SMC (TSE:6273) stock falls 3.6% in past week as one-year earnings and shareholder returns continue downward trend

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in SMC Corporation (TSE:6273) have tasted that bitter downside in the last year, as the share price dropped 30%. That's disappointing when you consider the market returned 7.8%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 12% in three years.

If the past week is anything to go by, investor sentiment for SMC isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for SMC

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

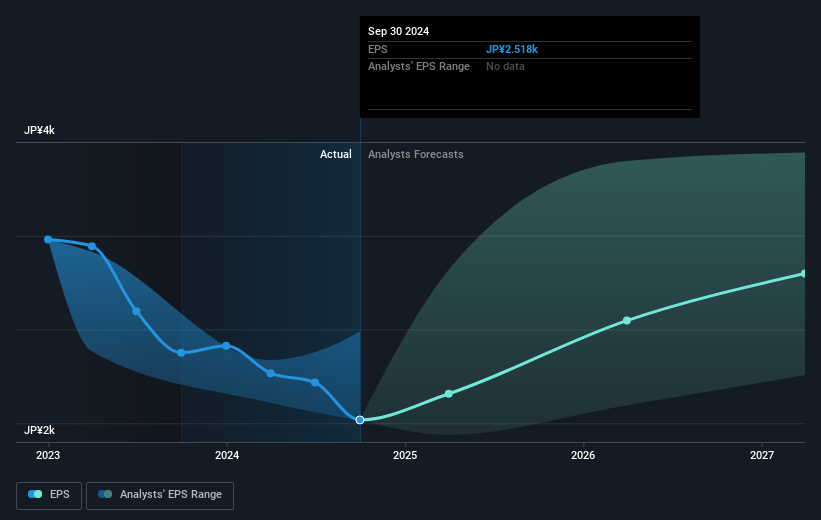

Unfortunately SMC reported an EPS drop of 12% for the last year. This reduction in EPS is not as bad as the 30% share price fall. This suggests the EPS fall has made some shareholders more nervous about the business.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While the broader market gained around 7.8% in the last year, SMC shareholders lost 29% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before forming an opinion on SMC you might want to consider these 3 valuation metrics.

Of course SMC may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6273

SMC

Manufactures, processes, and sells automatic control equipment, sintered filters, and various types of filtration equipment worldwide.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives