Does Kubota’s Nine-Month Revenue Reveal New Clues About Its Competitive Positioning (TSE:6326)?

Reviewed by Sasha Jovanovic

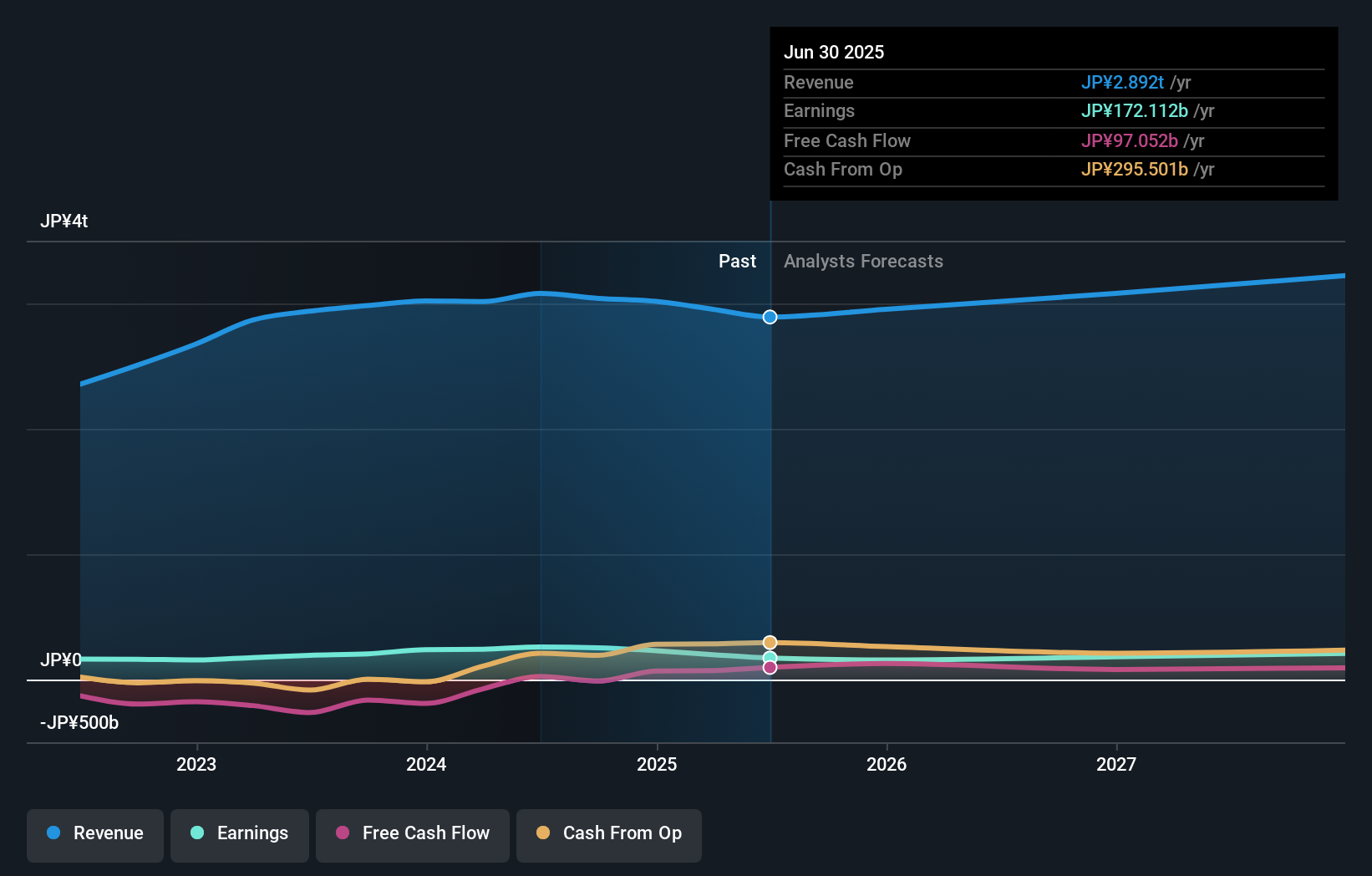

- Kubota Corporation recently announced its earnings results for the nine months ended September 30, 2025, reporting sales of ¥2.20 trillion and basic earnings per share from continuing operations of ¥124.1.

- This update, shared alongside Kubota’s Q3 2025 earnings call on November 7, offers investors deeper insights into the company’s financial performance for the year to date.

- We'll explore how Kubota’s reported year-to-date sales figures shape the company’s investment narrative and future outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Kubota's Investment Narrative?

For anyone considering Kubota, the core investment story centers on its ability to deliver steady earnings while navigating sector cycles and business transformation. The recent earnings release, showing year-to-date sales of ¥2.20 trillion and basic EPS of ¥124.1, largely confirms the company is tracking against its revised 2025 guidance. Short-term, this update doesn't appear to dramatically affect key catalysts like progress on the new Mid-Term Business Plan, leadership transitions, or Kubota's ongoing focus on stable dividends and buybacks. However, risks remain, particularly with profit margins under pressure and slower-than-market revenue growth, as previously highlighted. As a result, the Q3 results reinforce existing investor focus on profit recovery, future strategic execution and how the incoming CEO may impact operational priorities. The biggest question now is how Kubota balances growth ambitions with profitability concerns going into 2026.

But profit margins coming under pressure could be a bigger risk than some investors expect. Kubota's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 4 other fair value estimates on Kubota - why the stock might be worth 40% less than the current price!

Build Your Own Kubota Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kubota research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kubota research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kubota's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kubota might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6326

Kubota

Manufactures and sells agricultural and construction machinery in Japan, North America, Europe, Asia, and internationally.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives