- China

- /

- Electrical

- /

- SHSE:603050

Unveiling Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

In the current global market landscape, major indices have experienced fluctuations due to tariff uncertainties and mixed economic data, with the S&P 500 Index showing resilience despite a slight decline. As investors navigate these conditions, identifying stocks with strong fundamentals and growth potential becomes crucial for uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Conoil | 65.11% | 21.04% | 44.95% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shijiazhuang Kelin Electric (SHSE:603050)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shijiazhuang Kelin Electric Co., Ltd. is a company that designs, manufactures, and sells electrical power distribution and metering products in China with a market capitalization of approximately CN¥5.86 billion.

Operations: Kelin Electric generates revenue primarily from its electrical equipment manufacturing segment, amounting to CN¥4.19 billion. The company's market capitalization stands at approximately CN¥5.86 billion.

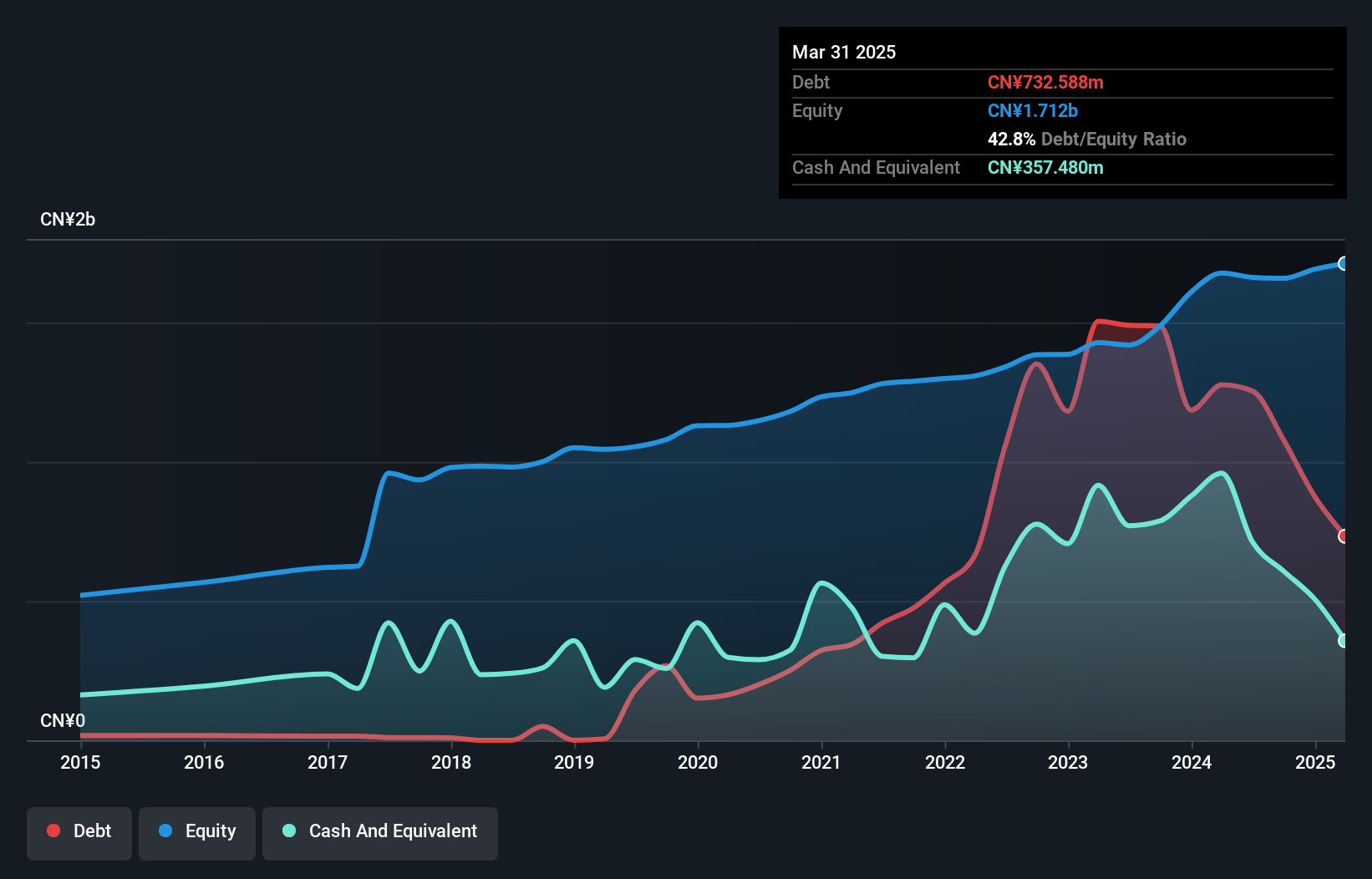

With a net debt to equity ratio of 28.4%, Shijiazhuang Kelin Electric seems to manage its financial obligations effectively, offering a satisfactory balance. The company has demonstrated strong earnings growth of 48.7% over the past year, significantly outpacing the Electrical industry average of 1.1%. Interest payments are well covered by EBIT at 8.8 times, indicating robust operational performance. Trading at approximately 83% below estimated fair value suggests potential undervaluation in the market. Despite an increase in debt levels over five years, its high-quality earnings and positive free cash flow position it as an intriguing prospect for investors seeking growth opportunities within this sector.

UTour Group (SZSE:002707)

Simply Wall St Value Rating: ★★★★☆☆

Overview: UTour Group Co., Ltd. operates in the outbound tourism wholesale and retail sector both within China and globally, with a market capitalization of CN¥7.38 billion.

Operations: The company generates revenue primarily through its outbound tourism wholesale and retail business. With a market capitalization of CN¥7.38 billion, it operates both within China and internationally.

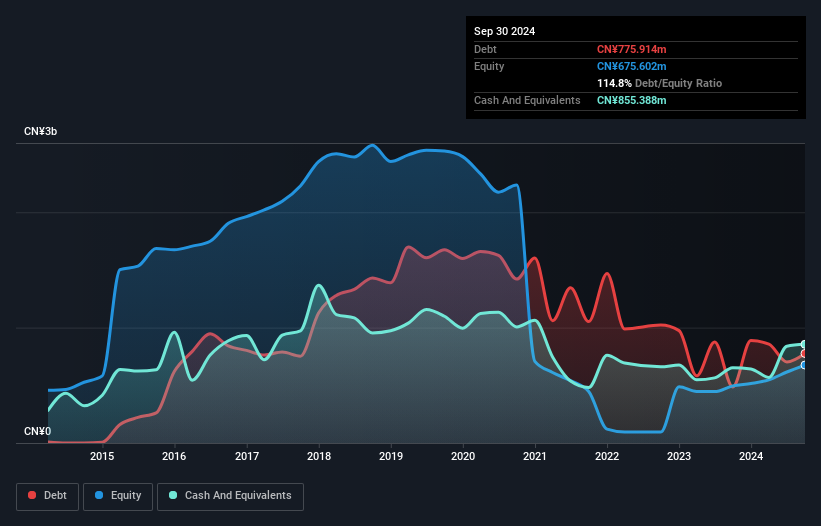

UTour Group, a smaller player in the travel industry, has recently turned profitable, which sets it apart from the broader hospitality sector that faced a 6.9% contraction. The company's debt-to-equity ratio has climbed to 114.8% over five years, indicating increased leverage but is balanced by cash exceeding its total debt. With earnings forecasted to grow at 33% annually and interest payments covered 9 times by EBIT, UTour's financial health seems robust. Trading at a significant discount of 82% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in this niche market segment.

- Unlock comprehensive insights into our analysis of UTour Group stock in this health report.

Explore historical data to track UTour Group's performance over time in our Past section.

Sinko Industries (TSE:6458)

Simply Wall St Value Rating: ★★★★★★

Overview: Sinko Industries Ltd. manufactures, sells, and installs air conditioning equipment in Japan and internationally with a market cap of ¥92.90 billion.

Operations: The company generates revenue primarily from the manufacturing, sales, and installation of air conditioning equipment. Its cost structure includes expenses related to production, distribution, and installation processes. The net profit margin has shown variability over recent periods.

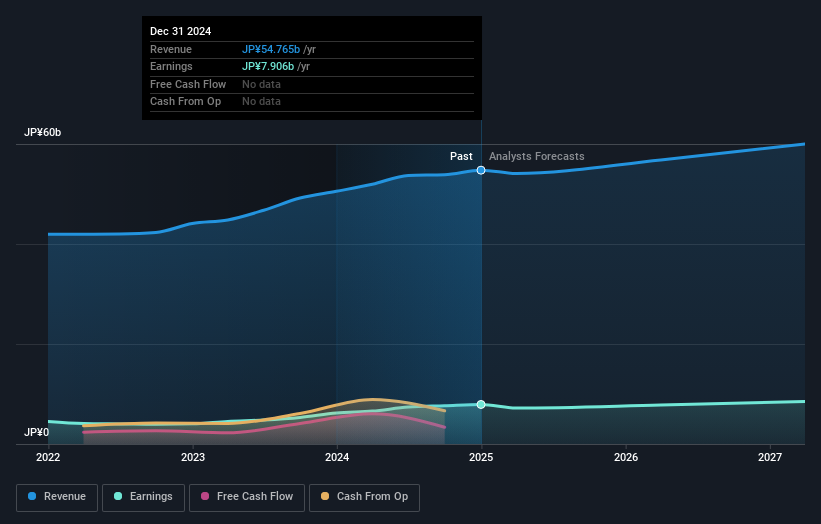

Sinko Industries, a nimble player in its sector, has showcased impressive earnings growth of 27.7% over the past year, outpacing the building industry's 16%. The company's debt-to-equity ratio has improved from 4.6 to 4% in five years, indicating prudent financial management. With a price-to-earnings ratio of 11.8x below Japan's market average of 13.3x, it seems attractively valued. Recent activities include repurchasing approximately 3.57% of shares for ¥3.30 billion and adjusting dividends with a notable second-quarter increase to ¥54 per share from ¥35 last year but lowering the year-end payout forecast significantly to JPY32 per share from JPY70 previously announced.

- Click here and access our complete health analysis report to understand the dynamics of Sinko Industries.

Gain insights into Sinko Industries' past trends and performance with our Past report.

Taking Advantage

- Delve into our full catalog of 4702 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603050

Shijiazhuang Kelin Electric

Engages in research, development, designing, manufacturing, and selling of electrical power generation, transmission, and distribution in China.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives