A Look at Hoshizaki (TSE:6465) Valuation Following Dividend Hike and Strong Sales Growth

Reviewed by Simply Wall St

Hoshizaki (TSE:6465) just released financial results showing net sales up by 10% for the first nine months of 2025, supported by recent acquisitions and shifts in accounting policies. The company also announced a planned dividend increase.

See our latest analysis for Hoshizaki.

Hoshizaki’s recent dividend hike and board changes have come amid a challenging stretch for the stock, with momentum fading this year. While the 1-year total shareholder return stands at -7.3%, long-term holders have still enjoyed a 19% gain over three years. This suggests that, despite short-term headwinds, the company’s fundamental growth story and management’s confidence remain intact.

If upbeat news around dividend hikes has you rethinking your portfolio, now’s an opportune moment to broaden your search and discover fast growing stocks with high insider ownership

With strong sales growth and management raising dividends, the question for investors is whether Hoshizaki’s improving fundamentals mean the stock is undervalued or if the market has already priced in future growth potential.

Price-to-Earnings of 17.8x: Is it justified?

Hoshizaki trades at a price-to-earnings (P/E) ratio of 17.8 times earnings, notably below its peer average of 25.7x. At its last closing price of ¥5,060, the stock appears attractively valued compared to similar companies in its sector.

The price-to-earnings ratio compares the current share price to per-share earnings, making it a common benchmark for weighing a company's market value against its profitability. For capital goods companies like Hoshizaki, which typically post steady earnings, this multiple captures how much investors are willing to pay per unit of profit.

Hoshizaki's lower P/E compared to peers could suggest the market is underestimating its future earnings growth or perhaps giving less credit for its consistent performance. The stock also trades just under the estimated fair P/E ratio of 18.3x, which may provide price support if sentiment changes.

Compared to its industry, Hoshizaki is more expensive than the JP Machinery average P/E of 13.2x, but cheaper than the average for its closest peers. This places the current valuation as reasonable, although not a bargain relative to the broader sector.

Explore the SWS fair ratio for Hoshizaki

Result: Price-to-Earnings of 17.8x (UNDERVALUED)

However, persistent share price weakness and lagging short-term returns could signal investor caution, even as fundamentals improve and management provides upbeat signals.

Find out about the key risks to this Hoshizaki narrative.

Another View: DCF Model Points to Further Upside

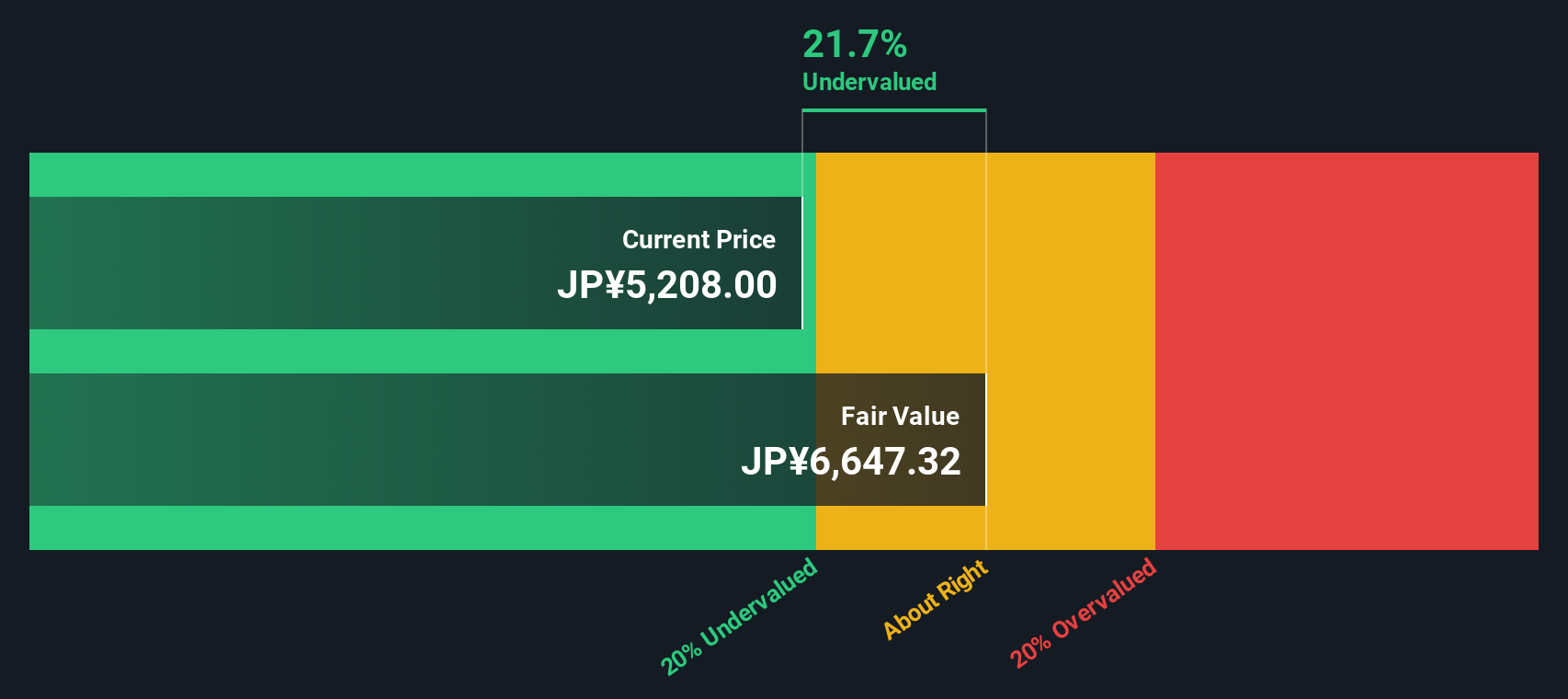

Looking beyond earnings multiples, our DCF model offers a different perspective. It estimates Hoshizaki’s fair value at ¥6,642 per share, which is about 24% above the current price. This raises the question of whether the market is missing something, or if caution is justified given recent performance.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hoshizaki for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hoshizaki Narrative

If you have your own take on Hoshizaki’s outlook or want to dig deeper into the numbers, you can craft a personal view in just minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Hoshizaki.

Looking for More Ways to Invest Smarter?

Stay ahead of the curve and seize new opportunities by checking out top stocks from sectors set for long-term growth, innovation, and strong financials.

- Uncover fresh potential with these 865 undervalued stocks based on cash flows, focused on companies that could be trading below their intrinsic worth and offering upside others may have missed.

- Catch the next wave of healthcare breakthroughs by tapping into these 32 healthcare AI stocks, where artificial intelligence is transforming the industry and driving promising business models.

- Boost your portfolio with income-generating picks using these 14 dividend stocks with yields > 3%, which highlights established businesses offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hoshizaki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6465

Hoshizaki

Researches, develops, manufactures, and sells commercial kitchen appliances and equipment worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives