Stock Analysis

- Japan

- /

- Food and Staples Retail

- /

- TSE:7508

Exploring Undiscovered Japanese Stocks With Potential In July 2024

Reviewed by Simply Wall St

Amid a backdrop of heightened global trade tensions and shifting market dynamics, Japan's stock markets have recently faced challenges, particularly in the technology sector due to potential U.S. restrictions on semiconductor exports. This environment may present opportunities for investors to explore lesser-known Japanese stocks that could be poised for growth despite broader market uncertainties. In such a climate, identifying stocks with robust fundamentals and potential resilience against macroeconomic pressures becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Business Brain Showa-Ota | 0.05% | 7.50% | 59.43% | ★★★★★★ |

| Central Forest Group | NA | 5.16% | 12.45% | ★★★★★★ |

| Tokyo Tekko | 14.77% | 6.58% | -0.70% | ★★★★★★ |

| KurimotoLtd | 17.04% | 3.22% | 19.20% | ★★★★★★ |

| DoshishaLtd | 7.83% | 1.91% | 4.41% | ★★★★★★ |

| Otec | 7.45% | 2.06% | -0.77% | ★★★★★★ |

| Kondotec | 12.01% | 6.76% | 0.32% | ★★★★★☆ |

| Cresco | 8.62% | 7.79% | 9.50% | ★★★★★☆ |

| Nippon Ski Resort DevelopmentLtd | 39.31% | 2.95% | 19.16% | ★★★★★☆ |

| GENOVA | 6.23% | 24.87% | 31.14% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

SAN-ALTD (TSE:2659)

Simply Wall St Value Rating: ★★★★★★

Overview: SAN-A CO., LTD. is a company that operates a chain of supermarkets primarily in Okinawa, with a market capitalization of approximately ¥157.96 billion.

Operations: The company generates revenue primarily through the sale of goods, as indicated by consistently high costs of goods sold (COGS), which form a substantial portion of its expenses. Over recent periods, it has demonstrated an increasing gross profit margin, reaching 37.05% by mid-2024, reflecting a gradual enhancement in the efficiency or pricing strategy of its core operations.

SAN-A CO., LTD., a lesser-known Japanese entity, has shown robust performance with a 34.4% earnings growth over the past year, surpassing the Consumer Retailing industry's 28.8%. Positioned at 41.4% below its fair value, the company is debt-free and forecasts a steady earnings growth of 4.09% annually. Recent corporate guidance anticipates operating revenue of JPY 236 billion and profits attributable to owners at JPY 11 billion for FY2025, despite a dividend cut to ¥55 per share from ¥110 last year.

- Click here to discover the nuances of SAN-ALTD with our detailed analytical health report.

Evaluate SAN-ALTD's historical performance by accessing our past performance report.

Shibuya (TSE:6340)

Simply Wall St Value Rating: ★★★★★★

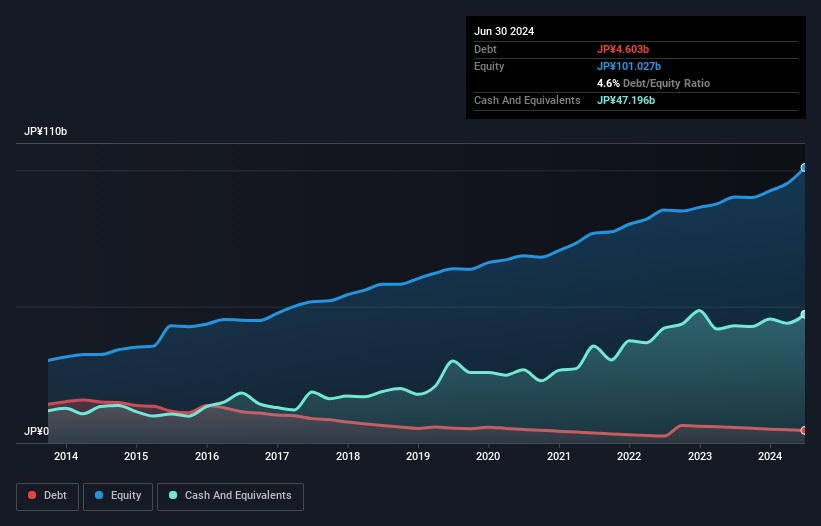

Overview: Shibuya Corporation operates in the manufacturing and sales of packaging and other systems both domestically in Japan and on an international scale, with a market capitalization of ¥102.51 billion.

Operations: The company generates revenue primarily through the sale of goods, with consistent cost of goods sold (COGS) forming a significant portion of its expenses. Over the observed periods, it has managed to achieve a gross profit margin consistently above 17%, reflecting its ability to maintain a profitable markup on products sold.

Shibuya, a lesser-known Japanese entity, stands out with its robust performance in the machinery sector. Over the past year, earnings surged by 17.6%, surpassing industry growth of 15.7%. Trading at 64.1% below its estimated fair value suggests significant upside potential. The company's strategic financial management is evident as its debt-to-equity ratio improved from 9.4% to 5.1% over five years, underscoring a strong balance sheet poised for future growth initiatives.

- Delve into the full analysis health report here for a deeper understanding of Shibuya.

Examine Shibuya's past performance report to understand how it has performed in the past.

G-7 Holdings (TSE:7508)

Simply Wall St Value Rating: ★★★★★★

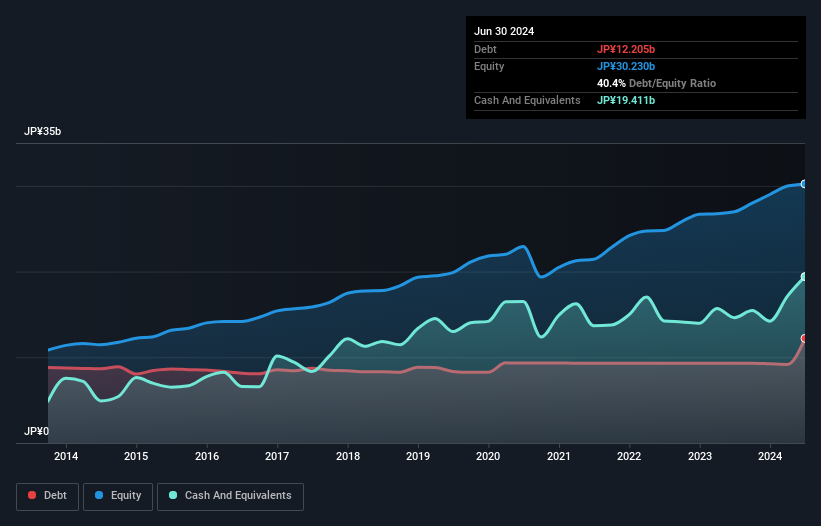

Overview: G-7 Holdings Inc. operates a food retail business through its subsidiaries, serving both domestic and international markets, with a market capitalization of ¥74.64 billion.

Operations: The company generates revenue primarily through the sale of goods, as indicated by consistently high costs of goods sold (COGS) relative to total revenue, with recent figures showing COGS at ¥147.30 billion against revenues of ¥192.99 billion. It operates with a gross profit margin that has trended slightly downwards over the years, from approximately 27% in 2013 to around 23.67% by mid-2024, reflecting variations in cost management and sales efficiency.

G-7 Holdings, a standout in Japan's retail sector, has demonstrated robust performance with a 35.3% earnings growth last year, outpacing the industry's 28.8%. The firm is valued attractively, trading at 49% below its estimated fair value and boasts high-quality earnings. Its financial health is solid with more cash than debt and interest payments well covered by EBIT (266.2x). Looking ahead, G-7 expects continued growth with a forecasted annual earnings increase of 4.57%.

- Dive into the specifics of G-7 Holdings here with our thorough health report.

Assess G-7 Holdings' past performance with our detailed historical performance reports.

Key Takeaways

- Dive into all 743 of the Japanese Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether G-7 Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7508

G-7 Holdings

Through its subsidiaries, engages in the food retail business in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.