- Japan

- /

- Auto Components

- /

- TSE:3569

Undiscovered Gems Three Promising Small Caps with Strong Potential

Reviewed by Simply Wall St

In the wake of a significant "red sweep" in the U.S. elections, global markets have seen notable shifts, with small-cap stocks like those in the Russell 2000 Index experiencing substantial gains yet still trailing their record highs. Amid this dynamic landscape, identifying promising small-cap stocks can be particularly rewarding as these companies often possess untapped potential and unique growth opportunities that align well with current market optimism and economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Citra Tubindo | NA | 9.17% | 14.32% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Focus Lighting and Fixtures | 12.21% | 36.42% | 77.11% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

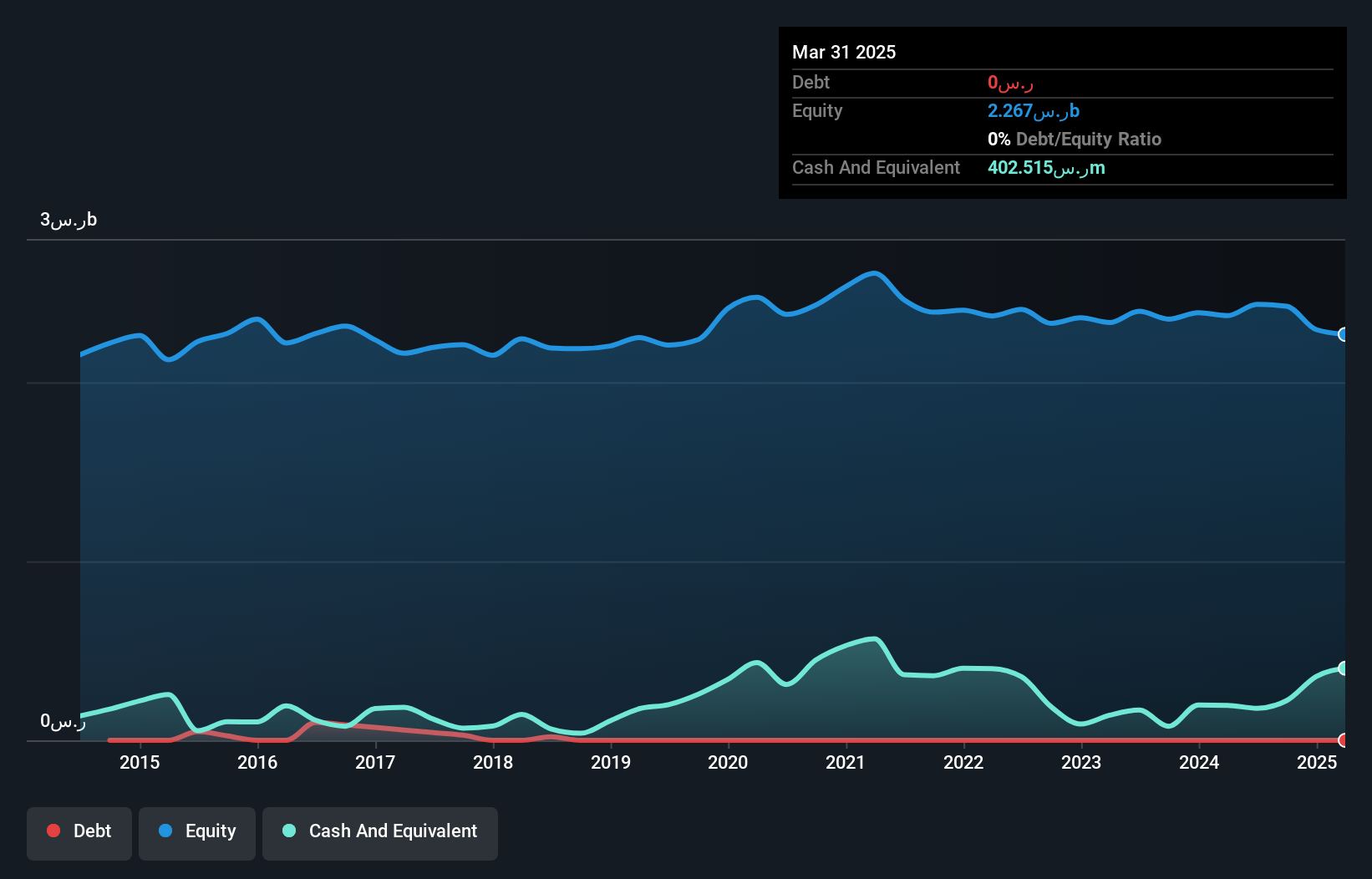

Eastern Province Cement (SASE:3080)

Simply Wall St Value Rating: ★★★★★★

Overview: Eastern Province Cement Company engages in the production and sale of clinker and cement within Saudi Arabia and internationally, with a market capitalization of SAR2.91 billion.

Operations: Eastern Province Cement generates revenue primarily from two segments: Cement, contributing SAR818.25 million, and Precast Concrete, adding SAR342.82 million.

Eastern Province Cement, a smaller player in the industry, showcases a robust financial standing with no debt over the past five years. Its recent performance highlights sales of SAR 279.72 million for Q3 2024, surpassing last year's SAR 242.91 million, and net income at SAR 41.15 million compared to SAR 40.89 million previously. The company trades at an attractive value, estimated to be 60% below its fair value, and has shown impressive earnings growth of 12% over the past year despite industry challenges. While future earnings are forecasted to decline by about 6% annually for three years, its high-quality earnings provide some confidence in its stability within the sector.

- Get an in-depth perspective on Eastern Province Cement's performance by reading our health report here.

Assess Eastern Province Cement's past performance with our detailed historical performance reports.

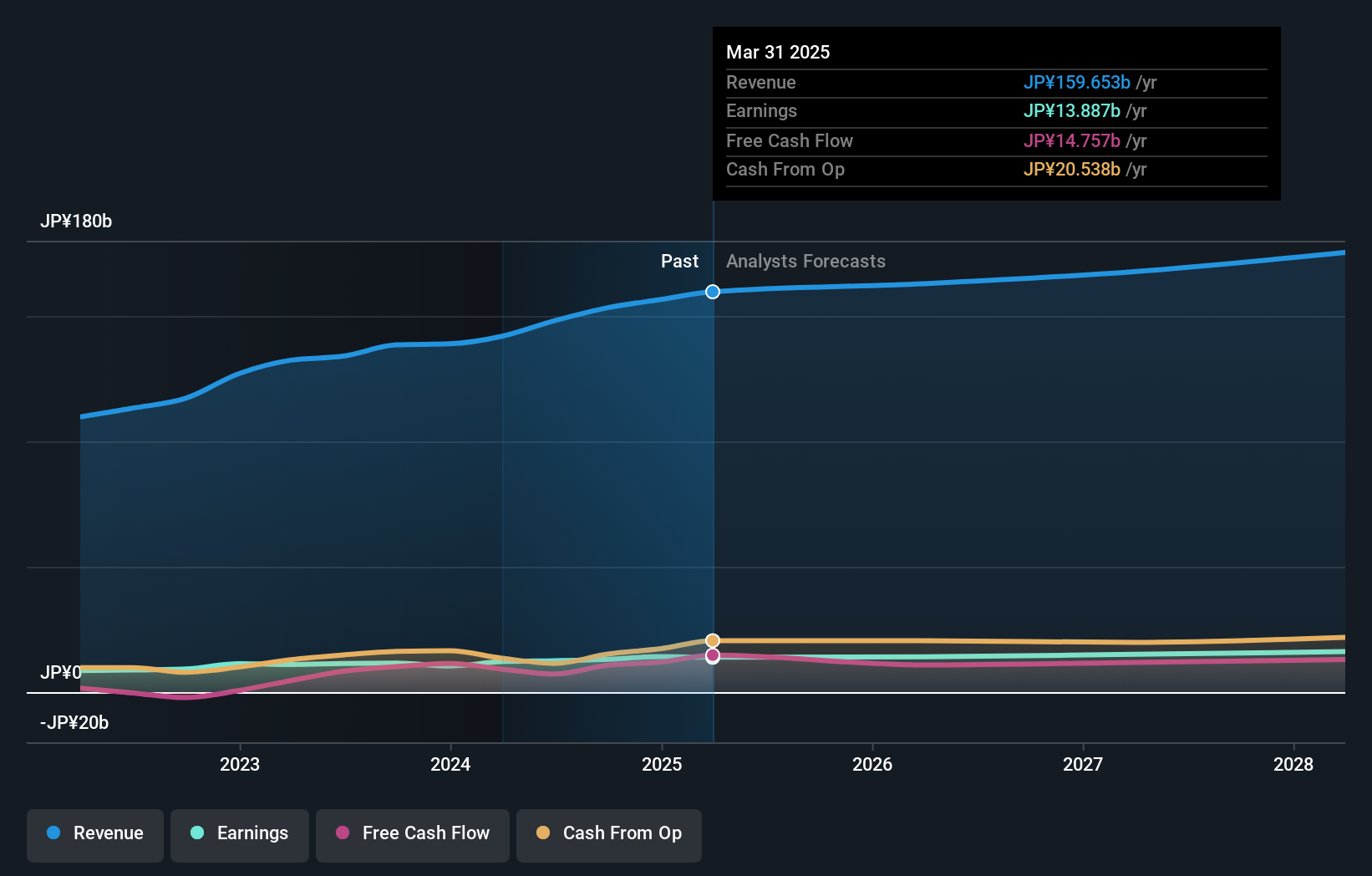

SeirenLtd (TSE:3569)

Simply Wall St Value Rating: ★★★★★★

Overview: Seiren Co., Ltd. is a company that produces and sells vehicle parts, textile products, industrial machines, and electronic parts both in Japan and abroad, with a market cap of ¥145.28 billion.

Operations: Seiren Ltd generates revenue through the production and sale of vehicle parts, textile products, industrial machines, and electronic parts. The company's cost structure is influenced by manufacturing expenses associated with these diverse product lines. Its financial performance can be assessed by examining key metrics such as gross profit margin or net profit margin trends over recent periods.

SeirenLtd, a smaller player in the market, showcases robust financial health with high-quality earnings and a promising growth trajectory. Over the past year, its earnings grew by 9.6%, outpacing the Auto Components industry's 9.1% growth rate. The company's debt-to-equity ratio has impressively decreased from 24.2% to 13.3% over five years, indicating effective debt management and solid financial footing as it holds more cash than total debt. Trading at nearly 44% below its estimated fair value adds to its attractiveness for potential investors seeking undervalued opportunities in this sector. Recently, SeirenLtd completed a share buyback of approximately ¥1,344 million for about 0.99% of shares outstanding, reflecting confidence in its valuation and future prospects.

- Click to explore a detailed breakdown of our findings in SeirenLtd's health report.

Evaluate SeirenLtd's historical performance by accessing our past performance report.

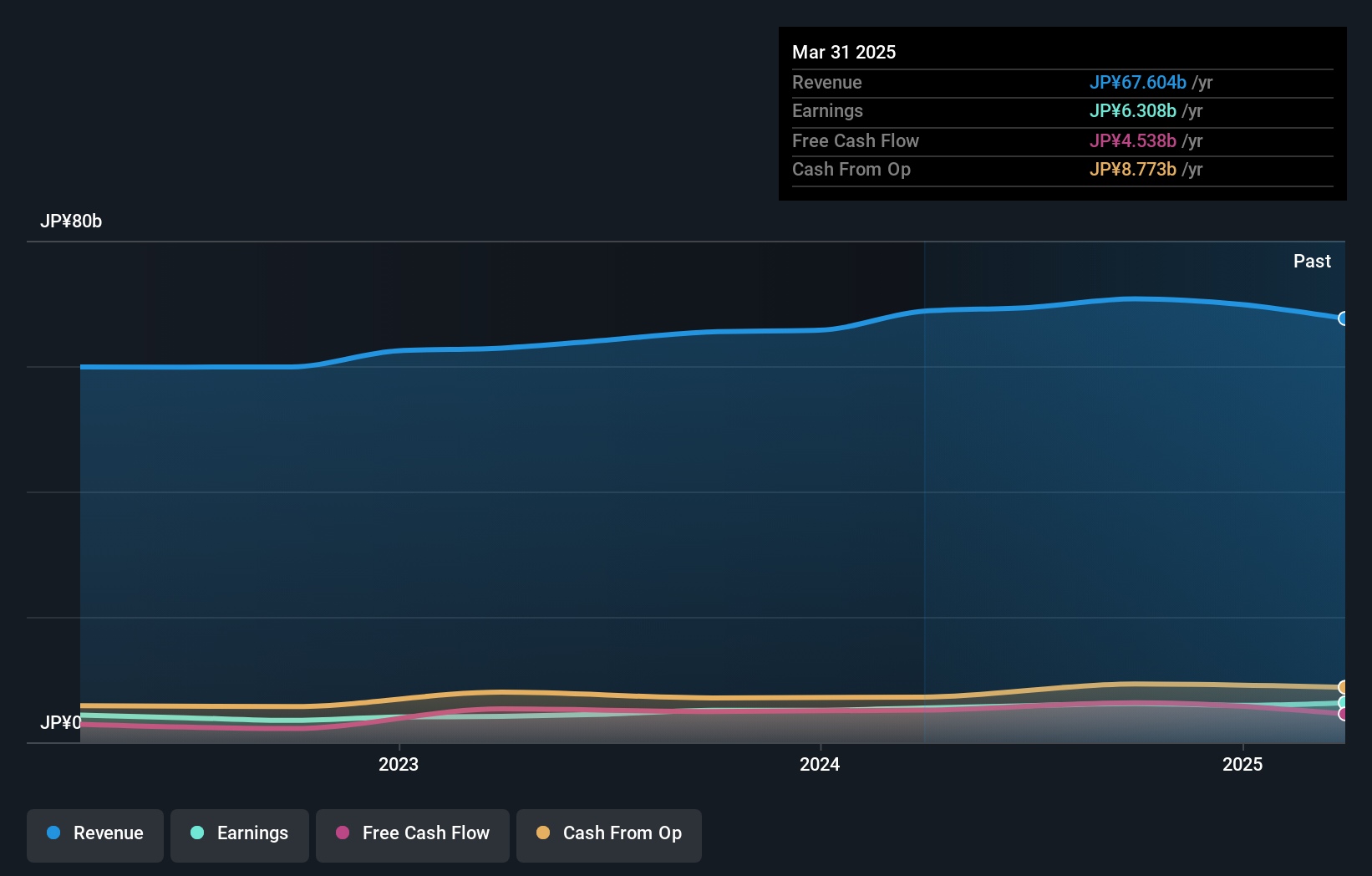

Oiles (TSE:6282)

Simply Wall St Value Rating: ★★★★★★

Overview: Oiles Corporation manufactures and sells bearings, structural equipment, and construction equipment in Japan and internationally, with a market cap of ¥66.17 billion.

Operations: Oiles Corporation generates revenue primarily from its Automotive Bearing Equipment and General Bearing Equipment segments, contributing ¥33.76 billion and ¥14.48 billion respectively. The Structural Equipment segment adds ¥13.82 billion, while Construction Equipment contributes ¥6.20 billion to the total revenue stream.

Oiles, a small player in the machinery sector, has been making significant strides with earnings growth of 20.4% over the past year, outpacing the industry's 1.2%. The company is trading at a notable discount of 31.7% below its estimated fair value, suggesting potential upside for investors. Oiles' debt-to-equity ratio has impressively decreased from 10% to just 2.1% over five years, indicating improved financial health. Recently, it announced a share repurchase program worth ¥2 billion to boost shareholder returns and raised its earnings guidance for fiscal year 2024 with expected net income per share increasing from ¥138 to ¥149.

- Delve into the full analysis health report here for a deeper understanding of Oiles.

Review our historical performance report to gain insights into Oiles''s past performance.

Seize The Opportunity

- Get an in-depth perspective on all 4666 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3569

SeirenLtd

Manufactures and markets vehicle parts, textile products, industrial machines, and electronic parts in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives