Slammed 35% DMG Mori Co., Ltd. (TSE:6141) Screens Well Here But There Might Be A Catch

To the annoyance of some shareholders, DMG Mori Co., Ltd. (TSE:6141) shares are down a considerable 35% in the last month, which continues a horrid run for the company. Indeed, the recent drop has reduced its annual gain to a relatively sedate 9.1% over the last twelve months.

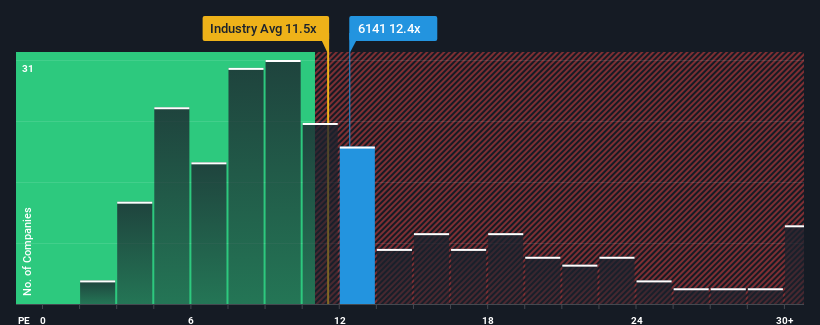

Even after such a large drop in price, you could still be forgiven for feeling indifferent about DMG Mori's P/E ratio of 12.4x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 13x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

DMG Mori certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for DMG Mori

How Is DMG Mori's Growth Trending?

In order to justify its P/E ratio, DMG Mori would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 16%. The latest three year period has also seen an excellent 238% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 19% per annum during the coming three years according to the four analysts following the company. That's shaping up to be materially higher than the 9.6% each year growth forecast for the broader market.

In light of this, it's curious that DMG Mori's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From DMG Mori's P/E?

DMG Mori's plummeting stock price has brought its P/E right back to the rest of the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of DMG Mori's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 3 warning signs for DMG Mori that you need to take into consideration.

If you're unsure about the strength of DMG Mori's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6141

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives