Undiscovered Gems Featuring Three Top Small Cap Stocks With Promising Potential

Reviewed by Simply Wall St

In the midst of a turbulent global market backdrop, where U.S. stocks have recently faced declines due to cautious Federal Reserve commentary and looming government shutdown fears, small-cap indices like the S&P 600 have experienced notable pressure. Despite these challenges, opportunities exist for discerning investors who can identify small-cap stocks with strong fundamentals and growth potential that may thrive even in uncertain economic climates.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Conoil | 27.59% | 16.64% | 46.05% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.18% | 50.86% | 65.05% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Kerevitas Gida Sanayi ve Ticaret | 48.40% | 45.75% | 37.51% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Shenzhen Qingyi Photomask (SHSE:688138)

Simply Wall St Value Rating: ★★★★★☆

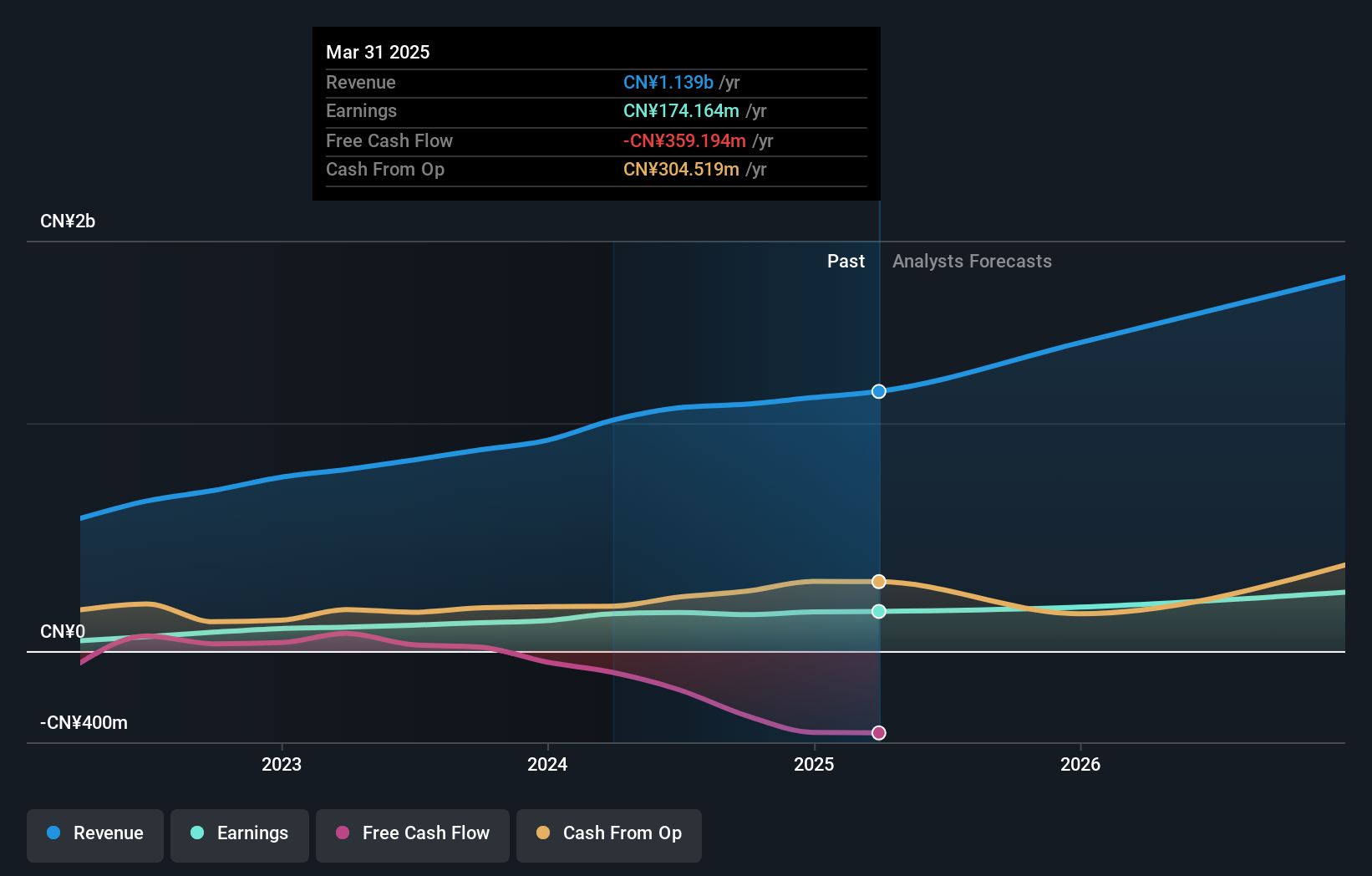

Overview: Shenzhen Qingyi Photomask Limited focuses on the research, design, production, and sales of high precision masks in China with a market cap of CN¥6.68 billion.

Operations: Shenzhen Qingyi Photomask generates revenue primarily from the sale of high precision masks. The company's cost structure includes expenses related to research, design, and production. Its financial performance is characterized by a net profit margin trend that provides insights into its profitability over time.

Shenzhen Qingyi Photomask, an intriguing player in the electronics sector, has shown robust earnings growth of 28.2% over the past year, outpacing the industry average of 1.9%. The company reported sales of CNY 826.75 million for nine months ending September 2024, up from CNY 667.77 million a year prior. Net income also rose to CNY 120.46 million from CNY 94.63 million last year, reflecting a solid performance amidst market challenges. With a satisfactory net debt to equity ratio of 26.2% and well-covered interest payments at an EBIT coverage of 15.6x, Shenzhen Qingyi seems financially sound despite its small size in the market landscape.

Longhua Technology GroupLtd (SZSE:300263)

Simply Wall St Value Rating: ★★★★☆☆

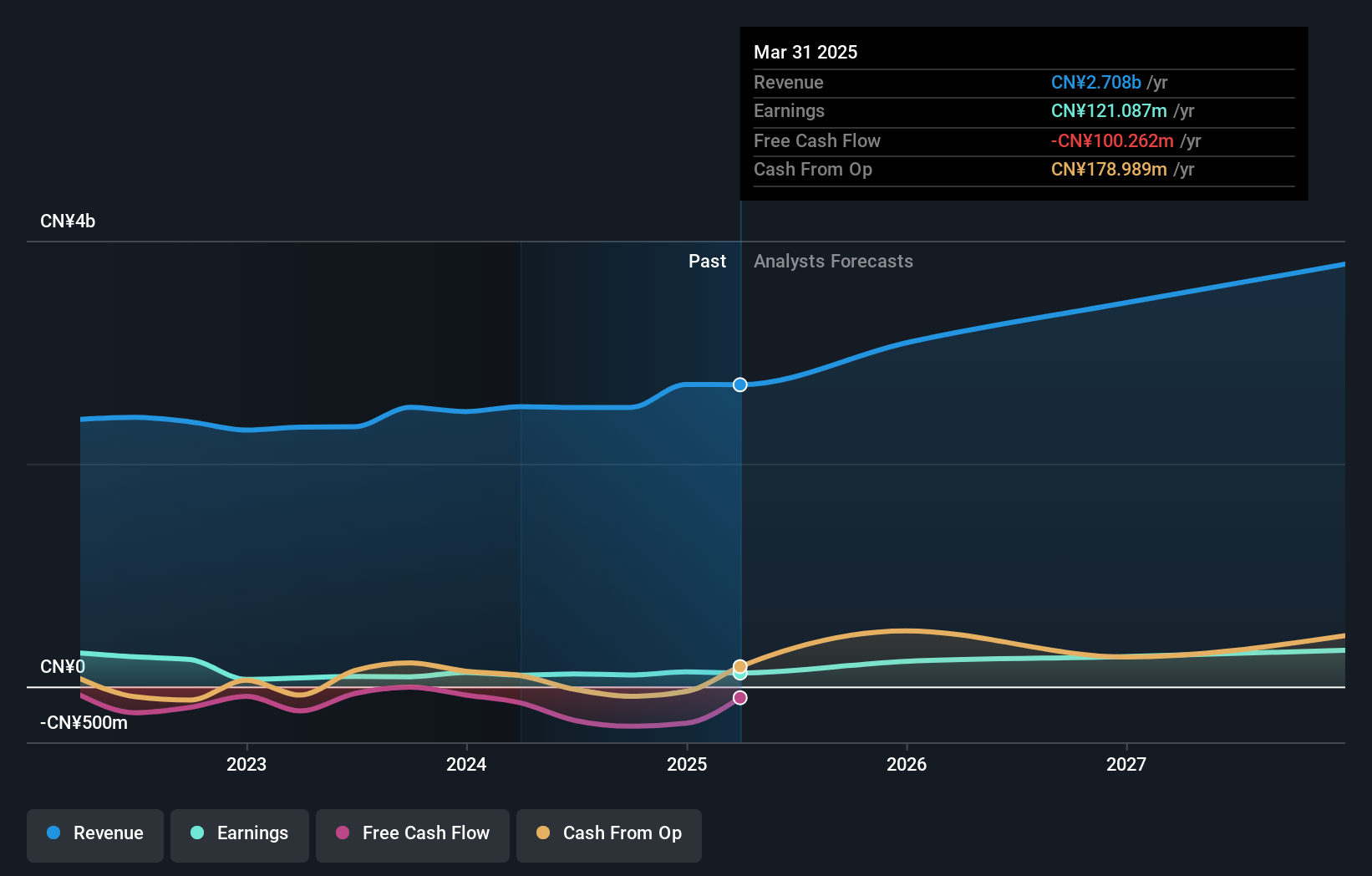

Overview: Longhua Technology Group Co., Ltd. specializes in the manufacturing and sale of heat transfer and energy-saving equipment in China, with a market capitalization of CN¥6.99 billion.

Operations: Longhua Technology Group generates revenue primarily from the sale of heat transfer and energy-saving equipment. The company's financial performance is highlighted by a net profit margin trend worth noting, which has shown variability over recent periods.

Longhua Tech, a promising player in the machinery sector, has shown robust earnings growth of 18.9% over the past year, outpacing the industry average of -0.2%. The company's debt management is commendable with a net debt to equity ratio at 32.1%, which is satisfactory by industry standards. Despite an increase in their debt to equity ratio from 12.7% to 48.6% over five years, interest payments are well-covered by EBIT at 5.5 times coverage. Recent reports indicate sales of ¥1,930 million for nine months ending September 2024; however, net income dipped to ¥154 million from ¥177 million previously due to unspecified factors impacting profit margins and possibly affecting future projections despite high-quality earnings and profitability being noted as strengths.

Sinko Industries (TSE:6458)

Simply Wall St Value Rating: ★★★★★★

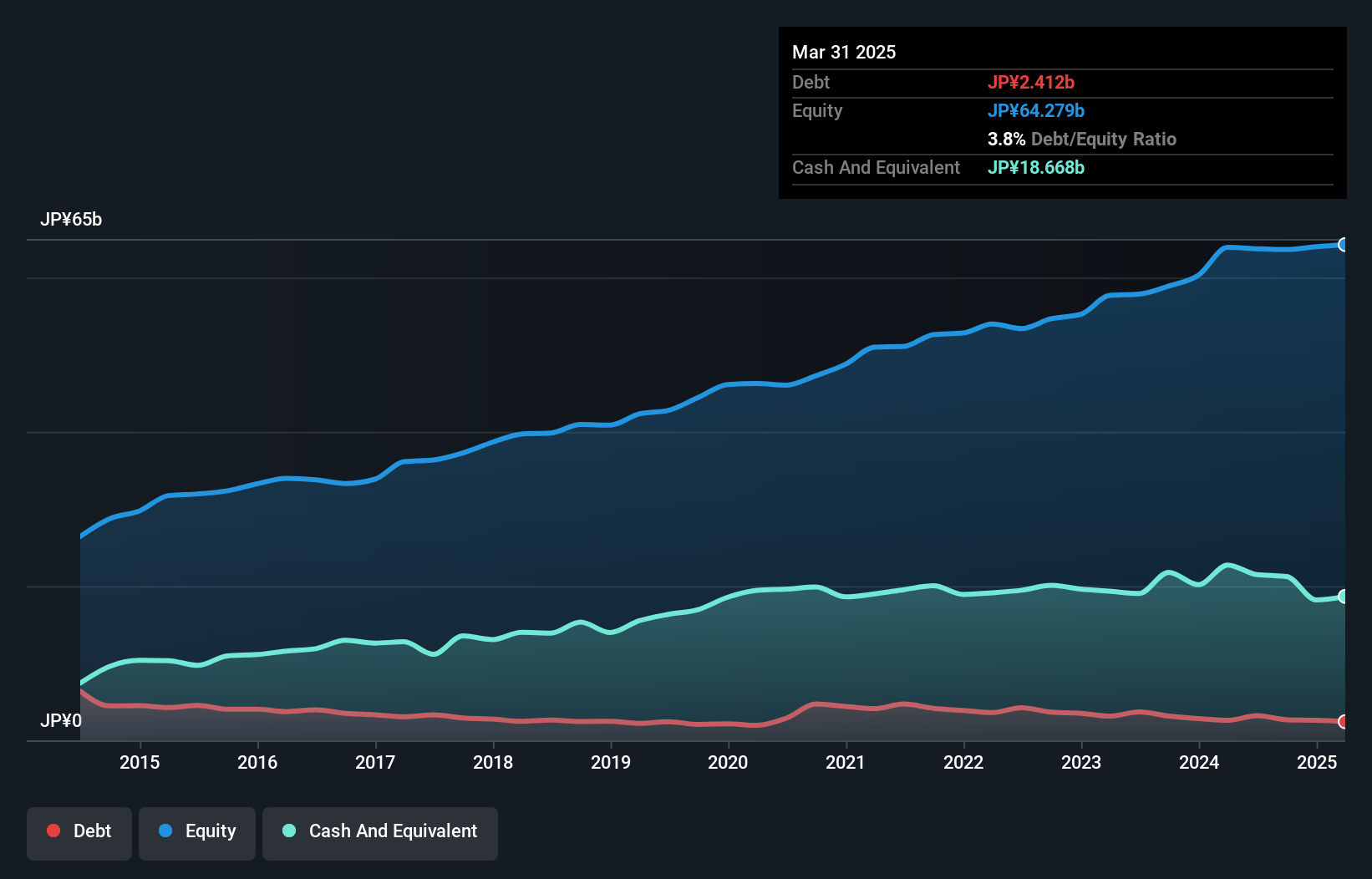

Overview: Sinko Industries Ltd. engages in the manufacturing, selling, and installation of air conditioning equipment both domestically in Japan and internationally, with a market capitalization of ¥89.02 billion.

Operations: Sinko Industries generates revenue primarily from its air conditioning equipment business, with ¥47.22 billion coming from Japan and ¥6.65 billion from Asia.

Sinko Industries, a smaller player in its field, has shown impressive earnings growth of 43.9% over the past year, outpacing the building industry's 7.6%. The company’s debt to equity ratio improved from 4.7 to 4.2 over five years, indicating better financial health. Despite a volatile share price recently, Sinko's price-to-earnings ratio of 11.6x remains attractive compared to the JP market average of 13.4x. Recent strategic moves include repurchasing approximately 3.57% of shares for ¥3,299 million and announcing a stock split and dividend adjustments that reflect its dynamic approach to shareholder value enhancement.

- Delve into the full analysis health report here for a deeper understanding of Sinko Industries.

Gain insights into Sinko Industries' past trends and performance with our Past report.

Make It Happen

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4612 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6458

Sinko Industries

Manufactures, sells, and installs air conditioning equipment in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives