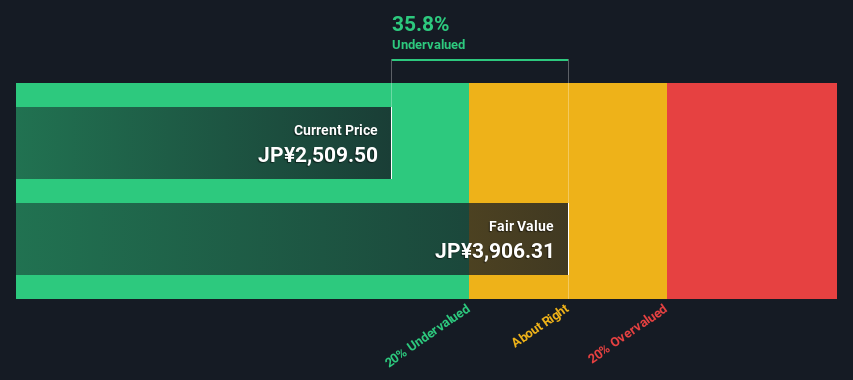

MINEBEA MITSUMI has demonstrated strong financial performance, with consolidated net sales for Q2 of the fiscal year ending March 2025 increasing by 11.3% year-on-year and 18.9% quarter-on-quarter, reaching ¥422.78 billion. Katsuhiko Yoshida, the Director, President, Executive Officer, COO, and CFO, highlighted that both net sales and operating income reached record highs for the quarter. This success is further supported by strong segment performance, particularly in PT, where sales exceeded forecasts due to a data center market recovery and solid aircraft application sales. Additionally, the company's stock is trading at 36.2% below its estimated fair value, suggesting potential for price appreciation, as analysts predict a 44.2% rise. The net debt to equity ratio of 36.9% and well-covered interest payments by EBIT (6x coverage) underscore financial stability.

Internal Limitations Hindering MINEBEA MITSUMI's Growth

The company faces challenges, such as a 26.1% drop in profit attributable to the owners of the parent year-on-year, totaling ¥12.11 billion. Yoshida noted this decline in the latest earnings call. Furthermore, the subcore segment, including mobile phones and game-related products, underperformed against expectations in the first half, as highlighted by Yoshihisa Kainuma, the Representative Director, Chairman, and CEO. The company's current net profit margin of 4% is lower than the previous year's 4.8%, and its Return on Equity at 8.5% remains below the 20% threshold. Additionally, the company is considered expensive with a Price-To-Earnings Ratio of 16.5x compared to the JP Machinery industry average of 12.2x, though it remains attractive relative to its peer average of 20.6x.

Growth Avenues Awaiting MINEBEA MITSUMI

Opportunities abound for MINEBEA MITSUMI, particularly in the aircraft business, where expansion into Thailand and India is anticipated to be effective, according to Kainuma. The company is also poised to capitalize on innovations in Access Solutions, a sector experiencing significant change and attracting numerous inquiries. The recent board meeting on November 29, 2024, discussed increasing the capital of Minebea Slovakia s.r.o., a wholly owned subsidiary, which could further enhance strategic positioning. Trading below analyst price targets suggests room for appreciation, and the low dividend yield of 1.61% presents an opportunity for future increases.

Competitive Pressures and Market Risks Facing MINEBEA MITSUMI

However, the company must navigate several threats, including foreign exchange fluctuations, which have seen more than ¥10 variations, making future predictions challenging, as noted by Kainuma. Additionally, competition in the semiconductor market is intensifying, with Chinese players introducing similar products at lower prices. The forecasted revenue growth of 1.8% lags behind both the JP market and industry averages, raising concerns about long-term profitability. Furthermore, the volatility in dividend payments over the past decade may deter potential investors, highlighting the need for consistent financial performance.

Conclusion

MINEBEA MITSUMI's impressive financial performance, with significant sales growth and record-high operating income, highlights its strong market position, particularly in the PT segment. This is further bolstered by its stock trading at a significant discount to its estimated fair value, suggesting potential for price appreciation. However, challenges such as declining profits and underperformance in certain segments, coupled with a Price-To-Earnings Ratio above the JP Machinery industry average, indicate areas needing improvement. The company's strategic expansions and innovations present growth opportunities, while its metrics relative to peers suggest it remains a competitive investment. Navigating foreign exchange risks and intensifying market competition will be crucial for sustaining long-term profitability and enhancing investor confidence.

Where To Now?

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6479

MINEBEA MITSUMI

Manufactures and supplies machined components, electronic devices and components, automotive, and industrial machinery and home security business in Japan and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives