Undiscovered Gems in Asia with Promising Potential This October 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by volatility and economic adjustments, Asia's stock markets are drawing attention with their unique challenges and opportunities amid ongoing trade tensions and shifting monetary policies. In this dynamic environment, identifying stocks with strong fundamentals, innovative business models, or strategic positioning can be key to uncovering potential gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CMC | 0.07% | 2.92% | 8.37% | ★★★★★★ |

| Korea Ratings | NA | 0.99% | 3.62% | ★★★★★★ |

| Lelon Electronics | 19.10% | 5.19% | 9.27% | ★★★★★★ |

| Advanced International Multitech | 30.42% | 1.80% | -3.87% | ★★★★★★ |

| AzureWave Technologies | 4.84% | -0.95% | 13.13% | ★★★★★★ |

| KC | 2.84% | 8.17% | -0.54% | ★★★★★☆ |

| Palasino Holdings | 9.75% | 10.88% | -14.54% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 100.29% | 3.05% | 10.51% | ★★★★☆☆ |

| Nippon Sharyo | 52.23% | -0.59% | -8.32% | ★★★★☆☆ |

| Shenzhen Leaguer | 62.41% | 0.65% | -18.79% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Guangxi Yuegui Guangye Holdings (SZSE:000833)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangxi Yuegui Guangye Holdings Co., Ltd. operates in various sectors and has a market capitalization of approximately CN¥11.51 billion.

Operations: The company generates revenue from multiple sectors, contributing to its market presence with a market capitalization of approximately CN¥11.51 billion.

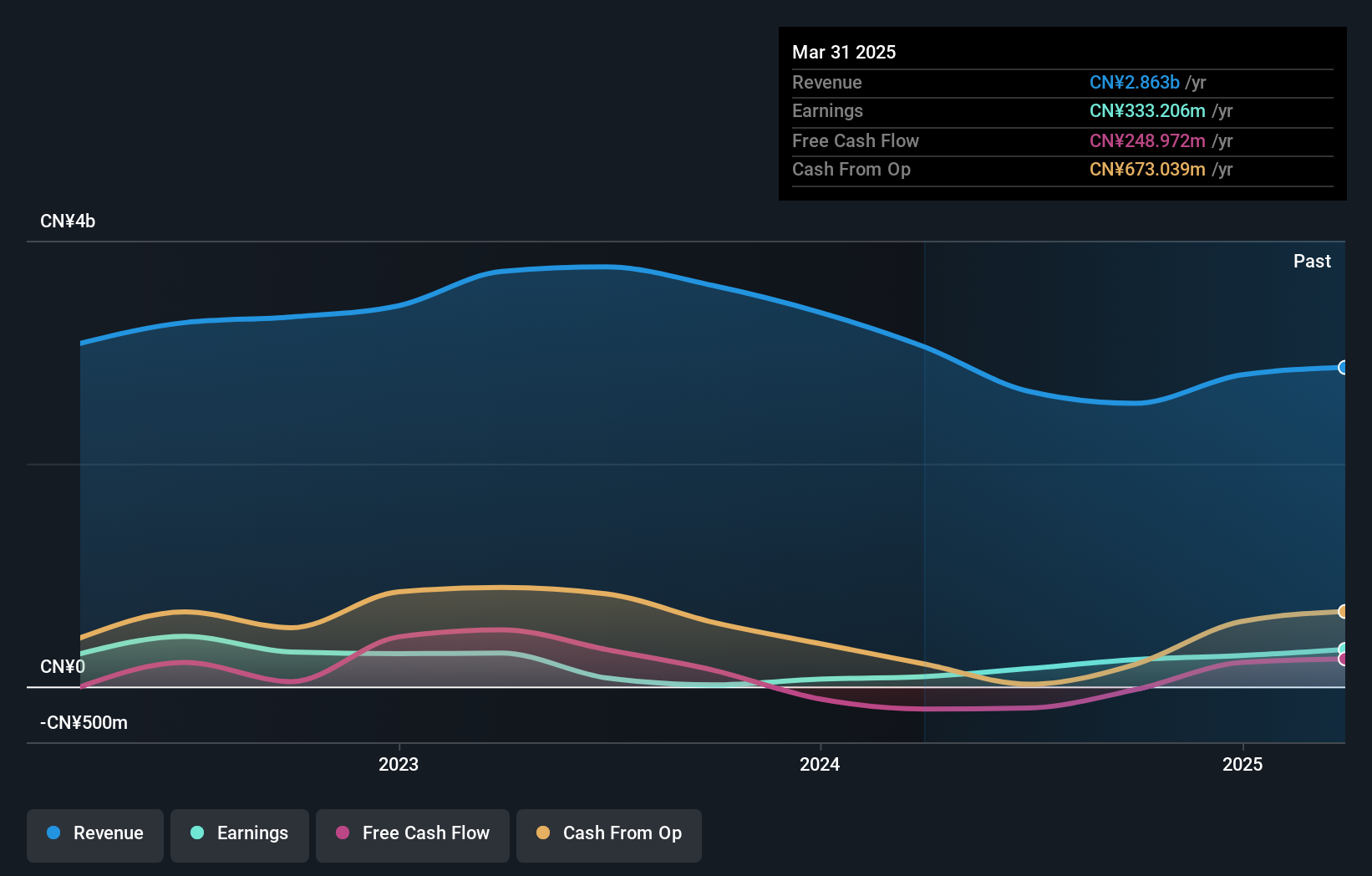

Guangxi Yuegui Guangye Holdings shows promising potential with its recent inclusion in the S&P Global BMI Index, reflecting growing recognition. Over the past year, earnings surged by 133.8%, outpacing the broader food industry significantly. The company's net debt to equity ratio stands at a satisfactory 18%, indicating prudent financial management. Recent half-year results revealed sales of ¥1.26 billion and net income of ¥234 million, showcasing robust growth compared to last year’s figures. With high-quality earnings and strategic amendments to its corporate structure, this company seems well-positioned for future opportunities in its sector.

Henan Tong-Da Cable (SZSE:002560)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Henan Tong-Da Cable Co., Ltd. engages in the research, development, and production of wires and cables in China, with a market capitalization of CN¥4.41 billion.

Operations: Henan Tong-Da Cable generates revenue primarily from its Wire and Cable Business (CN¥4.28 billion), Trading Operations (CN¥5.74 billion), and Aluminum Products Business (CN¥2.83 billion). The Parts Business contributes CN¥208.48 million, while segment adjustments account for a reduction of CN¥5.87 billion in reported figures.

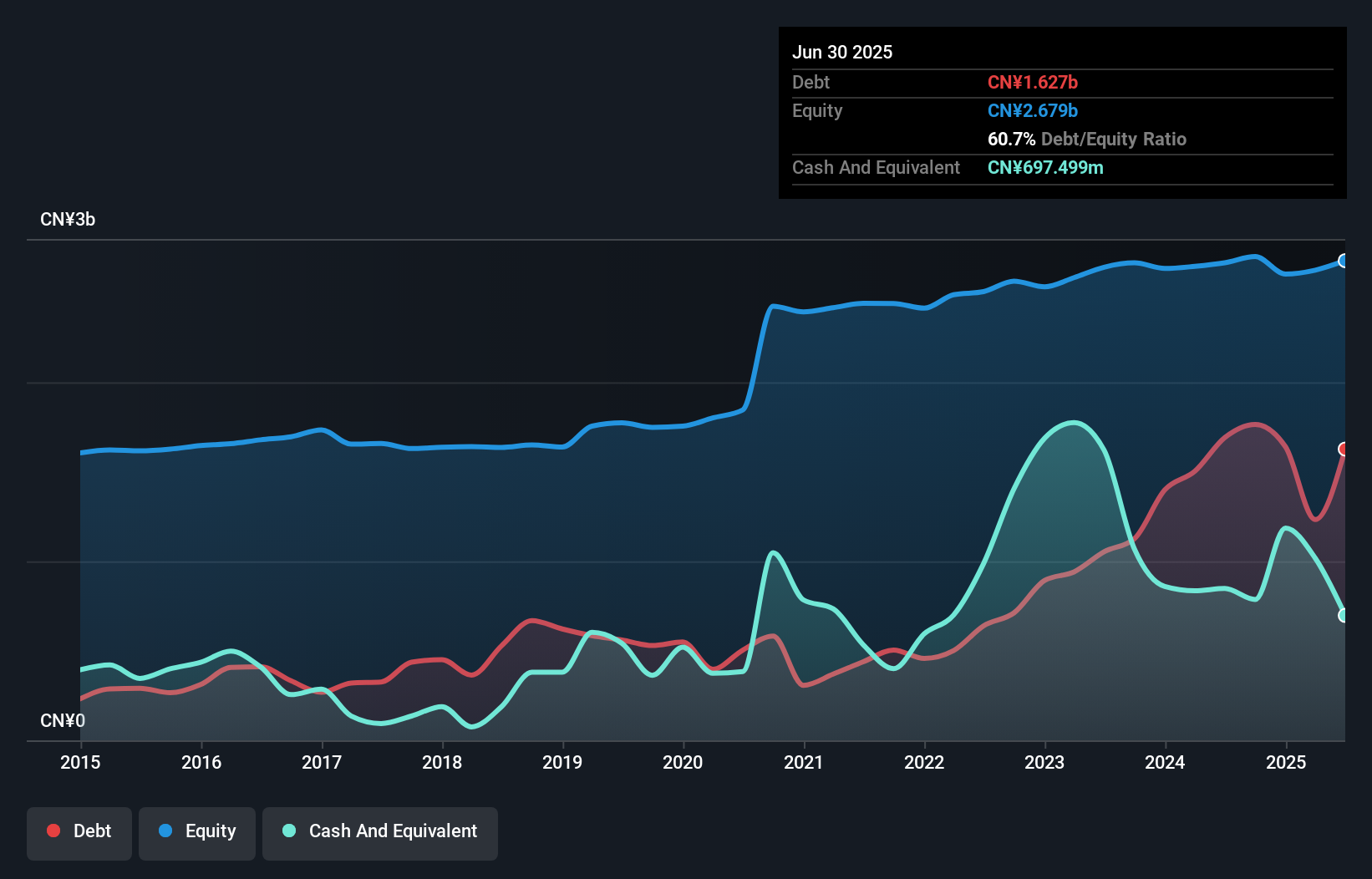

Henan Tong-Da Cable, a smaller player in the electrical industry, showcases robust growth with earnings surging 75% over the past year, significantly outpacing the industry's -0.2%. Despite a notable one-off loss of CN¥62M impacting recent results, its net income for the first half of 2025 reached CN¥61.87M from last year's CN¥36.78M, reflecting strong operational performance. The company's debt to equity ratio stands at a satisfactory 34.7%, though it has risen from 27.3% over five years to 60.7%. Earnings per share improved to CNY 0.1177 this year compared to CNY 0.07 previously, indicating enhanced shareholder value despite challenges in free cash flow positivity and historical earnings decline trends.

Tsugami (TSE:6101)

Simply Wall St Value Rating: ★★★★★★

Overview: Tsugami Corporation, along with its subsidiaries, specializes in the manufacturing and sale of precision machine tools in Japan, with a market capitalization of ¥122.49 billion.

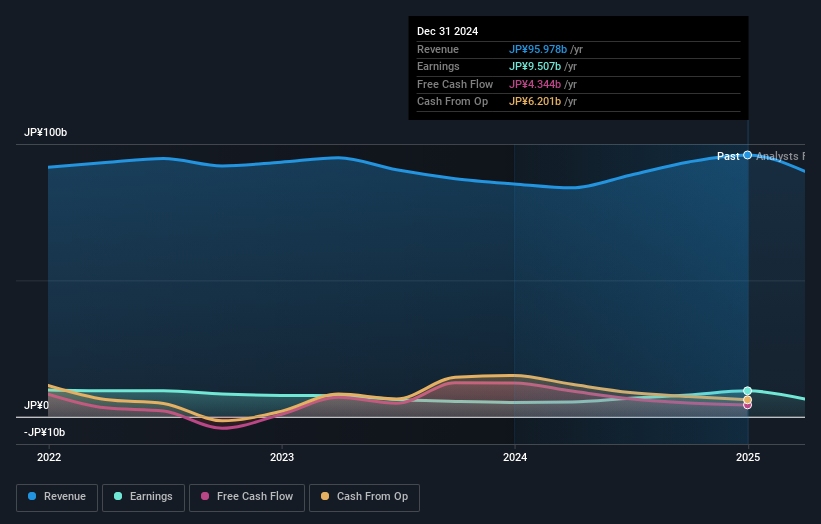

Operations: The primary revenue streams for Tsugami Corporation are from China, contributing ¥93.81 billion, and Japan, with ¥29.35 billion. The company also generates revenue from India and South Korea, amounting to ¥4.82 billion and ¥1.57 billion respectively.

Tsugami, a nimble player in the machinery sector, has been making waves with a notable 83% earnings growth over the past year, outpacing the industry's 6.3% rise. The company seems to be trading at an attractive valuation, sitting 73.5% below its estimated fair value. Over the last five years, Tsugami's debt-to-equity ratio improved from 24.3 to 13.1, showcasing prudent financial management. Recent activity includes repurchasing shares worth ¥329 million between July and September 2025, reflecting confidence in its own prospects and potentially enhancing shareholder value further down the line.

- Click here and access our complete health analysis report to understand the dynamics of Tsugami.

Evaluate Tsugami's historical performance by accessing our past performance report.

Next Steps

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2371 more companies for you to explore.Click here to unveil our expertly curated list of 2374 Asian Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000833

Guangxi Yuegui Guangye Holdings

Guangxi Yuegui Guangye Holdings Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives