- Japan

- /

- Construction

- /

- TSE:6331

3 Global Dividend Stocks Yielding Up To 4.2%

Reviewed by Simply Wall St

As global markets grapple with volatility driven by renewed tariff threats and fluctuating Treasury yields, investors are increasingly seeking stability through dividend stocks. In such uncertain times, a good dividend stock is characterized by a strong balance sheet and consistent payout history, offering potential income even amid market turbulence.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.99% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.37% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.21% | ★★★★★★ |

| Daicel (TSE:4202) | 4.92% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.49% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.86% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.75% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.34% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.48% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★★ |

Click here to see the full list of 1577 stocks from our Top Global Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Lao Feng Xiang (SHSE:600612)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Lao Feng Xiang Co., Ltd. operates in the jewelry industry both in the People's Republic of China and internationally, with a market cap of CN¥20.84 billion.

Operations: Lao Feng Xiang Co., Ltd. generates revenue primarily through its operations in the jewelry industry, catering to both domestic and international markets.

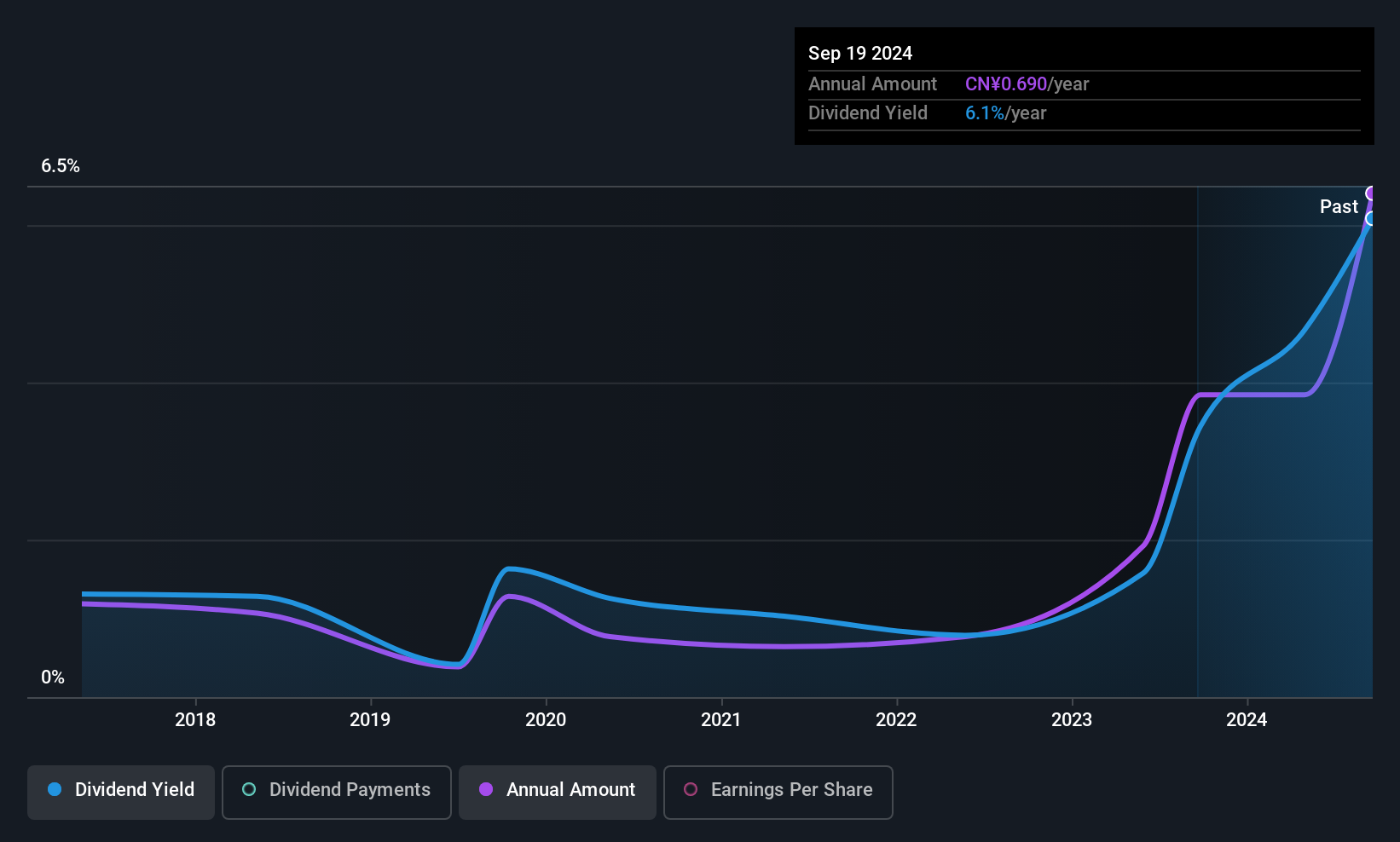

Dividend Yield: 3.2%

Lao Feng Xiang's dividends are appealing due to their stability and growth over the past decade, supported by a reasonable payout ratio of 51.1% and a cash payout ratio of 38.7%. Despite recent earnings declines, the company maintains a high dividend yield of 3.17%, placing it in the top quartile among Chinese dividend payers. Trading at good value compared to peers, its dividends remain well-covered by both earnings and cash flows, enhancing reliability for investors.

- Take a closer look at Lao Feng Xiang's potential here in our dividend report.

- Our expertly prepared valuation report Lao Feng Xiang implies its share price may be lower than expected.

New Trend International Logis-TechLtd (SZSE:300532)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Trend International Logis-Tech Ltd (SZSE:300532) operates in the logistics technology sector and has a market cap of CN¥5.28 billion.

Operations: Unfortunately, the revenue segments information for New Trend International Logis-Tech Ltd (SZSE:300532) is not provided in the text.

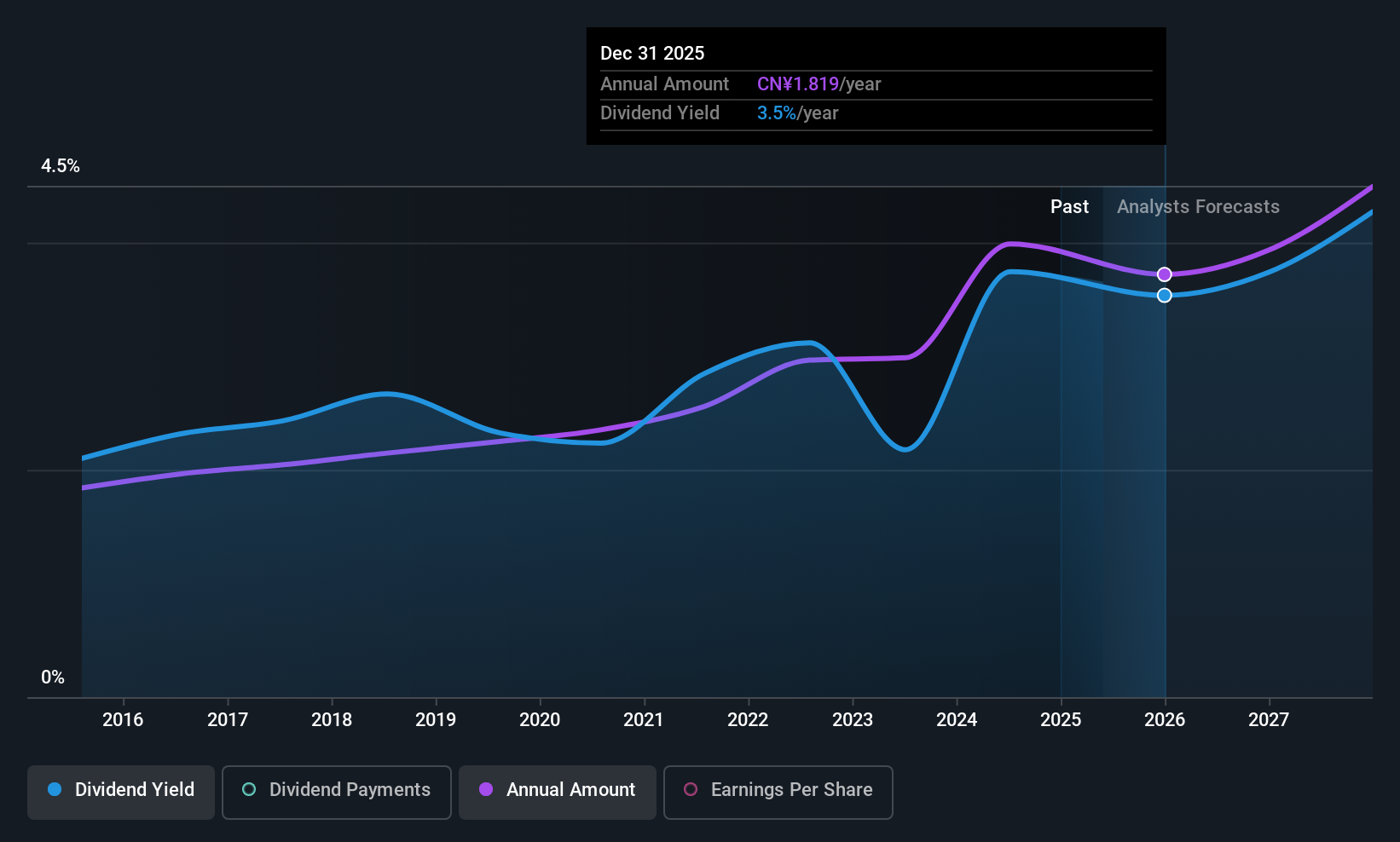

Dividend Yield: 3.5%

New Trend International Logis-Tech Ltd. offers a dividend yield of 3.5%, ranking in the top 25% of Chinese dividend stocks, though its dividends have been volatile over its eight-year history. The payout is covered by earnings with a payout ratio of 82.1% and cash flows with a cash payout ratio of 52.1%. Despite recent declines in sales and net income, the company trades below estimated fair value, suggesting potential investment appeal amidst dividend instability concerns.

- Click here to discover the nuances of New Trend International Logis-TechLtd with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that New Trend International Logis-TechLtd is priced lower than what may be justified by its financials.

Mitsubishi Kakoki Kaisha (TSE:6331)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsubishi Kakoki Kaisha, Ltd. specializes in the engineering, procurement, and construction of industrial and chemical plants as well as environmental control facilities across Japan, Asia, and internationally with a market cap of ¥41.96 billion.

Operations: Mitsubishi Kakoki Kaisha, Ltd. generates revenue through its operations in engineering, procurement, and construction of industrial and chemical plants and environmental control facilities across Japan, the rest of Asia, and internationally.

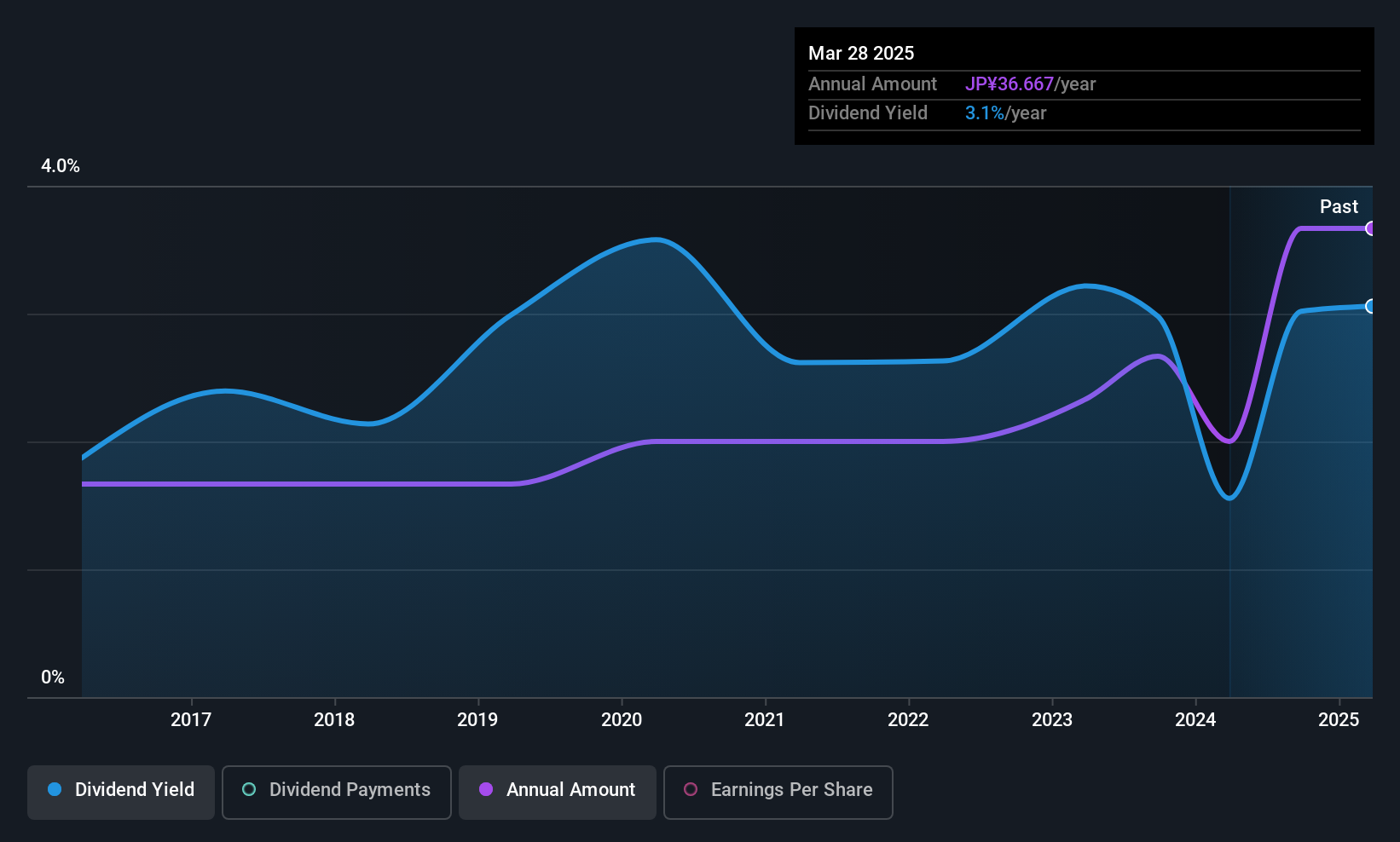

Dividend Yield: 4.3%

Mitsubishi Kakoki Kaisha's dividend yield of 4.25% ranks in the top 25% of Japanese dividend stocks, supported by a low payout ratio of 32.7%, though not covered by free cash flows. Recent announcements show an increase to JPY 160 per share for fiscal year 2025 but a decrease to JPY 40 per share for fiscal year 2026, indicating volatility. Despite stable dividends over the past decade, high non-cash earnings and volatile share prices pose risks.

- Click here and access our complete dividend analysis report to understand the dynamics of Mitsubishi Kakoki Kaisha.

- Our comprehensive valuation report raises the possibility that Mitsubishi Kakoki Kaisha is priced higher than what may be justified by its financials.

Key Takeaways

- Gain an insight into the universe of 1577 Top Global Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6331

Mitsubishi Kakoki Kaisha

Engages in the engineering, procurement, and construction of various industrial and chemical plants and environmental control facilities in Japan, rest of Asia, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives