As we step into January 2025, the global markets are navigating a landscape of mixed economic signals, with U.S. consumer confidence dipping and manufacturing orders seeing a decline, even as major stock indices like the Nasdaq Composite and S&P 500 have posted moderate gains. Amidst these fluctuations, small-cap stocks represented by indices such as the Russell 2000 continue to capture investor interest due to their potential for growth in an uncertain economic environment. In this context, identifying promising stocks often involves looking beyond current market sentiment to uncover companies with strong fundamentals and innovative strategies that can thrive despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Veidekke (OB:VEI)

Simply Wall St Value Rating: ★★★★★☆

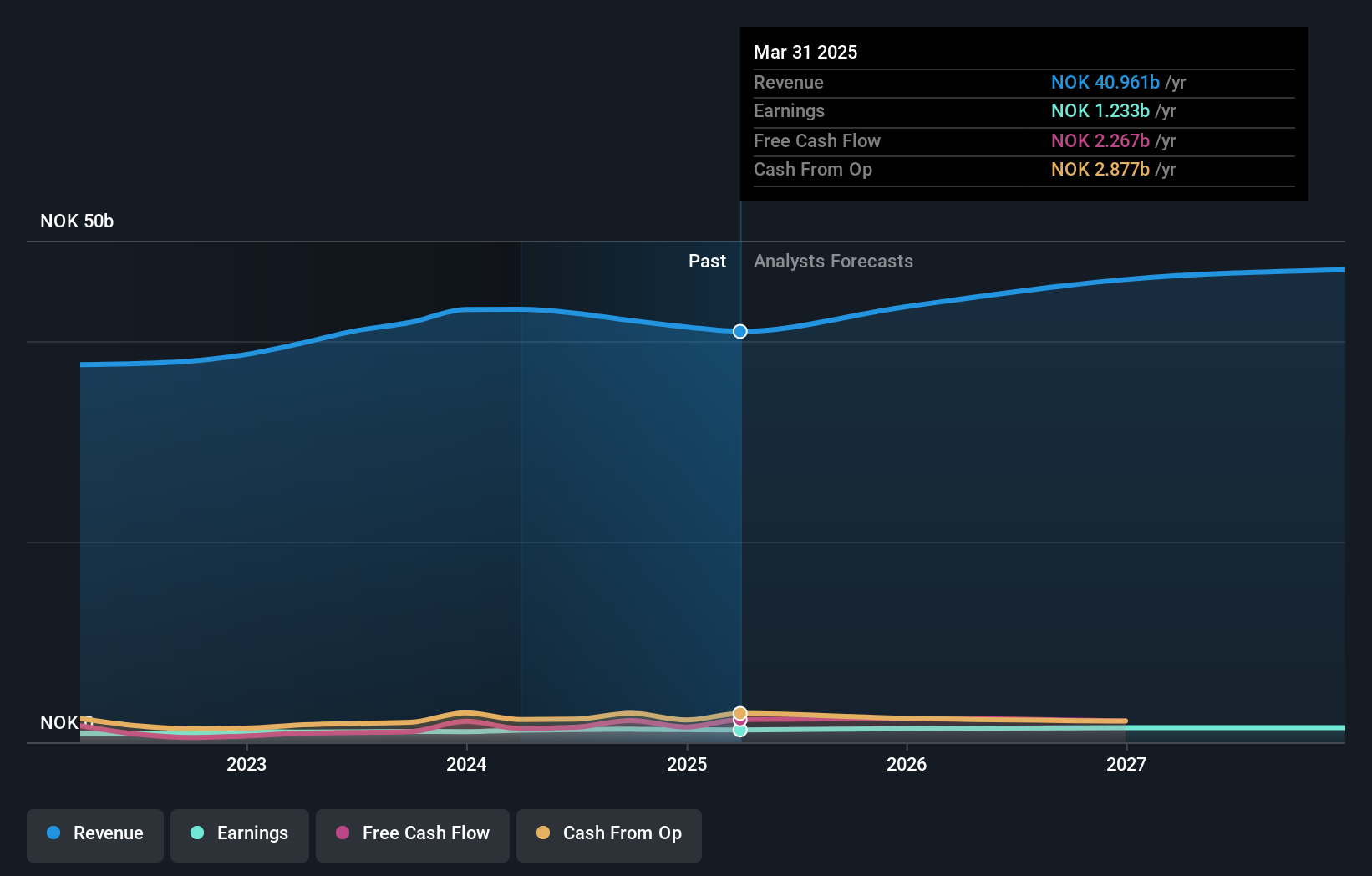

Overview: Veidekke ASA is a construction and property development company operating in Norway, Sweden, and Denmark, with a market capitalization of NOK19.21 billion.

Operations: Veidekke ASA generates revenue primarily from its operations in construction and infrastructure across Norway, Sweden, and Denmark. The largest revenue contributions come from Construction Norway (NOK15.16 billion) and Infrastructure Norway (NOK10.02 billion), followed by Construction Sweden excluding infrastructure (NOK8.18 billion) and Infrastructure Sweden (NOK6.10 billion).

Veidekke, a notable player in the construction industry, has demonstrated robust financial health with earnings growing by 20% over the past year. This growth outpaces the broader construction industry's 7%. The company trades at a value 17% below its estimated fair value and boasts a reduced debt-to-equity ratio from 136% to just 19% over five years. Recent wins include significant contracts like building metro stations for Fornebubanen worth NOK 1.8 billion and infrastructure projects in Gothenburg valued at SEK 997 million, underscoring its strategic prowess in securing large-scale projects.

- Delve into the full analysis health report here for a deeper understanding of Veidekke.

Gain insights into Veidekke's past trends and performance with our Past report.

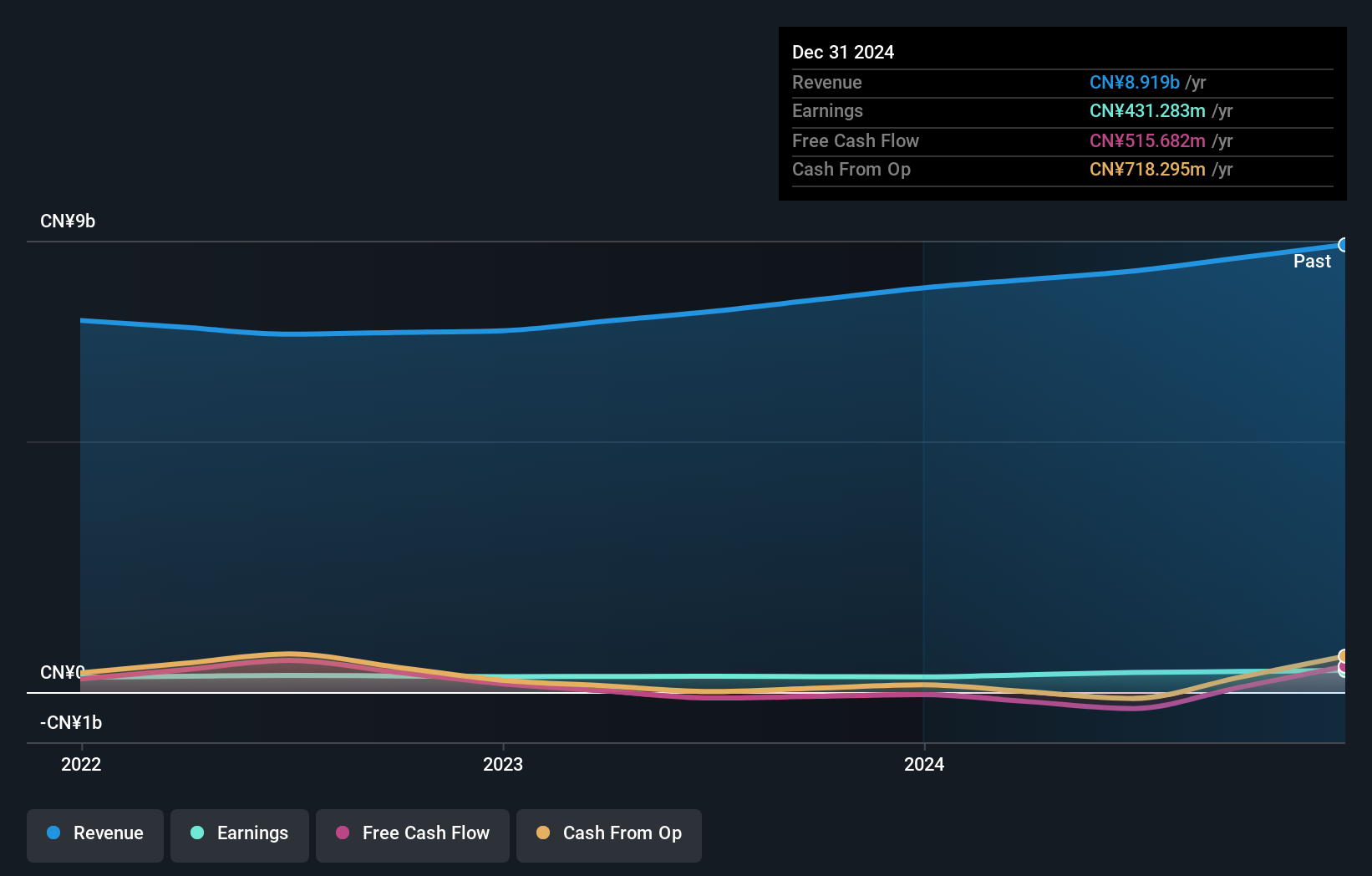

Chongqing Machinery & Electric (SEHK:2722)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Chongqing Machinery & Electric Co., Ltd. designs, manufactures, and sells clean energy equipment and high-end smart manufacturing equipment, with a market capitalization of HK$2.91 billion.

Operations: Chongqing Machinery & Electric generates revenue primarily from general machinery (CN¥2.23 billion), hydroelectric generation equipment (CN¥2.32 billion), and wire and cable sales (CN¥1.89 billion). The company also earns from numerically controlled machine tools, intelligent manufacturing, material sales, and financial services.

Chongqing Machinery & Electric, a smaller player in the industrial sector, has shown impressive earnings growth of 24% over the past year, outpacing the industry's 4.5%. The company’s price-to-earnings ratio stands at 7x, which is below Hong Kong's market average of 10x, indicating potential value. Despite a notable one-off gain of CN¥200M impacting recent financials, its debt to equity ratio has improved from 45% to 27.8% over five years. Recent changes include executive shifts and amendments to expand business scope into clean energy and technology services, suggesting strategic positioning for future opportunities.

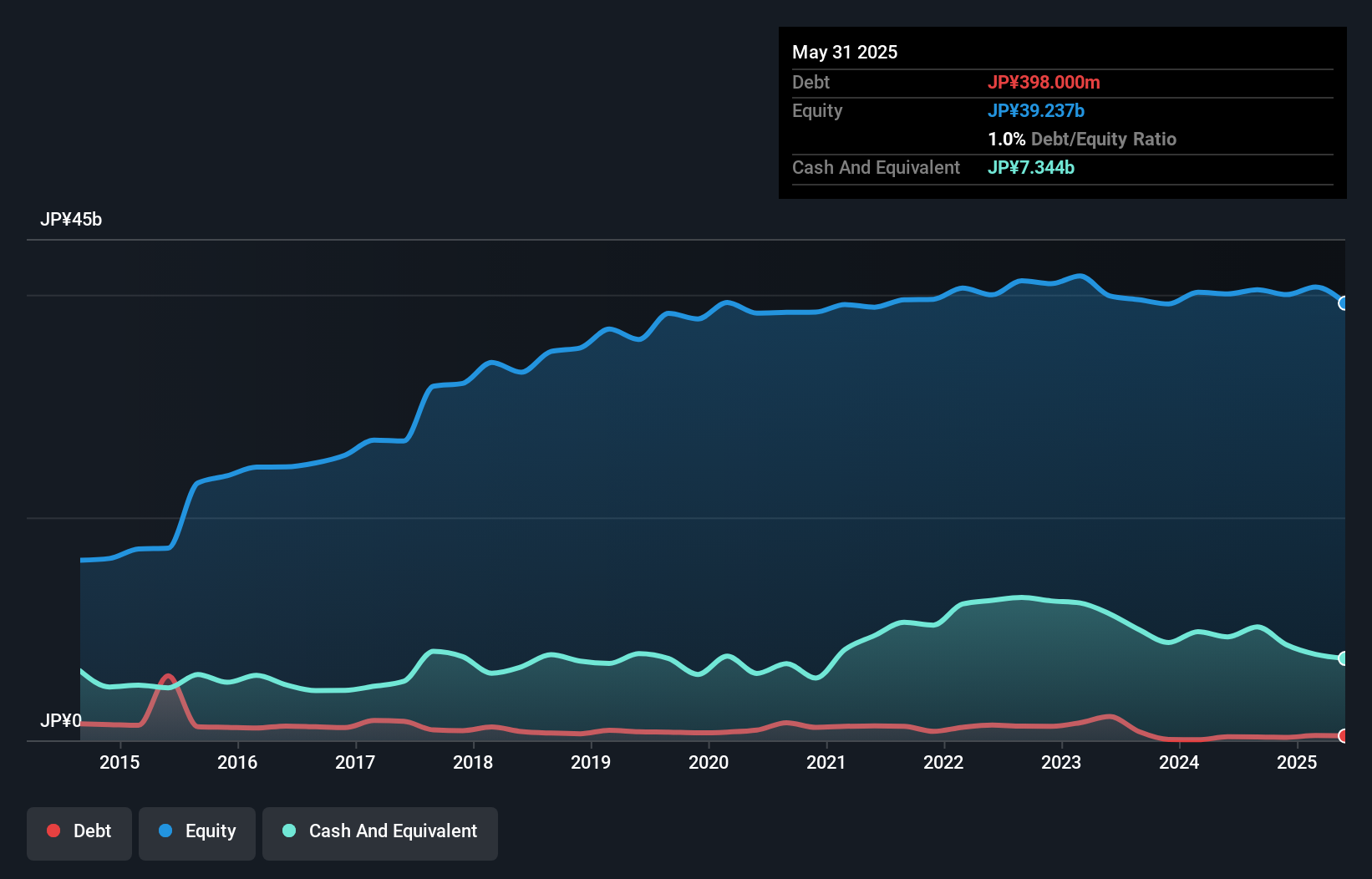

Giken (TSE:6289)

Simply Wall St Value Rating: ★★★★★★

Overview: Giken Ltd. is a company that focuses on the manufacture and sale of construction machinery both in Japan and internationally, with a market capitalization of ¥47.27 billion.

Operations: Giken generates revenue primarily from its Construction Machinery segment, which accounts for ¥21.40 billion, and Press-In Work, contributing ¥8.68 billion. The company's financial performance is characterized by a focus on these core areas of business without any inclusion of unallocated adjustments in the revenue breakdown.

Giken, a smaller player in the machinery sector, has seen its earnings soar by 188% over the past year, outpacing the industry's modest 1.4% growth. Despite a significant one-off loss of ¥798 million impacting recent results, Giken remains profitable with a debt to equity ratio reduced from 1.9% to 0.7% over five years, indicating improved financial health. The company is free cash flow positive and expects net sales of ¥30 billion for the current fiscal year ending August 2025. With dividends increased to ¥22 per share and solid earnings guidance, Giken's prospects appear promising amidst industry challenges.

- Click here to discover the nuances of Giken with our detailed analytical health report.

Understand Giken's track record by examining our Past report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 4637 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6289

Giken

Manufactures and sells construction machinery in Japan and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives