As global markets navigate a landscape marked by monetary policy easing and trade tension shifts, Asia's small-cap sector presents a unique opportunity for investors seeking growth amid volatility. In this dynamic environment, identifying stocks with strong fundamentals and resilience can be key to uncovering hidden gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hangzhou Fortune Gas Cryogenic Group | NA | 15.44% | 21.50% | ★★★★★★ |

| Hangzhou Xili Intelligent TechnologyLtd | NA | 7.91% | 10.45% | ★★★★★★ |

| Hubei Three Gorges Tourism Group | 11.21% | -18.05% | 18.39% | ★★★★★★ |

| ZHEJIANG DIBAY ELECTRICLtd | 0.09% | 4.57% | 4.99% | ★★★★★★ |

| Maezawa Kasei Industries | 0.79% | 3.33% | 20.44% | ★★★★★★ |

| Camelot Electronics TechnologyLtd | 11.46% | 4.94% | -6.37% | ★★★★★★ |

| Guangdong Green Precision Components | NA | -9.65% | -38.41% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 298.93% | 174.69% | ★★★★★★ |

| Shandong Longquan Pipe IndustryLtd | 43.89% | 3.97% | 7.27% | ★★★★★☆ |

| Banyan Tree Holdings | 42.74% | 15.33% | 72.59% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

China Hi-Tech Group (SHSE:600730)

Simply Wall St Value Rating: ★★★★★★

Overview: China Hi-Tech Group Co., Ltd. operates in the education and real estate leasing sectors within China, with a market capitalization of approximately CN¥5.85 billion.

Operations: China Hi-Tech Group Co., Ltd. generates revenue primarily from its education and real estate leasing sectors. The company's net profit margin is a key financial metric to consider when evaluating its financial health.

China Hi-Tech Group, a modest player in the market, has faced some challenges recently. Over the past year, earnings grew by 29.8%, outpacing the Consumer Services industry's 12.8%. However, a significant one-off loss of CN¥7.5M negatively impacted its financial results for the year ending June 2025. The company reported sales of CN¥47.53M for H1 2025 compared to CN¥69.91M last year, resulting in a net loss of CN¥4.6M versus a net income of CN¥21.77M previously. Despite these hurdles, being debt-free gives it flexibility in managing future growth opportunities effectively.

ASRock Rack Incorporation (TPEX:7711)

Simply Wall St Value Rating: ★★★★★★

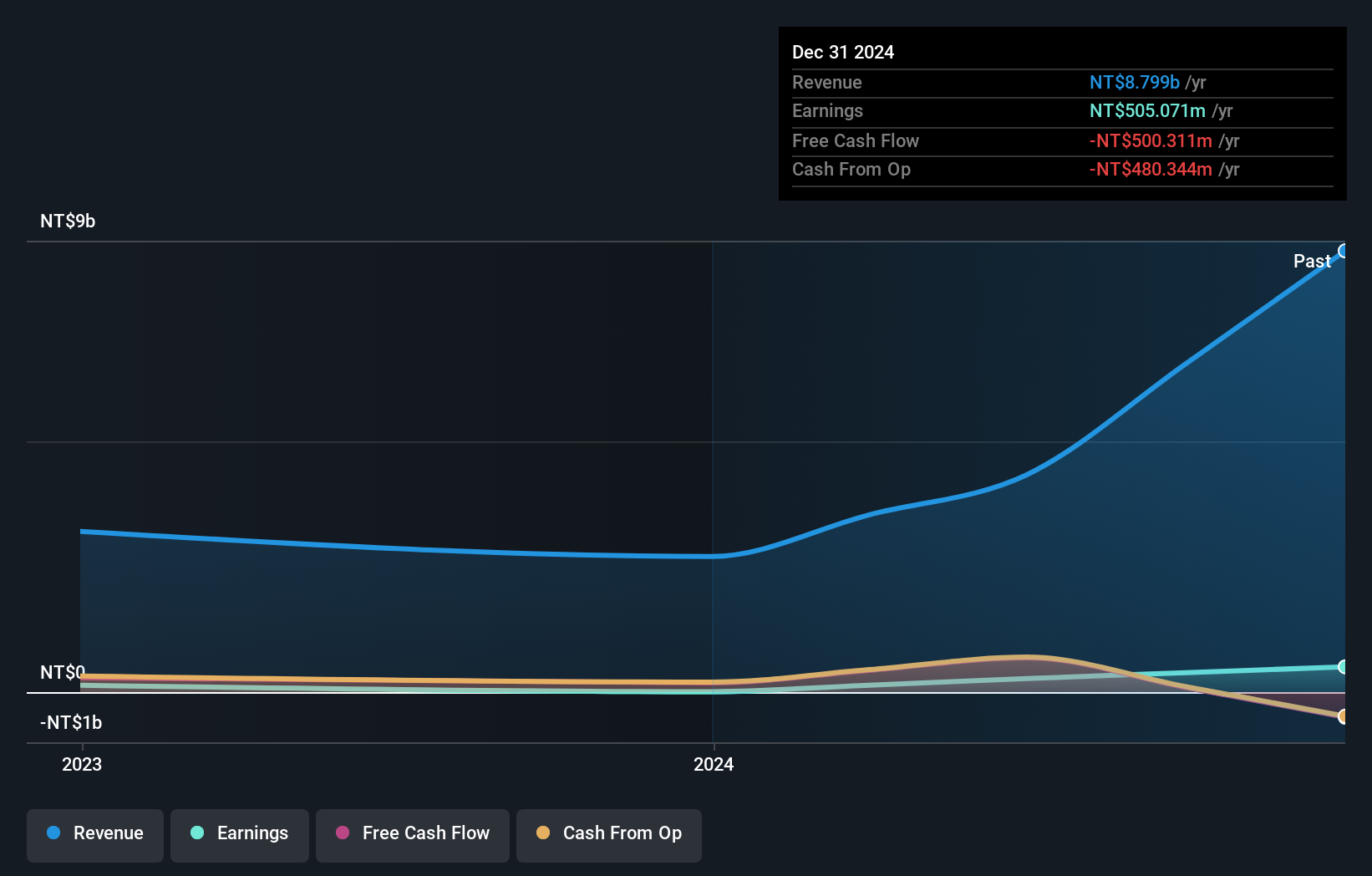

Overview: ASRock Rack Incorporation specializes in cloud computing server hardware products for both the Taiwanese and international markets, with a market cap of NT$33.07 billion.

Operations: ASRock Rack Incorporation generates revenue from its cloud computing server hardware products, serving both Taiwanese and international markets. The company has a market cap of NT$33.07 billion.

ASRock Rack, a nimble player in the tech space, showcases impressive growth with earnings surging 174.7% over the past year, outpacing the broader industry. Despite a dip in profit margins to 4.3% from 6.3%, its debt-free status and positive free cash flow highlight financial resilience. Recent product innovations like the ASRock Rack 4U16X-GNR2/ZC with ZutaCore's cooling technology underscore its commitment to cutting-edge solutions for AI workloads. The company's recent follow-on equity offering of TWD 2.995 million indicates strategic capital management aimed at fueling further expansion and innovation efforts in this competitive landscape.

Union Tool (TSE:6278)

Simply Wall St Value Rating: ★★★★★★

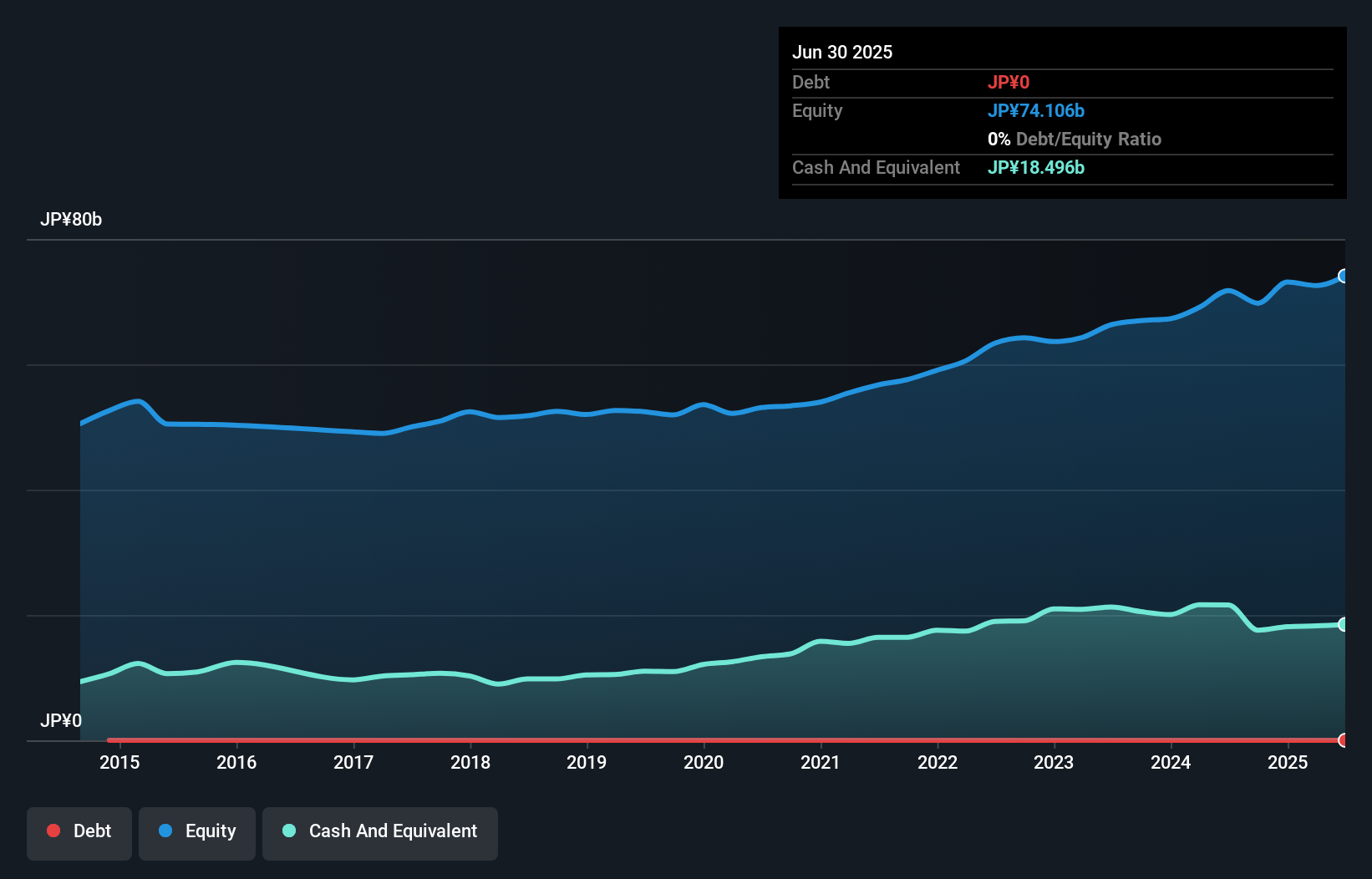

Overview: Union Tool Co. is a company that designs, manufactures, and sells cutting tools, linear motion products, and metal machining equipment across Japan, China, Taiwan, and other international markets with a market cap of ¥131.63 billion.

Operations: Union Tool generates revenue primarily from Asia and Japan, contributing ¥20.62 billion and ¥23.92 billion respectively, with additional income from Europe and North America.

Union Tool, a smaller player in the machinery sector, has shown impressive earnings growth of 40.9% over the past year, outpacing the industry average of 6.7%. This debt-free company is trading at a significant discount, about 40.3% below its estimated fair value. Recent developments include an increase in dividends to ¥60 per share for Q2 and revised guidance projecting net sales of ¥37.5 billion and operating profit of ¥7.9 billion for the full year ending December 2025. The surge in demand for package boards and favorable currency exchange rates have bolstered its financial performance significantly this year.

- Take a closer look at Union Tool's potential here in our health report.

Examine Union Tool's past performance report to understand how it has performed in the past.

Where To Now?

- Click this link to deep-dive into the 2379 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6278

Union Tool

Designs, manufactures, and sells of cutting tools, linear motion products, and metal machining equipment in Japan, China, Taiwan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives