Slammed 30% Hokuetsu Industries Co., Ltd. (TSE:6364) Screens Well Here But There Might Be A Catch

Hokuetsu Industries Co., Ltd. (TSE:6364) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 16% share price drop.

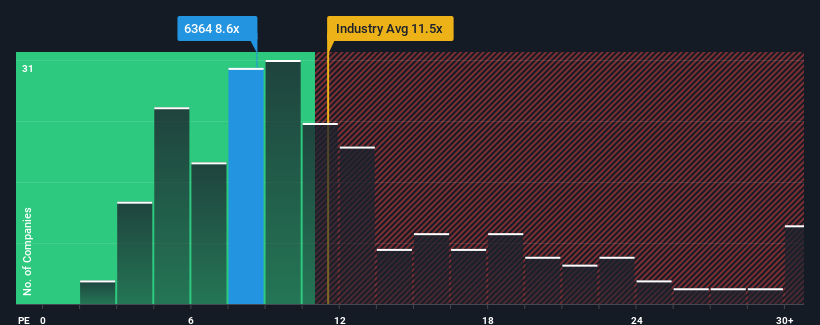

In spite of the heavy fall in price, Hokuetsu Industries' price-to-earnings (or "P/E") ratio of 8.6x might still make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 14x and even P/E's above 21x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Hokuetsu Industries certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Hokuetsu Industries

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Hokuetsu Industries' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 21%. Pleasingly, EPS has also lifted 158% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 10% each year during the coming three years according to the lone analyst following the company. Meanwhile, the rest of the market is forecast to expand by 9.6% per annum, which is not materially different.

In light of this, it's peculiar that Hokuetsu Industries' P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Hokuetsu Industries' P/E has taken a tumble along with its share price. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Hokuetsu Industries currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Hokuetsu Industries that you should be aware of.

If these risks are making you reconsider your opinion on Hokuetsu Industries, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6364

Airman

Engages in the manufacture and sale of construction machinery, including construction equipment for heavy machinery and industrial machinery in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives