Does Glory's Upward Earnings Revision Reinforce the Bull Case for TSE:6457?

Reviewed by Sasha Jovanovic

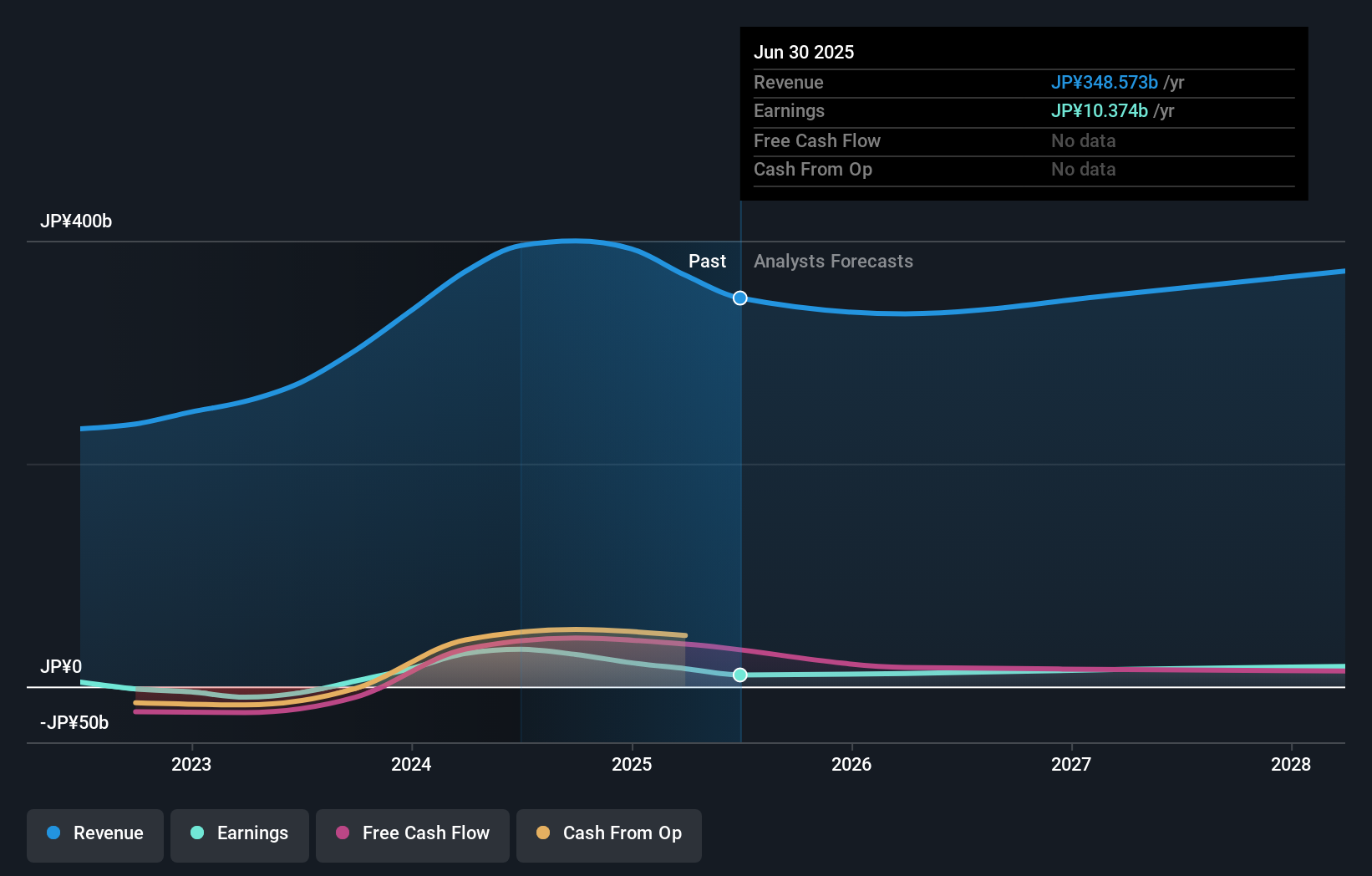

- Glory Ltd. recently raised its consolidated earnings forecast for the year ending March 31, 2026, projecting net sales of ¥340 billion, operating income of ¥24 billion, and a higher interim dividend of ¥56.00 per share to be paid on December 5, 2025.

- The company's outlook reflects steady demand for self-service products and improved domestic profitability through cost reductions and a stronger product mix.

- Let's examine how Glory's upward earnings revision and product demand support its overall investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Glory's Investment Narrative?

If I’m holding Glory shares or thinking about it, I’d need conviction in two big ideas: first, that rising labor costs and staff shortages will continue driving steady demand for Glory’s self-service and cash automation products, and second, that internal cost controls and a sharper product lineup can lift profitability even if overall market growth is slow. The company’s upward revision of earnings guidance and dividend, reflecting better domestic margins, offers a visible short-term catalyst, particularly given the consistent demand for automation solutions. At the same time, a risk I can’t ignore is Glory’s relatively low profit margins and sluggish revenue growth versus the broader machinery market, factors that haven’t fully gone away just because of this outlook upgrade. While the news lifts the near-term profit picture, it also raises the stakes for delivering on these improvements.

But keep in mind, margin pressure remains a concern that investors should be aware of. Glory's shares have been on the rise but are still potentially undervalued by 23%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Glory - why the stock might be worth 15% less than the current price!

Build Your Own Glory Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Glory research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Glory research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Glory's overall financial health at a glance.

No Opportunity In Glory?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6457

Glory

Develops, manufactures and sells cash handling machines in Japan, the United States, Europe, and Asia.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives