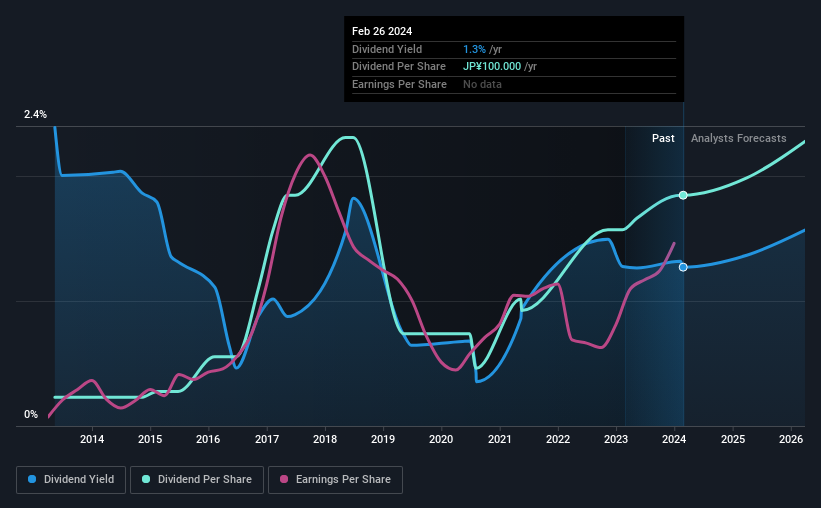

Hirata Corporation (TSE:6258) will increase its dividend from last year's comparable payment on the 5th of June to ¥100.00. Even though the dividend went up, the yield is still quite low at only 1.3%.

See our latest analysis for Hirata

Hirata's Dividend Is Well Covered By Earnings

If it is predictable over a long period, even low dividend yields can be attractive. Based on the last payment, Hirata was earning enough to cover the dividend, but free cash flows weren't positive. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Over the next year, EPS is forecast to expand by 9.8%. Assuming the dividend continues along recent trends, we think the payout ratio could be 19% by next year, which is in a pretty sustainable range.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2014, the annual payment back then was ¥12.50, compared to the most recent full-year payment of ¥100.00. This implies that the company grew its distributions at a yearly rate of about 23% over that duration. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

Hirata May Find It Hard To Grow The Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings per share has been crawling upwards at 3.2% per year. While EPS growth is quite low, Hirata has the option to increase the payout ratio to return more cash to shareholders.

Our Thoughts On Hirata's Dividend

Overall, we always like to see the dividend being raised, but we don't think Hirata will make a great income stock. While Hirata is earning enough to cover the payments, the cash flows are lacking. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 4 analysts we track are forecasting for Hirata for free with public analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

If you're looking to trade Hirata, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hirata might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6258

Hirata

Manufactures and sells various manufacturing line systems, industrial robots, and logistic equipment in Japan and internationally.

Reasonable growth potential slight.

Market Insights

Community Narratives