Koken Boring Machine Co.,Ltd.'s (TSE:6297) Popularity With Investors Under Threat As Stock Sinks 27%

Koken Boring Machine Co.,Ltd. (TSE:6297) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 21% share price drop.

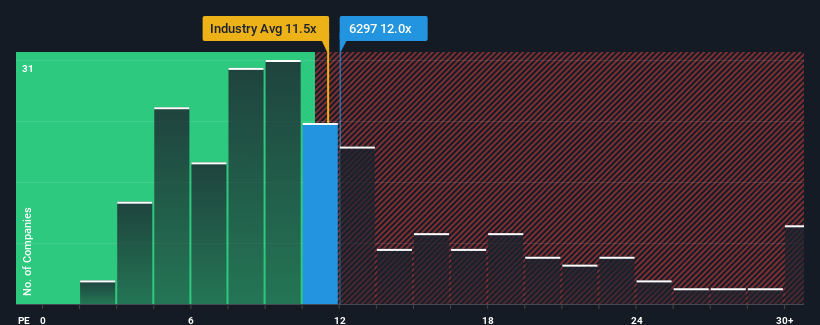

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Koken Boring MachineLtd's P/E ratio of 12x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, Koken Boring MachineLtd has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Koken Boring MachineLtd

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Koken Boring MachineLtd's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 61%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 62% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 9.8% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's somewhat alarming that Koken Boring MachineLtd's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Key Takeaway

Following Koken Boring MachineLtd's share price tumble, its P/E is now hanging on to the median market P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Koken Boring MachineLtd currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Koken Boring MachineLtd (2 shouldn't be ignored!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Koken Boring MachineLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Koken Boring MachineLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Koken Boring MachineLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6297

Koken Boring MachineLtd

Manufactures and sells drilling and grouting machines, and associated equipment in Japan and internationally.

Slight with mediocre balance sheet.

Market Insights

Community Narratives