Some May Be Optimistic About Yuken Kogyo's (TSE:6393) Earnings

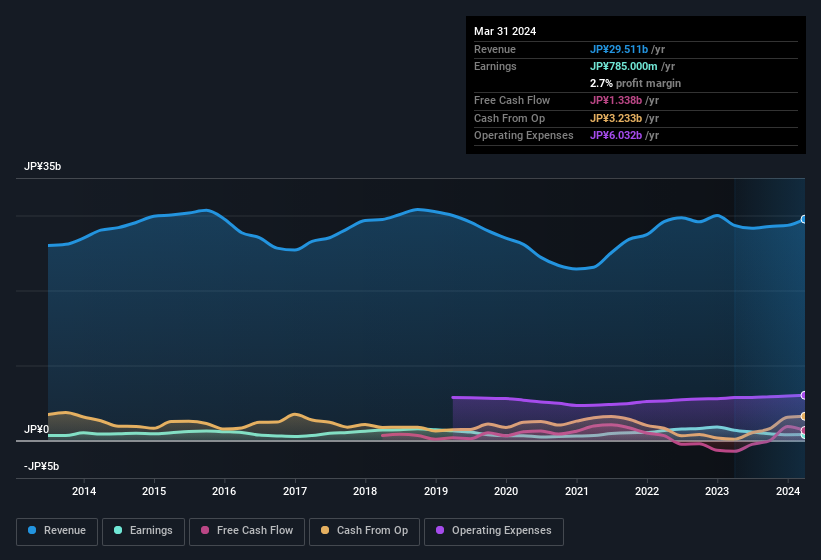

The market for Yuken Kogyo Co., Ltd.'s (TSE:6393) shares didn't move much after it posted weak earnings recently. Our analysis suggests that while the profits are soft, the foundations of the business are strong.

Check out our latest analysis for Yuken Kogyo

The Impact Of Unusual Items On Profit

To properly understand Yuken Kogyo's profit results, we need to consider the JP¥198m expense attributed to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect Yuken Kogyo to produce a higher profit next year, all else being equal.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Yuken Kogyo.

Our Take On Yuken Kogyo's Profit Performance

Unusual items (expenses) detracted from Yuken Kogyo's earnings over the last year, but we might see an improvement next year. Based on this observation, we consider it likely that Yuken Kogyo's statutory profit actually understates its earnings potential! And on top of that, its earnings per share have grown at 26% per year over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. While conducting our analysis, we found that Yuken Kogyo has 2 warning signs and it would be unwise to ignore them.

This note has only looked at a single factor that sheds light on the nature of Yuken Kogyo's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

If you're looking to trade Yuken Kogyo, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6393

Yuken Kogyo

Develops, manufactures, and sells hydraulic equipment and systems, and environmental machinery in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives