Assessing OSG (TSE:6136)'s Valuation Following Its Recent Sector-Beating Climb

Reviewed by Simply Wall St

See our latest analysis for OSG.

Momentum appears to be building for OSG as its share price continues to climb, with a notable 14.5% gain over the last 90 days and a solid 1-year total shareholder return of nearly 37%. The current price action reflects growing optimism surrounding the company’s steady performance and ongoing profit growth.

If you’re interested in what else is drawing attention this season, it could be a good opportunity to expand your search and explore fast growing stocks with high insider ownership

With OSG’s recent rally and impressive long-term returns, the key question for investors is whether the current price remains attractive or if the market has already factored in all expected growth, leaving little room for upside.

Price-to-Earnings of 14.2x: Is it justified?

OSG is trading at a price-to-earnings (P/E) ratio of 14.2x, which is above both its peers and the industry average. At its last close of ¥2,298.5 per share, the current valuation suggests the market is expecting a premium for OSG compared to its sector.

The P/E ratio indicates how much investors are willing to pay for each yen of the company’s earnings. This makes it a popular yardstick for comparing stocks within the machinery and tools space. A higher P/E can reflect optimism about future growth, but it also means there is less margin for error if that growth does not occur.

For OSG, the premium valuation comes despite its revenue and earnings growth forecasts lagging both the broader market and its industry. The market is pricing in better prospects than the metrics currently suggest. The estimated fair P/E is lower at 13.4x, which is a level the market could adjust toward if expectations do not materialize.

OSG’s P/E ratio is also above the JP Machinery industry average of 12.9x. This emphasizes that the stock’s premium is even more pronounced on a sector basis. Comparatively, it trades above its estimated fair value, which may put future share price gains at risk if performance does not accelerate.

Explore the SWS fair ratio for OSG

Result: Price-to-Earnings of 14.2x (OVERVALUED)

However, OSG's slower revenue growth and a slight discount to its analyst price target remain potential risks that could challenge the current bullish sentiment.

Find out about the key risks to this OSG narrative.

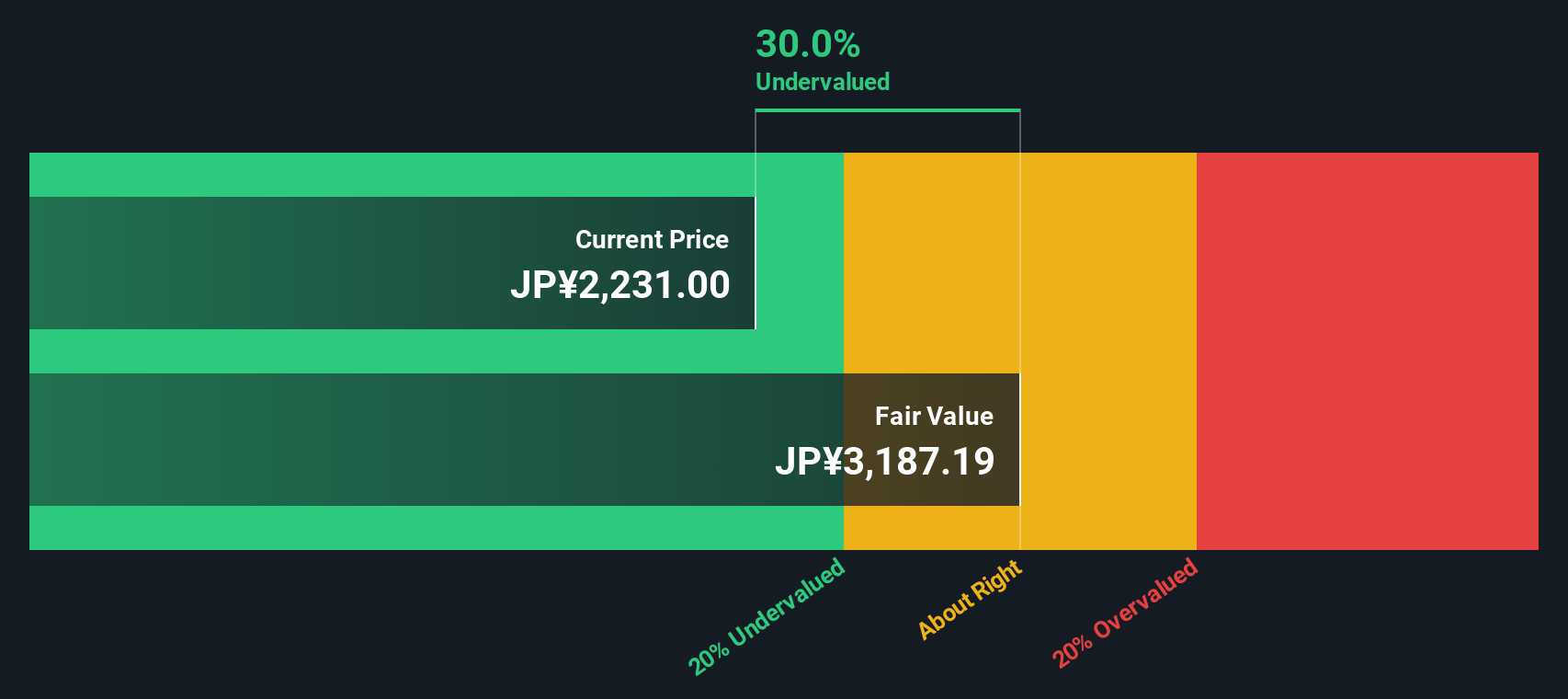

Another View: Discounted Cash Flow Signals Opportunity

While OSG appears expensive compared to its peers based on the price-to-earnings approach, our DCF model presents a different perspective. It indicates that OSG is trading approximately 25% below its fair value. This contrast highlights an important debate: is the current price a risk, or is it a potential bargain waiting to be unlocked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OSG for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OSG Narrative

If you see the numbers differently or want to dig deeper for yourself, you can shape your own view in just a few minutes with Do it your way.

A great starting point for your OSG research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Expand your horizons and give yourself an edge by checking out fresh ideas that could take your portfolio to the next level.

- Uncover promising innovations shaping healthcare by reviewing these 30 healthcare AI stocks with a focus on breakthrough patient care and AI-powered diagnostics.

- Capture strong yields and build long-term wealth by exploring these 15 dividend stocks with yields > 3% offering reliable payouts above 3 percent.

- Catalyze your returns with emerging trends by evaluating these 25 AI penny stocks that support advancements in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6136

OSG

Manufactures and sells precision machinery tools in Japan, the Americas, Europe, Africa, and Asia.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026