Japan's stock markets have shown significant gains recently, with the Nikkei 225 Index rising by 3.1% and the broader TOPIX Index up by 2.8%, buoyed by a weakened yen following the U.S. Federal Reserve's decision to cut interest rates. As investors navigate these dynamic market conditions, dividend stocks in Japan present an attractive option for those seeking steady income and potential capital appreciation. In light of current economic trends, a good dividend stock is characterized not only by its yield but also by its stability and growth prospects within a supportive macroeconomic environment.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Globeride (TSE:7990) | 4.23% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| Yahagi ConstructionLtd (TSE:1870) | 4.88% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.78% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.88% | ★★★★★★ |

| Innotech (TSE:9880) | 4.72% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.09% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.40% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.33% | ★★★★★★ |

Click here to see the full list of 434 stocks from our Top Japanese Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Bunka Shutter (TSE:5930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bunka Shutter Co., Ltd. manufactures and sells various shutters and construction materials in Japan, with a market cap of ¥129.53 billion.

Operations: Bunka Shutter Co., Ltd. generates revenue primarily from its Shutter Business (¥96.93 billion), Construction-Related Materials Business (¥87.30 billion), Service Business (¥30.43 billion), and Refurbishment Business (¥6.04 billion).

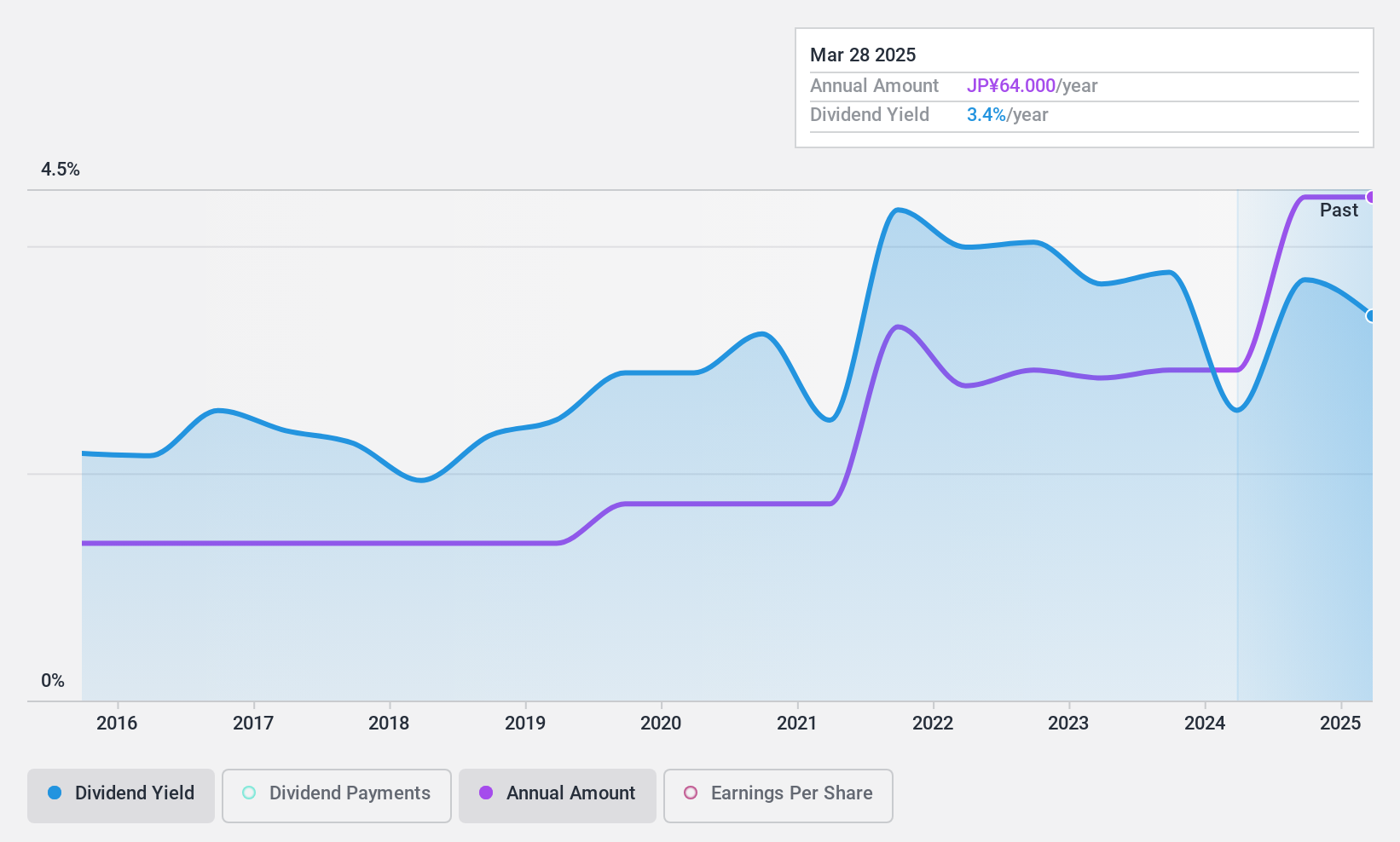

Dividend Yield: 3.5%

Bunka Shutter's dividend yield (3.51%) is slightly below the top 25% of JP market payers. While its dividends have grown over the past decade, they have been volatile and unreliable. The payout ratio is sustainable at 34.7%, with cash flows covering dividends at a 41.4% cash payout ratio. Despite recent shareholder dilution, earnings grew by 28.8% last year, and the stock trades at a significant discount to its estimated fair value (40.9%).

- Click here and access our complete dividend analysis report to understand the dynamics of Bunka Shutter.

- The valuation report we've compiled suggests that Bunka Shutter's current price could be quite moderate.

Will Group (TSE:6089)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Will Group, Inc. provides human resource services in Japan and internationally with a market cap of ¥22.94 billion.

Operations: Will Group, Inc.'s revenue segments include ¥82.83 billion from its Domestic Work Business and ¥55.78 billion from its Overseas Work Business.

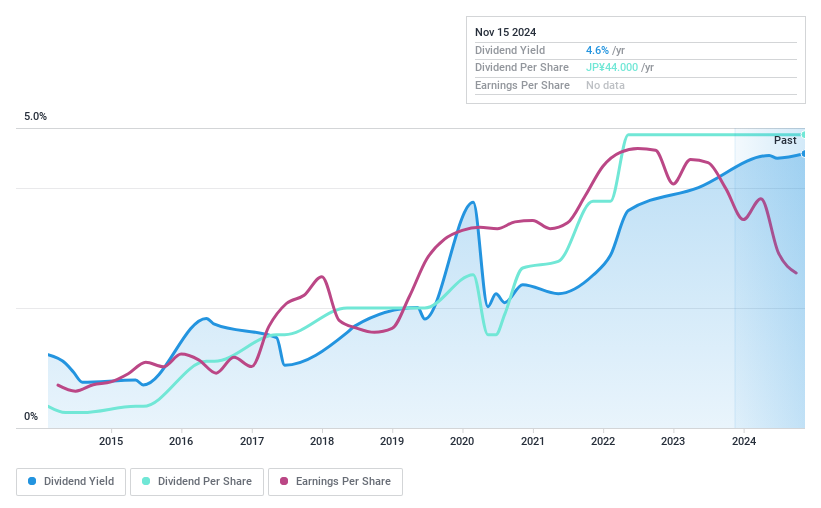

Dividend Yield: 4.4%

Will Group's dividend yield (4.37%) ranks in the top 25% of JP market payers, and its payout ratio is sustainable at 47.1%, with cash flows covering dividends at a 57.1% cash payout ratio. Despite a volatile dividend track record over the past decade, recent guidance revisions have raised revenue and profit expectations for the six months ending September 30, 2024, due to favorable foreign exchange impacts and government subsidies in Singapore.

- Navigate through the intricacies of Will Group with our comprehensive dividend report here.

- Our valuation report unveils the possibility Will Group's shares may be trading at a premium.

Yamabiko (TSE:6250)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yamabiko Corporation, with a market cap of ¥105.41 billion, manufactures and sells agricultural machinery in Japan, Europe, the United States, and internationally.

Operations: Yamabiko Corporation generates revenue from manufacturing and selling agricultural machinery across Japan, Europe, the United States, and other international markets.

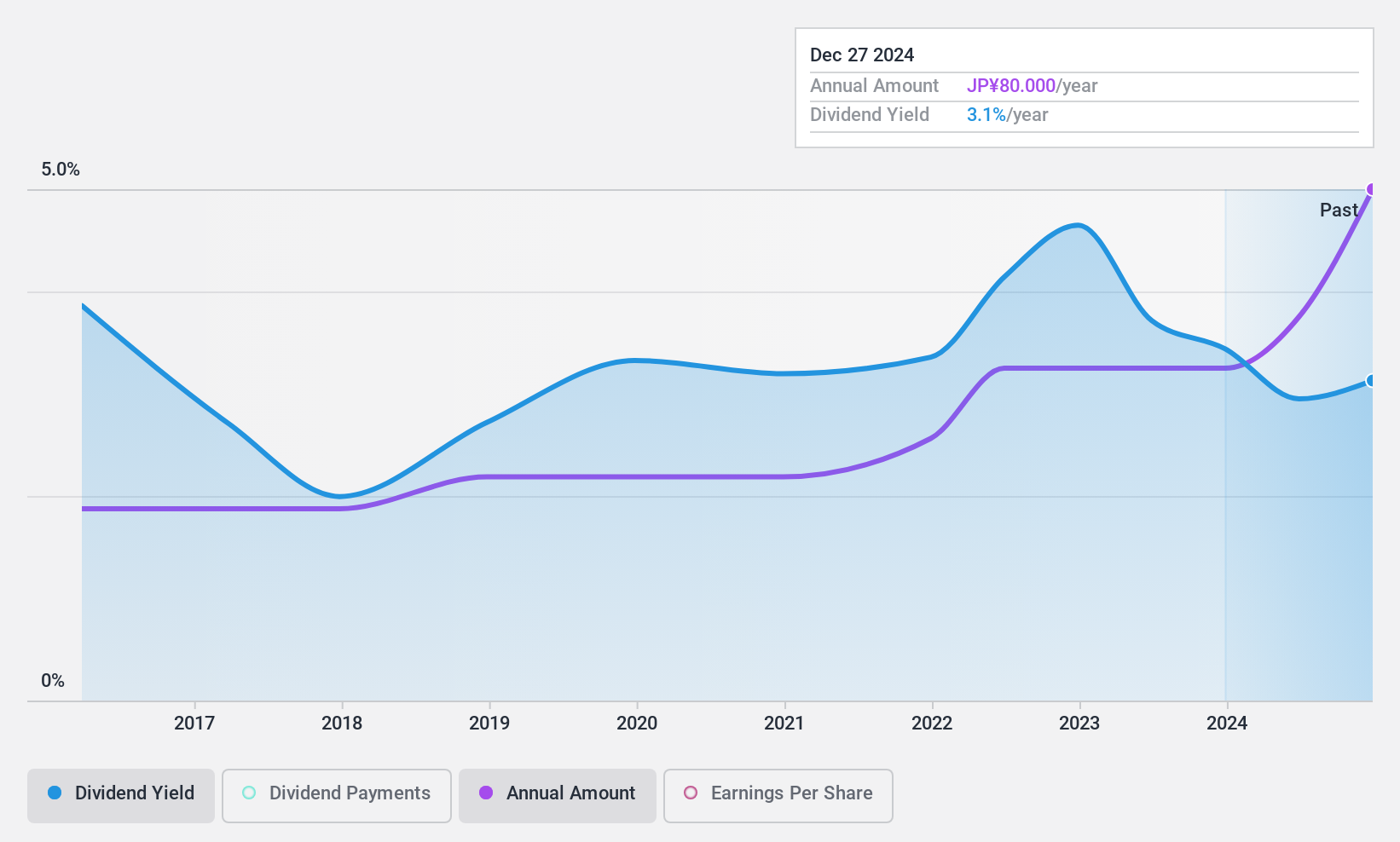

Dividend Yield: 3.1%

Yamabiko Corporation's dividend payments have been stable and growing over the past decade, with a recent increase to JPY 40.00 per share for Q2 2024 and an expected annual dividend of JPY 40.00 per share. The payout ratios are sustainable, with earnings coverage at 31.6% and cash flow coverage at 48.6%. Despite a highly volatile share price recently, its P/E ratio of 8.5x indicates good value compared to the JP market average of 13.4x.

- Dive into the specifics of Yamabiko here with our thorough dividend report.

- The valuation report we've compiled suggests that Yamabiko's current price could be inflated.

Next Steps

- Access the full spectrum of 434 Top Japanese Dividend Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6250

Yamabiko

Manufactures and sells agricultural machinery in Japan, Europe, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.