Uncovering None And Two More Hidden Small Caps With Strong Foundations

Reviewed by Simply Wall St

As global markets grapple with cautious Federal Reserve commentary and looming political uncertainties, small-cap stocks have faced heightened volatility, with indices like the S&P 600 experiencing notable declines. Amid these challenging conditions, identifying small-cap companies with strong foundations becomes crucial, as they often possess unique growth potential and resilience that can weather broader market turbulence.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Shibuya (TSE:6340)

Simply Wall St Value Rating: ★★★★★★

Overview: Shibuya Corporation manufactures and sells packaging and other systems both in Japan and internationally, with a market cap of ¥105.96 billion.

Operations: The company generates revenue through the manufacturing and sale of packaging systems. Its financial performance is characterized by a net profit margin, which provides insight into profitability after accounting for all expenses.

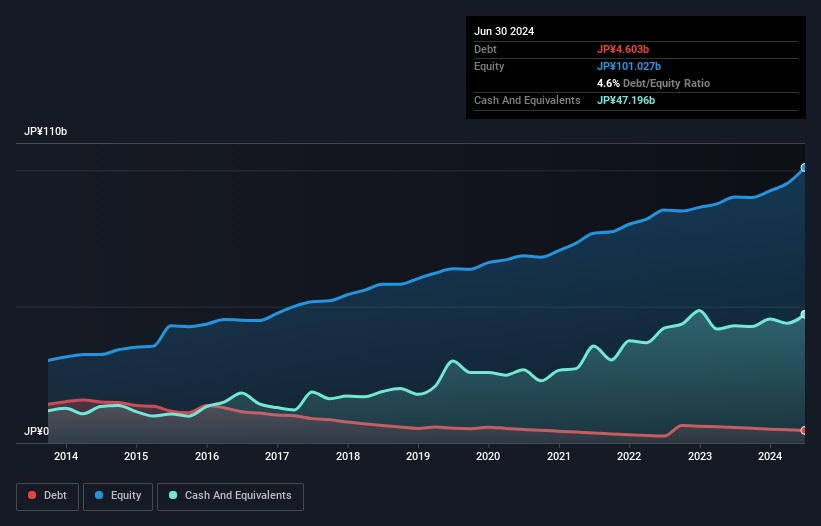

In the bustling machinery sector, Shibuya stands out with a noteworthy earnings growth of 91.5% over the past year, significantly surpassing the industry average of 0.8%. The company is trading at an attractive price-to-earnings ratio of 9.2x, which is below the JP market's average of 13.4x, suggesting good relative value against peers and within its industry. With a debt-to-equity ratio decreasing from 8.2% to 4.3% over five years and more cash than total debt, Shibuya seems financially sound and poised for sustainable operations without immediate liquidity concerns.

- Click here and access our complete health analysis report to understand the dynamics of Shibuya.

Evaluate Shibuya's historical performance by accessing our past performance report.

Daiichikosho (TSE:7458)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daiichikosho Co., Ltd. is a Japanese company that specializes in the sale and rental of commercial karaoke systems, with a market capitalization of ¥196.30 billion.

Operations: Daiichikosho's primary revenue streams are from its Karaoke and Restaurant Business, generating ¥65.87 billion, and Commercial Karaoke segment, contributing ¥61.39 billion. The Music Soft segment adds an additional ¥6.34 billion to the company's revenue mix.

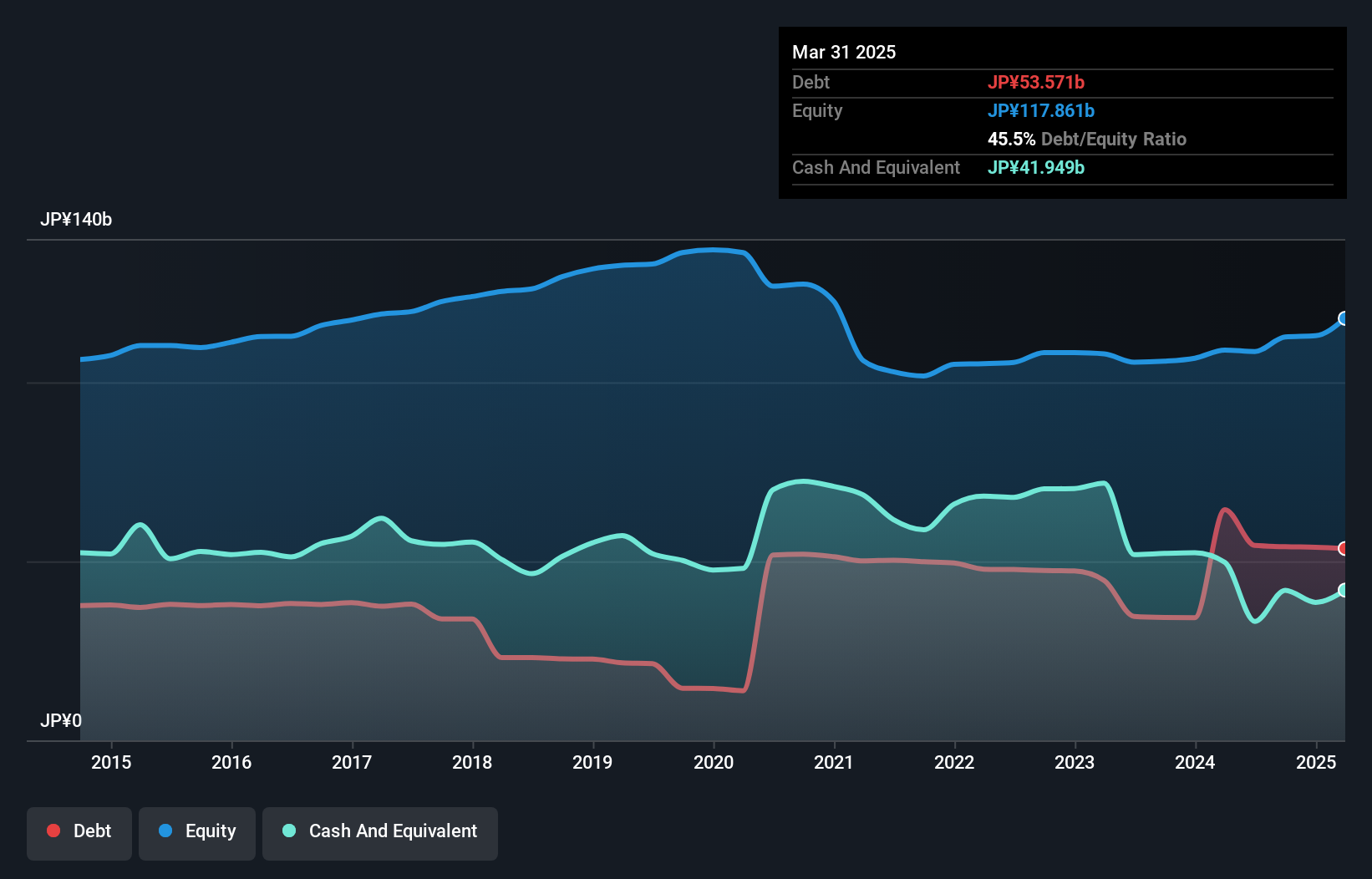

Daiichikosho, a notable player in the entertainment sector, has displayed impressive earnings growth of 75.1% over the past year, significantly outpacing the industry's -7% performance. Its debt to equity ratio has risen from 10.7% to 48% over five years, yet its interest payments are comfortably covered by EBIT at an impressive 396x. The company trades at a price-to-earnings ratio of 12.6x, which is favorable compared to Japan's market average of 13.4x. Recently, Daiichikosho completed share buybacks totaling ¥3,999 million for approximately 2.22%, signaling confidence in its valuation and future prospects as it maintains dividends at JPY28 per share.

- Click here to discover the nuances of Daiichikosho with our detailed analytical health report.

Explore historical data to track Daiichikosho's performance over time in our Past section.

Hold-Key Electric Wire & Cable (TWSE:1618)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hold-Key Electric Wire & Cable Co., Ltd. is a Taiwanese company engaged in the manufacturing, importing, and selling of cable products, with a market capitalization of NT$8.71 billion.

Operations: Hold-Key Electric Wire & Cable generates revenue primarily from its wire and cable segment, totaling NT$4.60 billion.

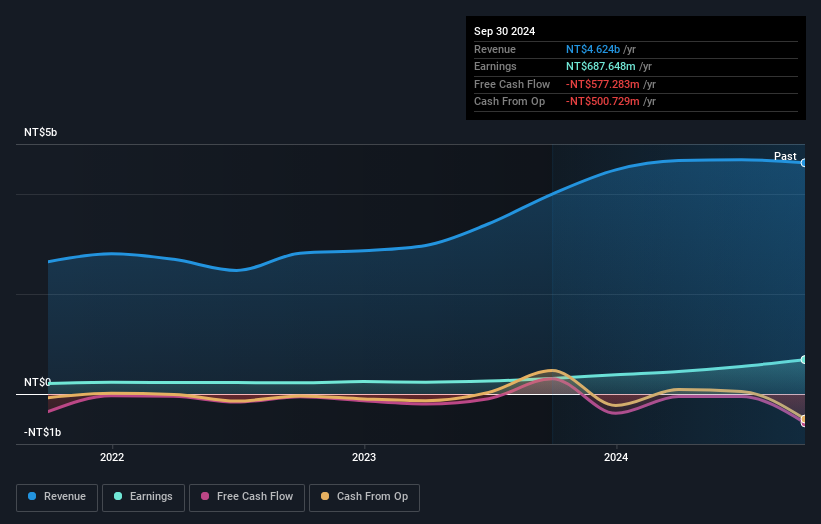

Hold-Key Electric Wire & Cable, a smaller player in the electrical industry, showcases impressive earnings growth of 120.9% over the past year, surpassing the industry's 6.1%. The company's net debt to equity ratio stands at a satisfactory 3.2%, indicating prudent financial management. Despite not having positive free cash flow recently, Hold-Key's profitability ensures its operations remain sustainable without immediate liquidity concerns. Recent reports highlight a significant jump in net income for Q3 2024 to TWD 226.89 million from TWD 91.31 million last year, with basic earnings per share rising from TWD 0.47 to TWD 1.18, reflecting strong operational performance and potential value for investors seeking hidden opportunities in this sector.

Turning Ideas Into Actions

- Click here to access our complete index of 4624 Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6340

Shibuya

Manufactures and sells packaging and other systems in Japan and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives