Is Komatsu (TSE:6301) Still Undervalued? A Fresh Look at Valuation After Recent Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Komatsu.

Over the past year, Komatsu’s total shareholder return reached 33%, comfortably outpacing its share price gains and signaling solid momentum as confidence in both earnings growth and end-market demand strengthens. Investors continue to watch for catalysts that could extend this positive trend.

If Komatsu’s steady climb has you thinking about other opportunities in industrials, it could be the perfect time to discover See the full list for free.

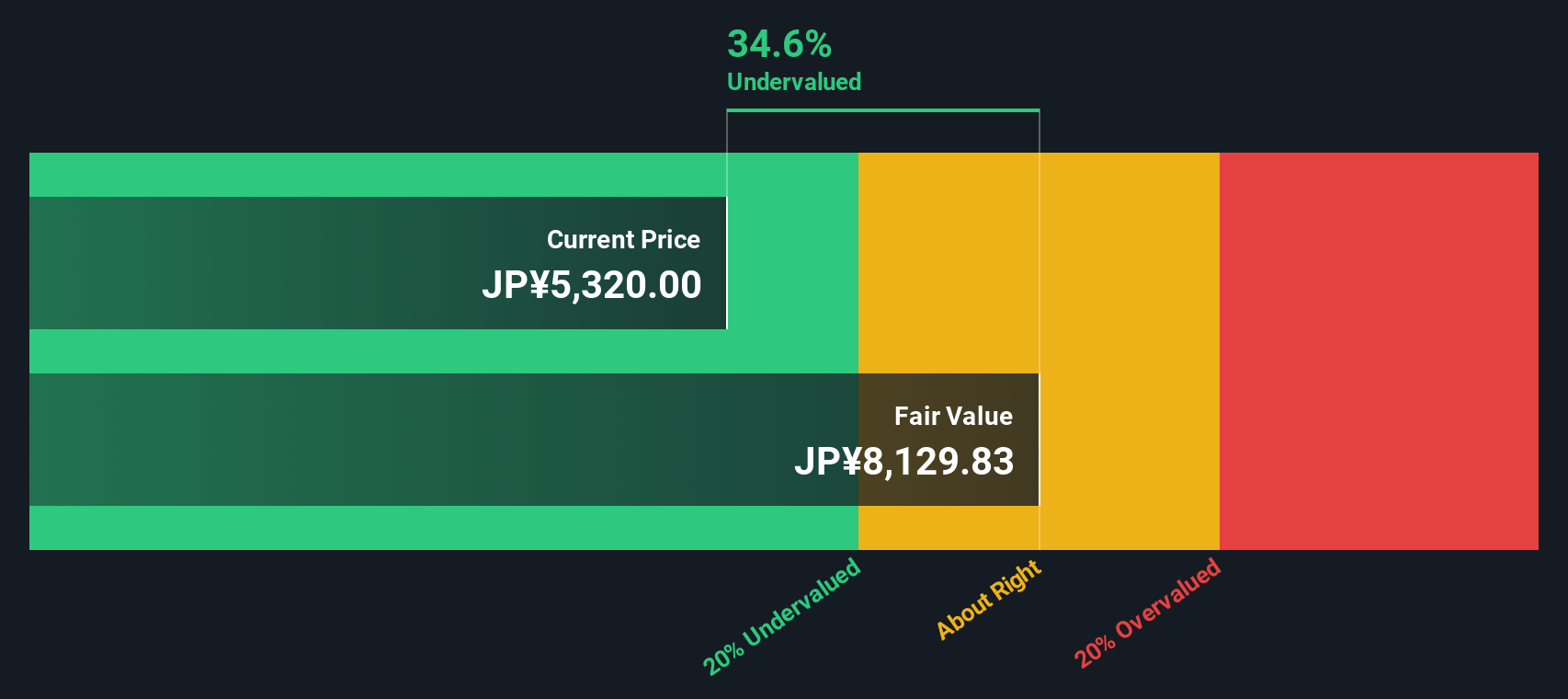

But with shares near recent highs and a track record of outperformance, investors are left to wonder: Is Komatsu still undervalued, or has the market already priced in the company’s future growth potential?

Most Popular Narrative: 2% Overvalued

Komatsu’s most widely tracked narrative assigns a slightly higher fair value than the current market price, putting its latest close a notch above what the consensus expects. This sets up a fascinating story about how future innovation and contracts could factor into valuation.

Komatsu's contract for the large-scale Reko Diq copper/gold mining project in Pakistan, with equipment deliveries beginning FY2026, provides a multi-year revenue stream tied to growing global demand for battery metals and infrastructure materials. This supports future revenue growth and order backlog. Komatsu's introduction of a modular, power-agnostic mining truck that can seamlessly switch to battery or hydrogen power positions it well as stricter environmental regulations accelerate customer preference for low and zero-emission equipment. This could potentially drive higher-margin sales and increase net margins.

Want to know which growth engines and disruptive technologies this fair value is built around? The narrative hints at market-shifting earnings and margin forecasts. Get the real story behind the profit assumptions and their bold outlook to discover what’s powering this valuation.

Result: Fair Value of ¥5,075 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent demand weakness in key regions or unanticipated tariff increases could quickly challenge the optimistic outlook behind Komatsu’s current valuation.

Find out about the key risks to this Komatsu narrative.

Another View: Discounted Cash Flow Paints a Different Picture

If analysts' multiples point to Komatsu being slightly overvalued, our SWS DCF model tells a very different story. By estimating future cash flows today, the DCF model suggests Komatsu is actually trading around 36% below its intrinsic value, raising the question: Is the current market overlooking long-term growth?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Komatsu Narrative

Prefer to dig into the numbers yourself and challenge these perspectives? Dive into the data, shape your own view in just minutes: Do it your way

A great starting point for your Komatsu research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Set yourself apart by uncovering untapped opportunities that most investors overlook. Use the Simply Wall Street Screener to find stocks aligned with your goals and capture tomorrow’s winners today.

- Harvest steady income by checking out these 19 dividend stocks with yields > 3% delivering yields above 3% and enhancing your portfolio’s reliability.

- Ride the wave of artificial intelligence and spot trailblazers early with these 24 AI penny stocks making real-world impact across industries.

- Tap into value gems by reviewing these 909 undervalued stocks based on cash flows identified for future gains based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Komatsu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6301

Komatsu

Manufactures and sells construction, mining, and utility equipment in Japan, the Americas, Europe, China, Rest of Asia, Oceania, the Middle East, Africa, and CIS countries.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives