Is Harmonic Drive Systems’ (TSE:6324) Management Shift a Sign of Evolving Competitive Strategy?

Reviewed by Sasha Jovanovic

- Harmonic Drive Systems recently announced a renewed focus on enhancing its management processes and flexibility to support long-term competitiveness in the precision engineering sector.

- This initiative highlights the company's ongoing commitment to its ‘Total Motion Control’ vision, aiming to solidify its leadership in high-precision motion technologies.

- We'll explore how Harmonic Drive Systems’ renewed management flexibility focus shapes its investment narrative and growth ambitions in precision engineering.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Harmonic Drive Systems' Investment Narrative?

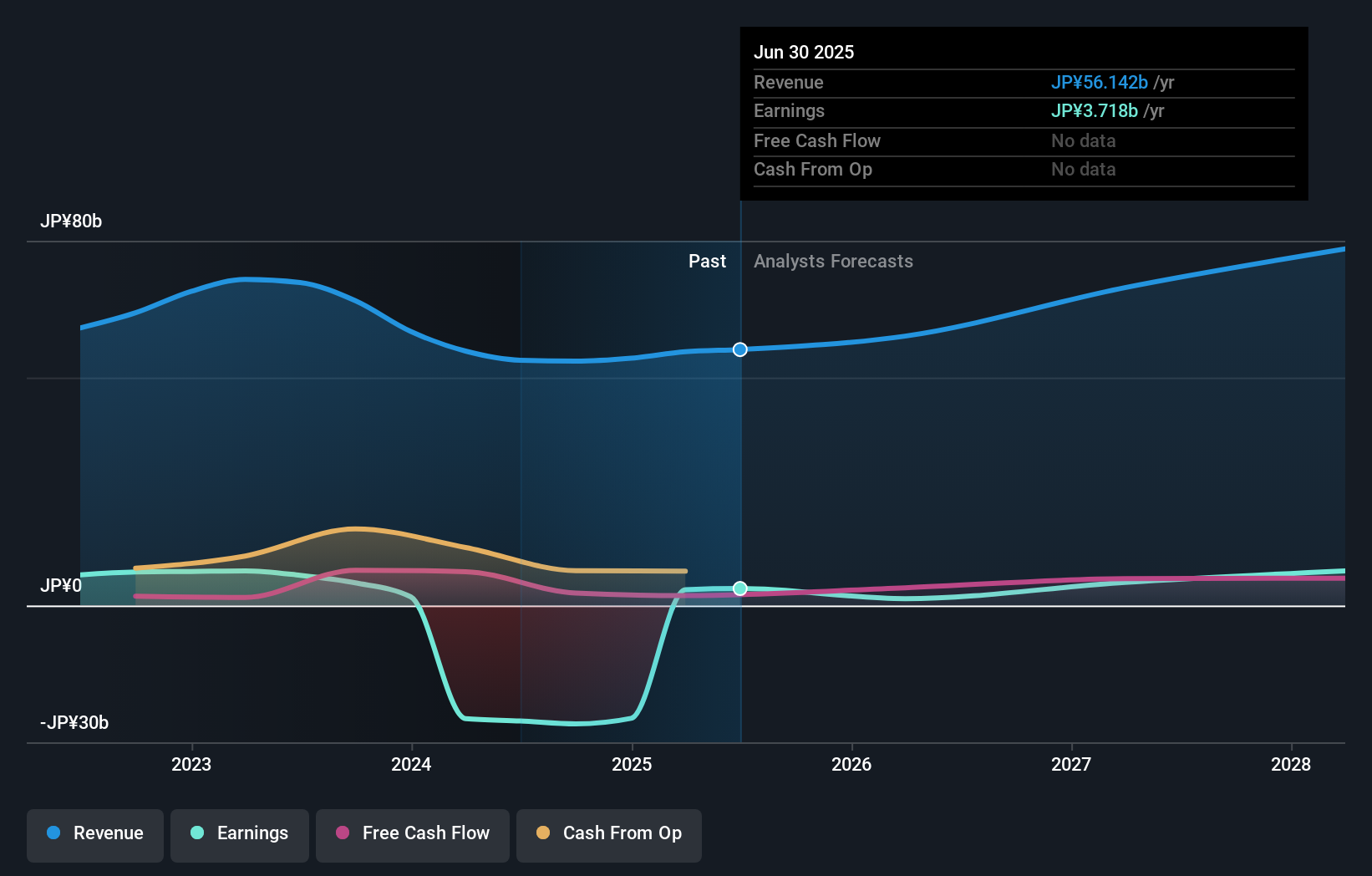

Owning Harmonic Drive Systems means believing in the company's ability to innovate and maintain its edge in precision engineering, even as it faces a demanding competitive and economic environment. The recent push to make management processes more flexible directly addresses the need for resilience amid shifting industry trends and market uncertainty. While the news signals a conscious move toward organizational adaptability, its immediate effect on key short-term catalysts, like joint sales agreements in Asia or the ongoing share buyback, may be incremental rather than transformative. Still, risk factors remain: high valuation multiples, significant one-off gains impacting earnings quality, and a volatile share price could temper confidence for some investors. As management strives to back its ambitious ‘Total Motion Control’ vision, its ability to deliver sustainable, quality earnings growth is likely to come under greater scrutiny in the months ahead.

On the other hand, the risk of share price volatility should not be underestimated by investors. Harmonic Drive Systems' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Harmonic Drive Systems - why the stock might be worth as much as 37% more than the current price!

Build Your Own Harmonic Drive Systems Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harmonic Drive Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Harmonic Drive Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harmonic Drive Systems' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmonic Drive Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6324

Harmonic Drive Systems

Produces and sells precision control equipment and components worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives