Exploring Dividend Stocks On The Tokyo Stock Exchange In July 2024

Reviewed by Simply Wall St

As of July 2024, Japan's stock markets have experienced a downturn, largely influenced by rising concerns over U.S. restrictions on semiconductor technology exports affecting key Japanese companies. This backdrop sets a challenging stage for investors looking at dividend stocks on the Tokyo Stock Exchange. In such an environment, identifying stocks with stable dividends becomes crucial as they might offer some resilience against the broader market volatility.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.57% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.54% | ★★★★★★ |

| AiphoneLtd (TSE:6718) | 4.30% | ★★★★★★ |

| Globeride (TSE:7990) | 3.87% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.29% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.11% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.48% | ★★★★★★ |

| Innotech (TSE:9880) | 4.16% | ★★★★★★ |

Click here to see the full list of 405 stocks from our Top Japanese Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Nichia Steel Works (TSE:5658)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nichia Steel Works, Ltd. is a Japanese company that specializes in the manufacturing and selling of iron and steel products, with a market capitalization of ¥15.83 billion.

Operations: Nichia Steel Works, Ltd. generates its revenue primarily through the manufacturing and sales of iron and steel products within Japan.

Dividend Yield: 3%

Nichia Steel Works has a mixed track record with dividends, showing growth over the past decade but also volatility in payments. The company's dividend yield of 3.01% is below the top quartile in Japan, and recent buybacks, including a repurchase of shares for ¥13.94 million, aim to enhance shareholder returns despite a low cash payout ratio of 26.1%. While dividends are supported by earnings and cash flows (payout ratio: 61.1%), their reliability remains questionable due to historical unpredictability.

- Dive into the specifics of Nichia Steel Works here with our thorough dividend report.

- The valuation report we've compiled suggests that Nichia Steel Works' current price could be inflated.

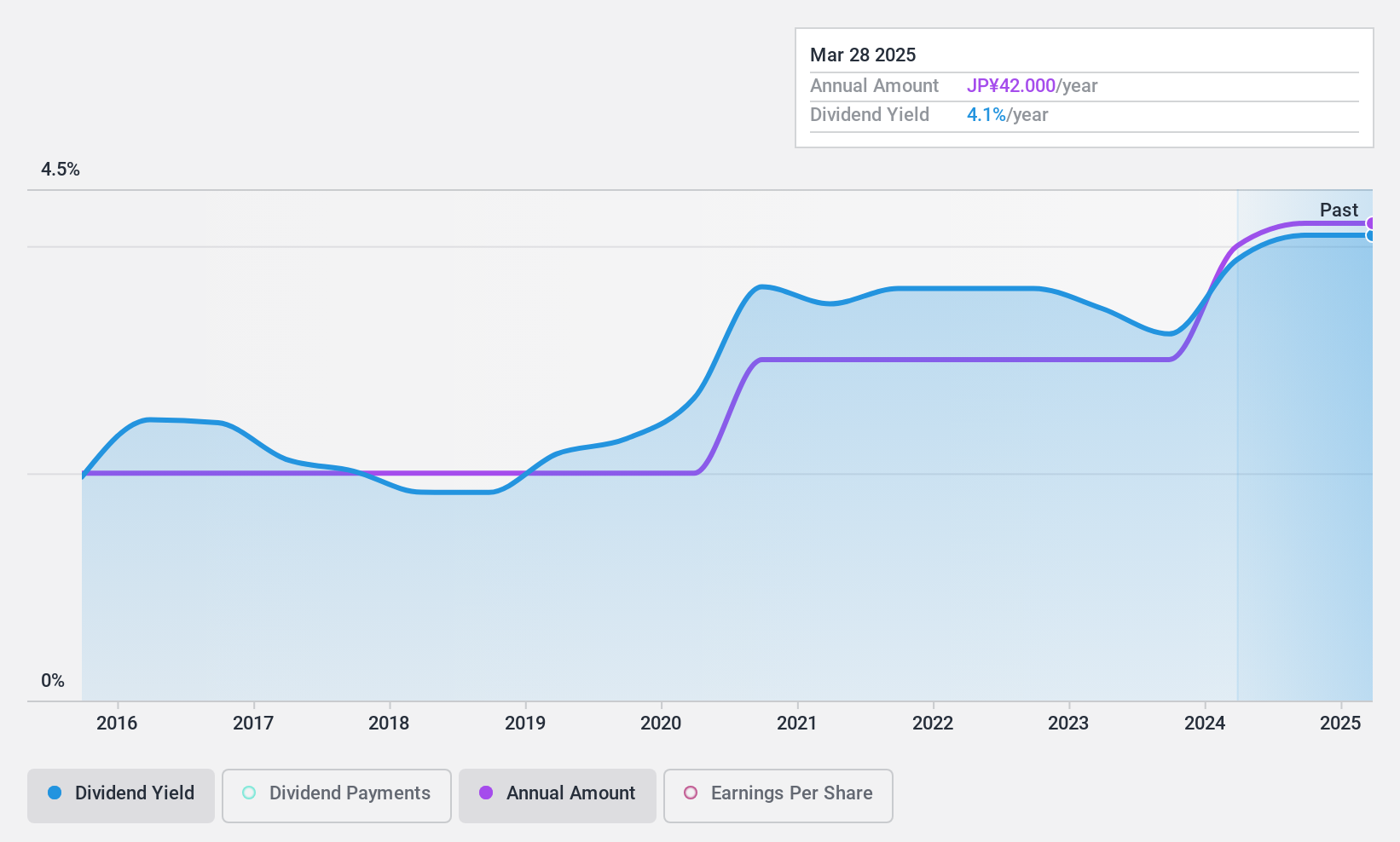

Hisaka Works (TSE:6247)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hisaka Works, Ltd. operates globally in the manufacturing and sales of industrial machinery, with a market capitalization of approximately ¥30.50 billion.

Operations: Hisaka Works, Ltd. specializes in the global production and distribution of industrial machinery.

Dividend Yield: 3.9%

Hisaka Works offers a dividend yield of 3.89%, placing it in the top 25% for Japan's market, though its sustainability is questionable with dividends not well covered by earnings or free cash flows. Despite this, the company has maintained stable and growing dividends over the past decade. With a lower P/E ratio of 12.6x compared to the market average, Hisaka appears undervalued, but financial prudence is advised due to potential cash flow concerns.

- Click here to discover the nuances of Hisaka Works with our detailed analytical dividend report.

- Our valuation report here indicates Hisaka Works may be overvalued.

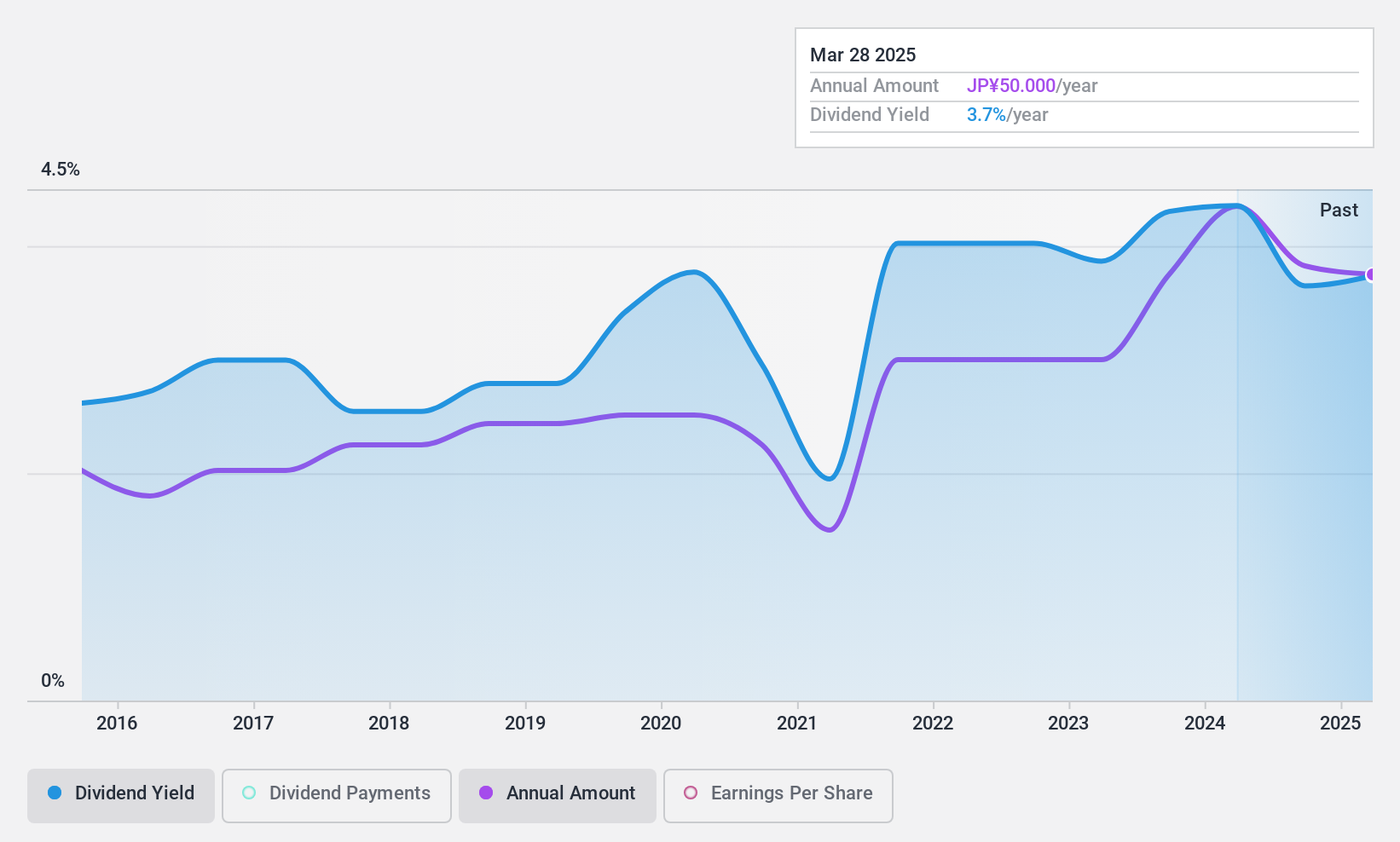

Yamazen (TSE:8051)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yamazen Corporation operates globally, supplying production equipment, housing equipment/materials, and home products with a market capitalization of approximately ¥131.64 billion.

Operations: Yamazen Corporation's business encompasses the global supply of production equipment, as well as housing equipment/materials and home products.

Dividend Yield: 3.4%

Yamazen has recently completed a share repurchase, buying back 678,400 shares for ¥978.68 million, signaling confidence in its financial stability. However, its dividend yield at 3.42% is slightly below the top quartile of Japanese dividend stocks. Despite a volatile dividend history over the past decade, dividends are well-covered by earnings with a payout ratio of 39.6% and cash flows with a cash payout ratio of 51.4%. Yet, profit margins have declined from last year's 2.4% to this year's 1.3%, suggesting potential pressure on future dividends.

- Take a closer look at Yamazen's potential here in our dividend report.

- The analysis detailed in our Yamazen valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Get an in-depth perspective on all 405 Top Japanese Dividend Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hisaka Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6247

Hisaka Works

Engages in the manufacture and sale of industrial machinery worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives