Stock Analysis

- Japan

- /

- Entertainment

- /

- TSE:9697

Insider-Owned Growth Companies On The Japanese Exchange In July 2024

Reviewed by Simply Wall St

As of July 2024, Japan's stock markets have experienced a downturn, particularly in technology sectors due to heightened U.S. export restrictions affecting several Japanese chip makers. This backdrop sets a challenging yet intriguing stage for investors focusing on insider-owned growth companies in Japan, where high insider ownership might signal strong confidence from those who know the companies best amidst broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 42.9% |

| Medley (TSE:4480) | 34% | 28.7% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| SHIFT (TSE:3697) | 35.4% | 32.8% |

| Money Forward (TSE:3994) | 21.4% | 66.9% |

| ExaWizards (TSE:4259) | 21.9% | 91.1% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| AeroEdge (TSE:7409) | 10.7% | 28.5% |

We'll examine a selection from our screener results.

BayCurrent Consulting (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BayCurrent Consulting, Inc. offers consulting services across various sectors in Japan and has a market capitalization of approximately ¥694.28 billion.

Operations: The firm generates its revenue primarily through consulting services across diverse sectors in Japan.

Insider Ownership: 13.9%

BayCurrent Consulting, a growth-focused firm in Japan, exhibits strong revenue and earnings forecasts with annual increases expected at 18.2% and 18.7% respectively, outpacing the Japanese market averages. Despite its highly volatile share price recently, the company demonstrates robust potential with a forecasted Return on Equity of 34.7%. Additionally, recent activities include a share buyback program where BayCurrent repurchased shares for ¥3.6 billion, underscoring confidence from management amid no significant insider trading reported in the past three months.

- Take a closer look at BayCurrent Consulting's potential here in our earnings growth report.

- According our valuation report, there's an indication that BayCurrent Consulting's share price might be on the cheaper side.

SaizeriyaLtd (TSE:7581)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Saizeriya Co., Ltd. operates a chain of Italian-themed restaurants across Japan, Australia, and Asia, with a market capitalization of approximately ¥294.83 billion.

Operations: The company generates its revenue through its Italian-themed dining establishments located across Japan, Australia, and Asia.

Insider Ownership: 30.2%

Saizeriya Co., Ltd. is poised for substantial growth with earnings expected to rise by 26.1% annually, outstripping the Japanese market's average of 8.9%. Despite a slower revenue growth rate of 7.1% compared to high-growth benchmarks, it remains above the market norm of 4.3%. The stock is currently valued at 10.8% below its estimated fair value, and analysts predict a potential price increase of 20.5%. Notably, there has been no significant insider trading recently, aligning with stable ownership confidence as profits surged by 341% last year.

- Unlock comprehensive insights into our analysis of SaizeriyaLtd stock in this growth report.

- Our comprehensive valuation report raises the possibility that SaizeriyaLtd is priced lower than what may be justified by its financials.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a global company based in Japan that specializes in the planning, development, manufacturing, sale, and distribution of home video games, online games, mobile games, and arcade games with a market capitalization of approximately ¥1.30 trillion.

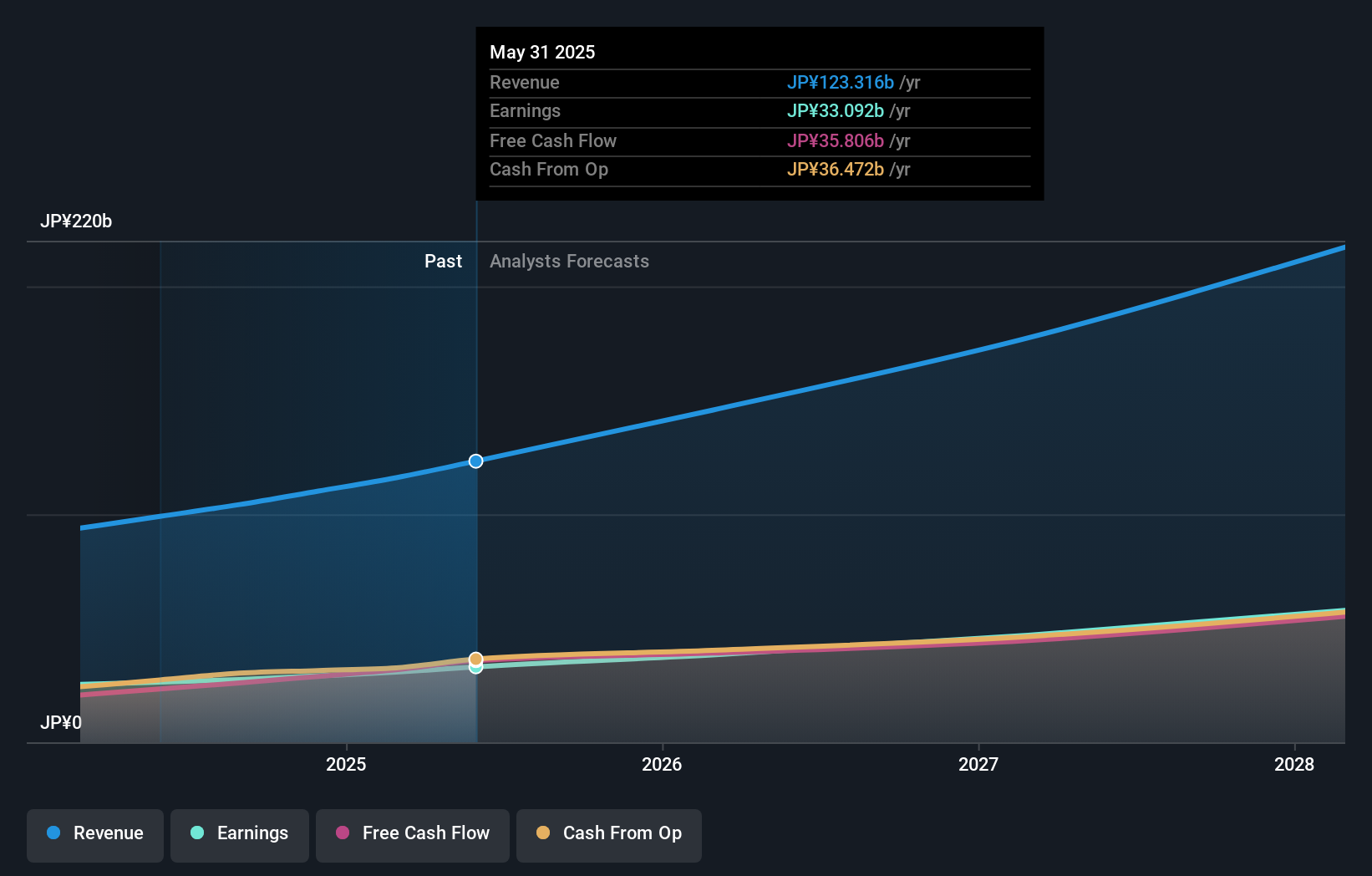

Operations: Capcom's revenue is primarily generated from digital content, which accounts for ¥119.84 billion, followed by amusement facilities and equipment contributing ¥19.34 billion and ¥9.02 billion respectively.

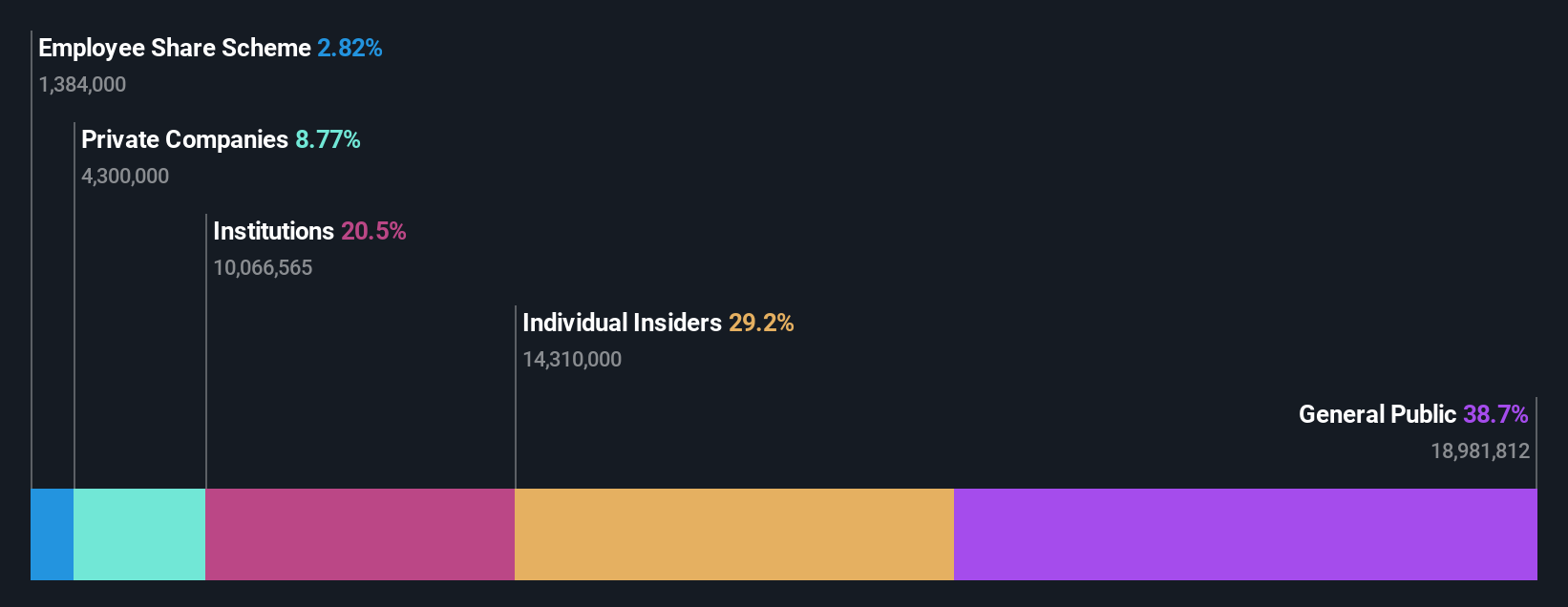

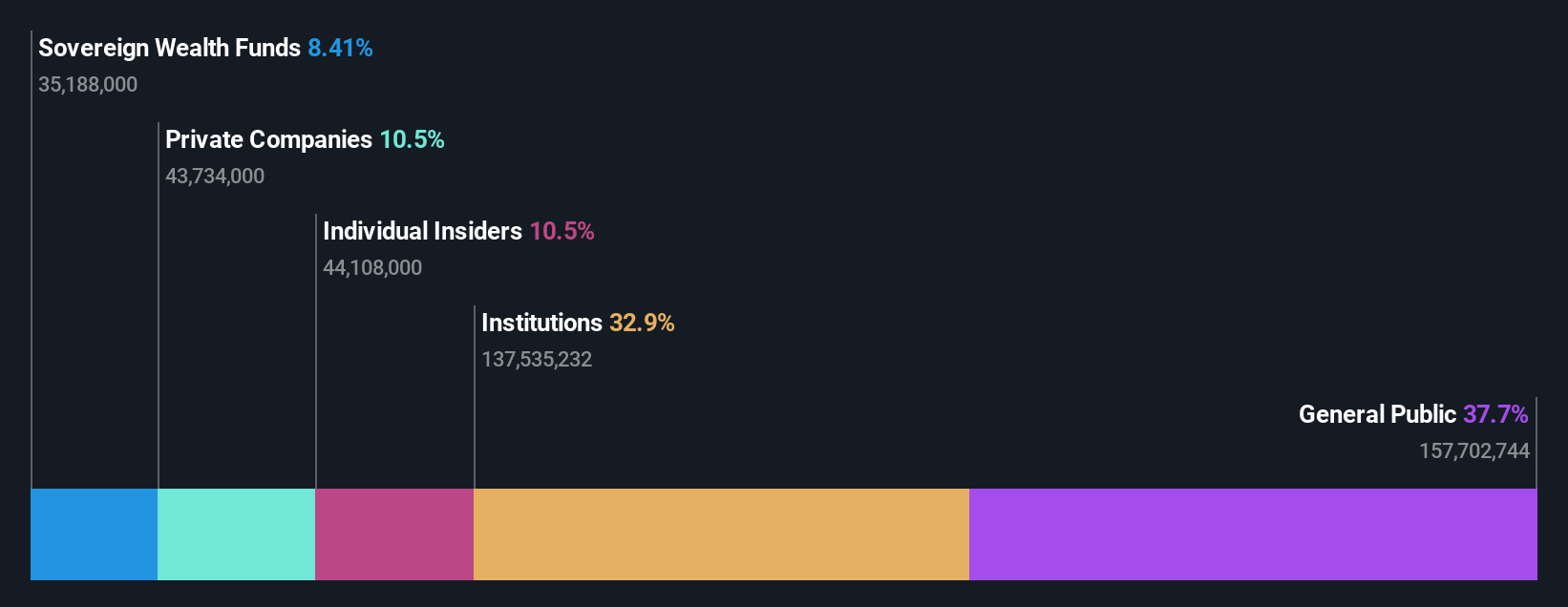

Insider Ownership: 11.5%

Capcom, a Japanese game developer, shows promise with a 21.2% forecasted return on equity in three years and an earnings growth rate of 9.3% per year, outpacing the Japanese market average of 8.9%. However, its revenue growth at 6.6% annually is modest compared to high-growth benchmarks but still exceeds the market norm of 4.3%. The upcoming Annual General Meeting may introduce changes including a performance-linked stock remuneration system for directors, indicating potential shifts in insider ownership dynamics and incentives.

- Dive into the specifics of Capcom here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Capcom's share price might be too optimistic.

Where To Now?

- Get an in-depth perspective on all 98 Fast Growing Japanese Companies With High Insider Ownership by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Capcom is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9697

Capcom

Plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.