- Norway

- /

- Construction

- /

- OB:NORCO

3 Stocks Estimated To Be Up To 40.9% Below Intrinsic Value

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding the incoming Trump administration's policies has led to a mixed performance across major indices, with sectors like financials and energy gaining from deregulation hopes while healthcare and EV shares face setbacks. Amid these fluctuations, identifying stocks that are undervalued can present opportunities for investors looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$279.00 | NT$554.65 | 49.7% |

| Lindab International (OM:LIAB) | SEK226.60 | SEK450.18 | 49.7% |

| SeSa (BIT:SES) | €76.00 | €150.71 | 49.6% |

| S-Pool (TSE:2471) | ¥344.00 | ¥681.84 | 49.5% |

| Solum (KOSE:A248070) | ₩17280.00 | ₩34265.45 | 49.6% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥16.20 | CN¥32.31 | 49.9% |

| XD (SEHK:2400) | HK$22.40 | HK$44.60 | 49.8% |

| AirBoss of America (TSX:BOS) | CA$4.25 | CA$8.45 | 49.7% |

| Intellian Technologies (KOSDAQ:A189300) | ₩44600.00 | ₩88907.79 | 49.8% |

| iFLYTEKLTD (SZSE:002230) | CN¥53.07 | CN¥105.85 | 49.9% |

We'll examine a selection from our screener results.

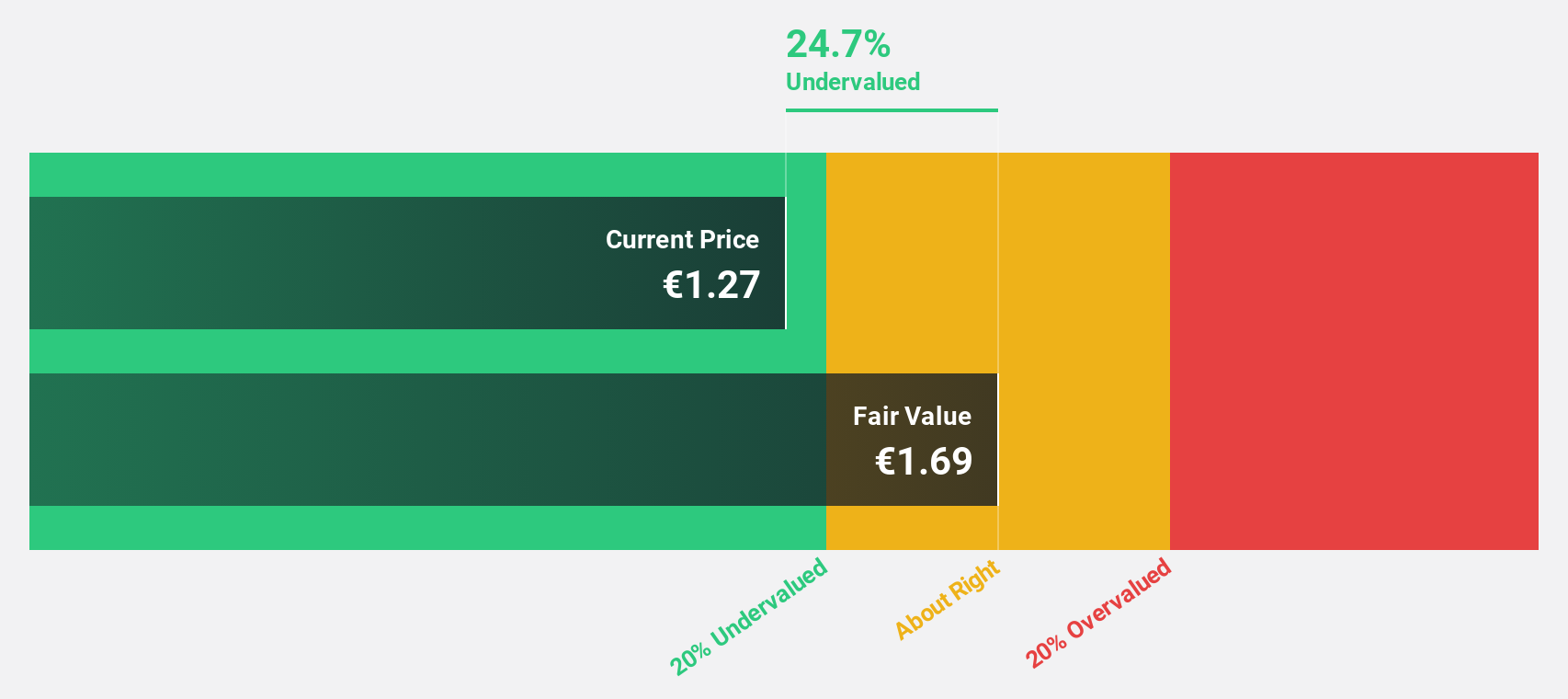

Línea Directa Aseguradora Compañía de Seguros y Reaseguros (BME:LDA)

Overview: Línea Directa Aseguradora, S.A., Compañía de Seguros y Reaseguros operates in the insurance and reinsurance sectors in Spain and Portugal, with a market capitalization of approximately €1.19 billion.

Operations: The company's revenue is primarily derived from its insurance segments, with €841.53 million from cars, €152.27 million from home, and €21.27 million from health insurance in Spain and Portugal.

Estimated Discount To Fair Value: 15.6%

Línea Directa Aseguradora is trading at €1.09, below its estimated fair value of €1.29, suggesting undervaluation based on discounted cash flow analysis. Despite slower revenue growth forecasts compared to the Spanish market, the company's earnings are expected to grow significantly at 22.3% annually. Recent results show a turnaround with a net income of €40.75 million for nine months ending September 2024, up from a loss last year, highlighting improved profitability prospects.

- Our growth report here indicates Línea Directa Aseguradora Compañía de Seguros y Reaseguros may be poised for an improving outlook.

- Get an in-depth perspective on Línea Directa Aseguradora Compañía de Seguros y Reaseguros' balance sheet by reading our health report here.

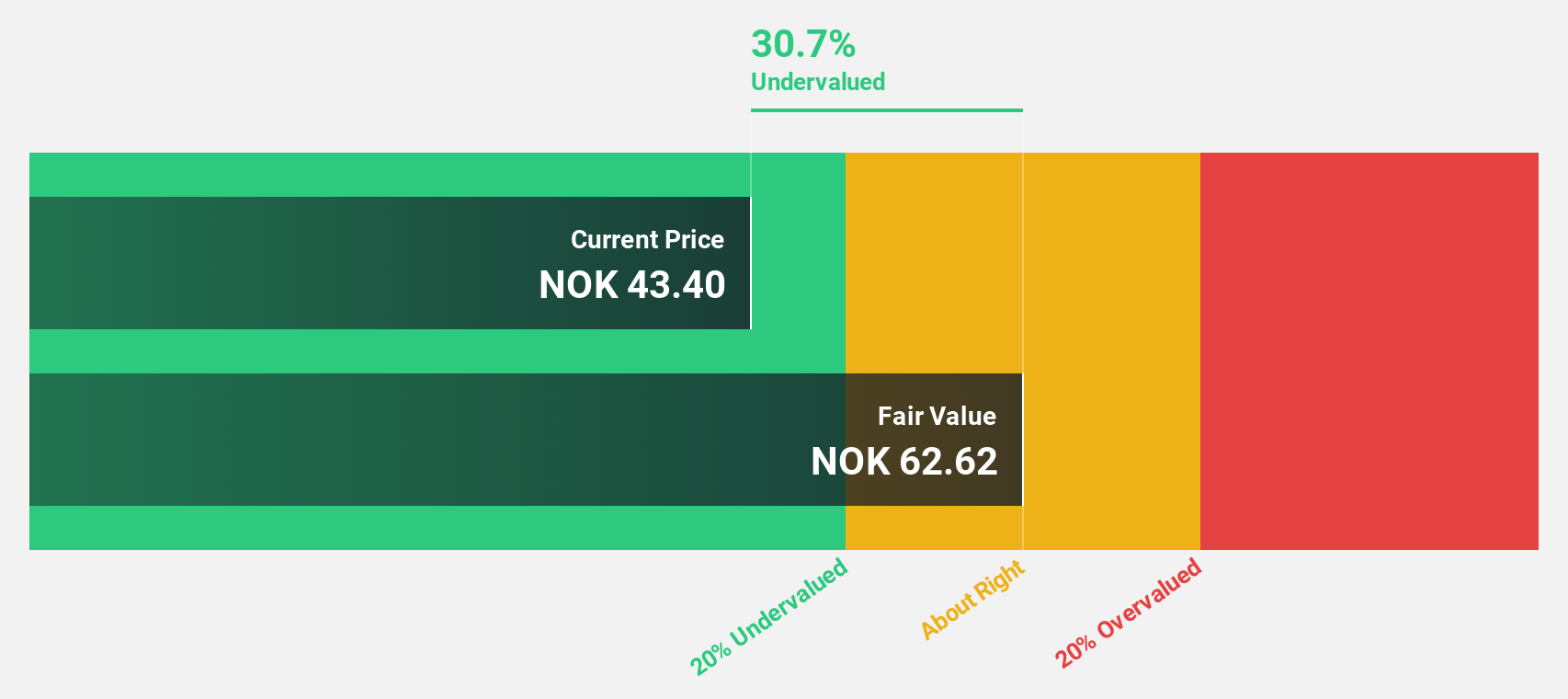

Norconsult (OB:NORCO)

Overview: Norconsult ASA offers consultancy services specializing in community planning, engineering design, and architecture within the Nordics and internationally, with a market cap of NOK11.21 billion.

Operations: The company's revenue segments include NOK1.75 billion from Sweden, NOK858 million from Denmark, NOK2.78 billion from Norway Regions, NOK909 million in Renewable Energy, NOK2.99 billion from Norway Head Office, and NOK1.20 billion in Digital and Techno-Garden services.

Estimated Discount To Fair Value: 40.9%

Norconsult is trading at NOK38.85, below its estimated fair value of NOK65.74, indicating significant undervaluation based on discounted cash flow analysis. While revenue growth is modest at 3.5% annually, earnings are projected to grow significantly by 30.1% per year, outpacing the Norwegian market's average growth rate of 9.3%. Recent earnings reports show a decline in net income and profit margins compared to the previous year, reflecting some operational challenges despite strong future earnings prospects.

- According our earnings growth report, there's an indication that Norconsult might be ready to expand.

- Navigate through the intricacies of Norconsult with our comprehensive financial health report here.

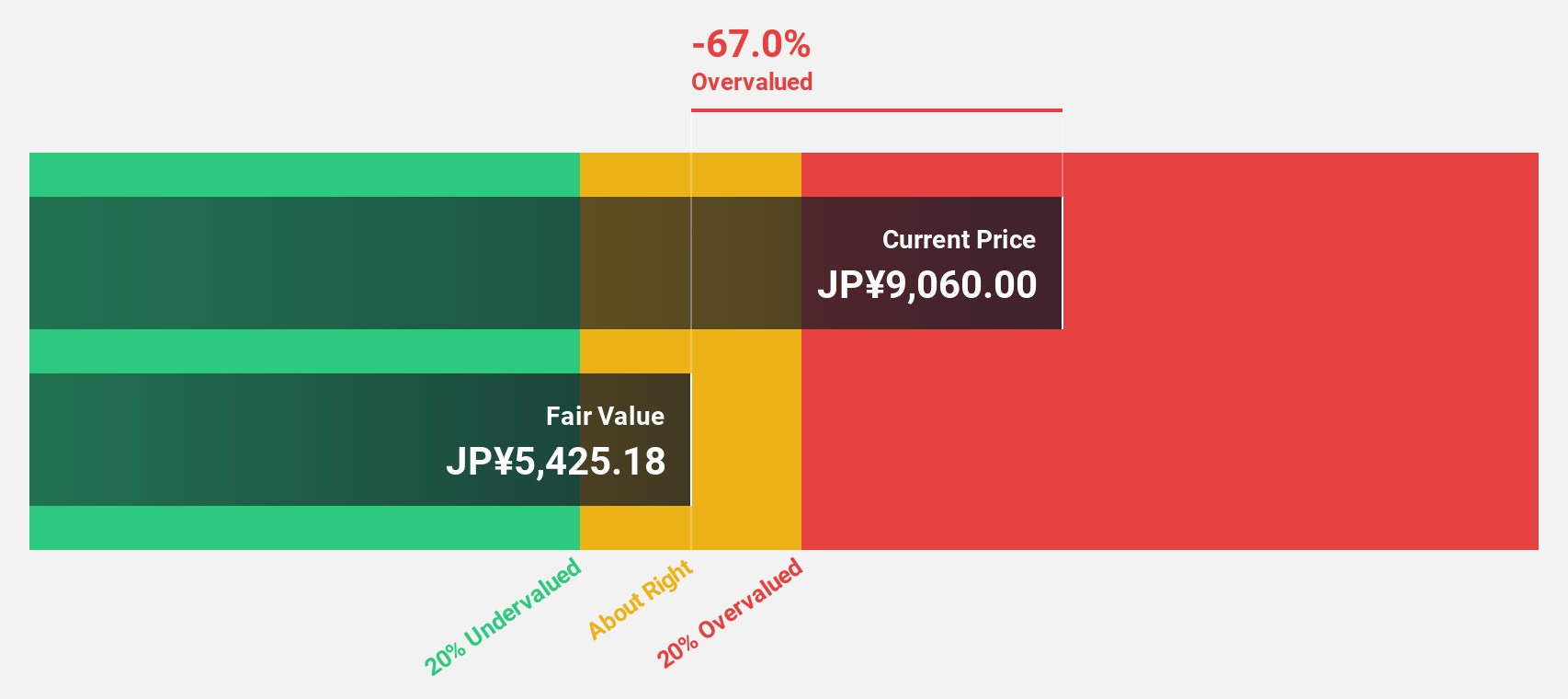

Union Tool (TSE:6278)

Overview: Union Tool Co. specializes in manufacturing and selling cutting tools, linear motion products, and metal machining equipment both in Japan and globally, with a market capitalization of ¥105.55 billion.

Operations: Revenue Segments (in millions of ¥): Cutting Tools: ¥27,500; Linear Motion Products: ¥5,200; Metal Machining Equipment: ¥3,800.

Estimated Discount To Fair Value: 22.2%

Union Tool is trading at ¥6,110, significantly below its estimated fair value of ¥7,856.36. Despite recent share price volatility, the company shows strong growth potential with earnings expected to grow 20.67% annually over the next three years—outpacing the Japanese market's average growth rate of 8%. The company's fiscal year forecast includes net sales of ¥30.1 billion and an operating profit of ¥6.2 billion, reflecting robust cash flow prospects despite modest revenue growth expectations at 8.5% per year.

- Our earnings growth report unveils the potential for significant increases in Union Tool's future results.

- Delve into the full analysis health report here for a deeper understanding of Union Tool.

Next Steps

- Investigate our full lineup of 935 Undervalued Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norconsult might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NORCO

Norconsult

Provides consultancy services with focus on community planning, engineering design, and architecture in the Nordics and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives