Hirata Corporation (TSE:6258) Stock's 29% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the Hirata Corporation (TSE:6258) share price has dived 29% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

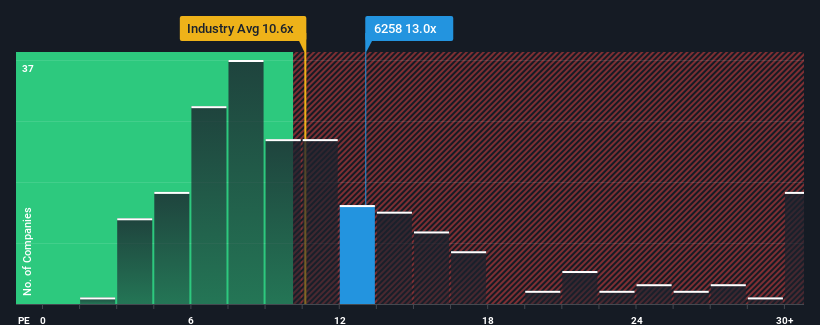

Although its price has dipped substantially, there still wouldn't be many who think Hirata's price-to-earnings (or "P/E") ratio of 13x is worth a mention when the median P/E in Japan is similar at about 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Hirata could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Hirata

Does Growth Match The P/E?

Hirata's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 54%. As a result, earnings from three years ago have also fallen 39% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 99% as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 10% growth forecast for the broader market.

In light of this, it's curious that Hirata's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Hirata's P/E

Hirata's plummeting stock price has brought its P/E right back to the rest of the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hirata currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Hirata (1 is significant!) that you should be aware of before investing here.

Of course, you might also be able to find a better stock than Hirata. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hirata might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6258

Hirata

Manufactures and sells various manufacturing line systems, industrial robots, and logistic equipment in Japan and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives