As global markets navigate the complexities of easing core inflation and strong bank earnings, major U.S. stock indexes have experienced a notable upswing, with value stocks outperforming growth shares significantly. This environment highlights the potential appeal of dividend stocks, which can offer investors a combination of income and stability amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.16% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.52% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.62% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.06% | ★★★★★★ |

Click here to see the full list of 1975 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Air Water (TSE:4088)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Air Water Inc. operates in Japan, manufacturing and selling products and services across sectors such as industrial gas, chemicals, medical, energy, agriculture and food products, logistics, and seawater with a market cap of ¥434.78 billion.

Operations: Air Water Inc.'s revenue is primarily derived from its Digital & Industry segment at ¥349.40 billion, followed by Health and Safety at ¥238.29 billion, Agriculture & Foods at ¥172.38 billion, and Energy Solution at ¥74.18 billion.

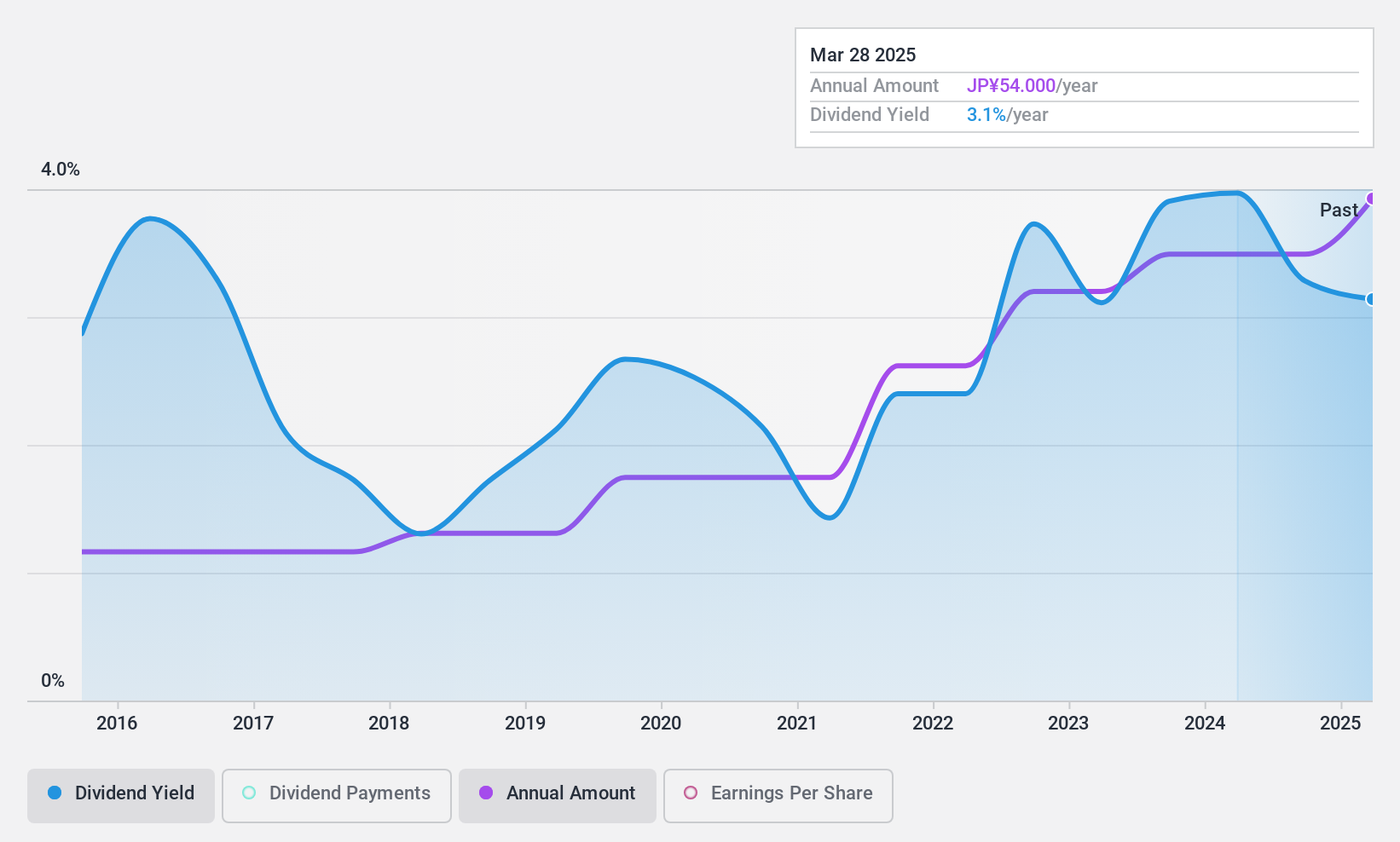

Dividend Yield: 3.4%

Air Water offers a stable and reliable dividend history with consistent growth over the past decade, supported by a low payout ratio of 31.9% and a cash payout ratio of 51.7%. Despite its dividend yield being below the top quartile in Japan, it remains attractive due to its strong earnings growth of 14% last year. Trading at a price-to-earnings ratio of 9.2x, Air Water is valued favorably compared to peers and industry standards.

- Get an in-depth perspective on Air Water's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Air Water's current price could be quite moderate.

FurukawaLtd (TSE:5715)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Furukawa Co., Ltd., along with its subsidiaries, operates globally in the manufacturing and sale of machinery, metals, electronics, and chemical products, with a market cap of ¥65.99 billion.

Operations: Furukawa Co., Ltd.'s revenue is primarily derived from its Metals segment at ¥82.19 billion, followed by Rock Drill at ¥37.16 billion, UNIC Machinery at ¥28.44 billion, Industrial Machinery at ¥21.23 billion, Chemicals Segment at ¥9.28 billion, and Electronics at ¥6.38 billion.

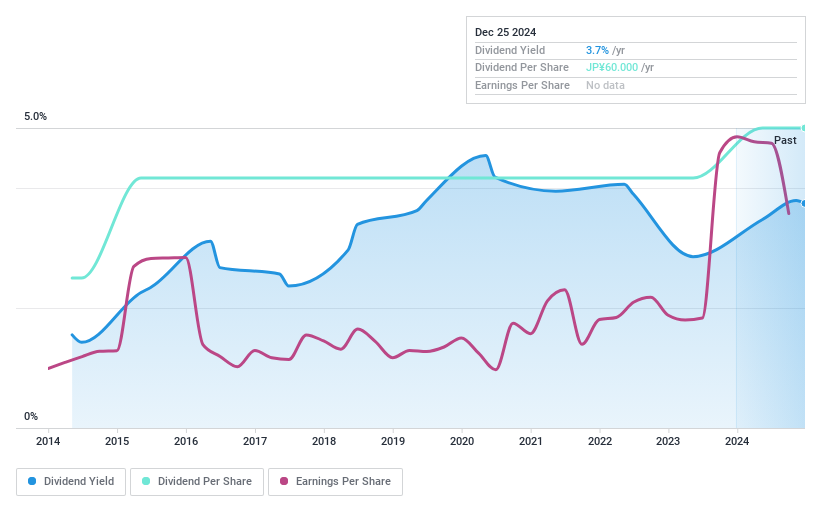

Dividend Yield: 3.3%

Furukawa Ltd. has a reliable dividend history with consistent growth over the past decade, although its current 3.3% yield is below Japan's top quartile. The recent dividend increase to JPY 30 per share reflects confidence despite dividends not being covered by free cash flows. The payout ratio of 26.4% indicates earnings coverage, but the lack of free cash flow raises sustainability concerns. Its price-to-earnings ratio of 5.5x suggests favorable valuation compared to the market average.

- Click to explore a detailed breakdown of our findings in FurukawaLtd's dividend report.

- The valuation report we've compiled suggests that FurukawaLtd's current price could be inflated.

Tsugami (TSE:6101)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tsugami Corporation, along with its subsidiaries, manufactures and sells precision machine tools in Japan and has a market capitalization of approximately ¥74.50 billion.

Operations: Tsugami Corporation generates revenue from several regions, with ¥75.84 billion from China, ¥5.22 billion from India, ¥30.09 billion from Japan, and ¥1.88 billion from Korea.

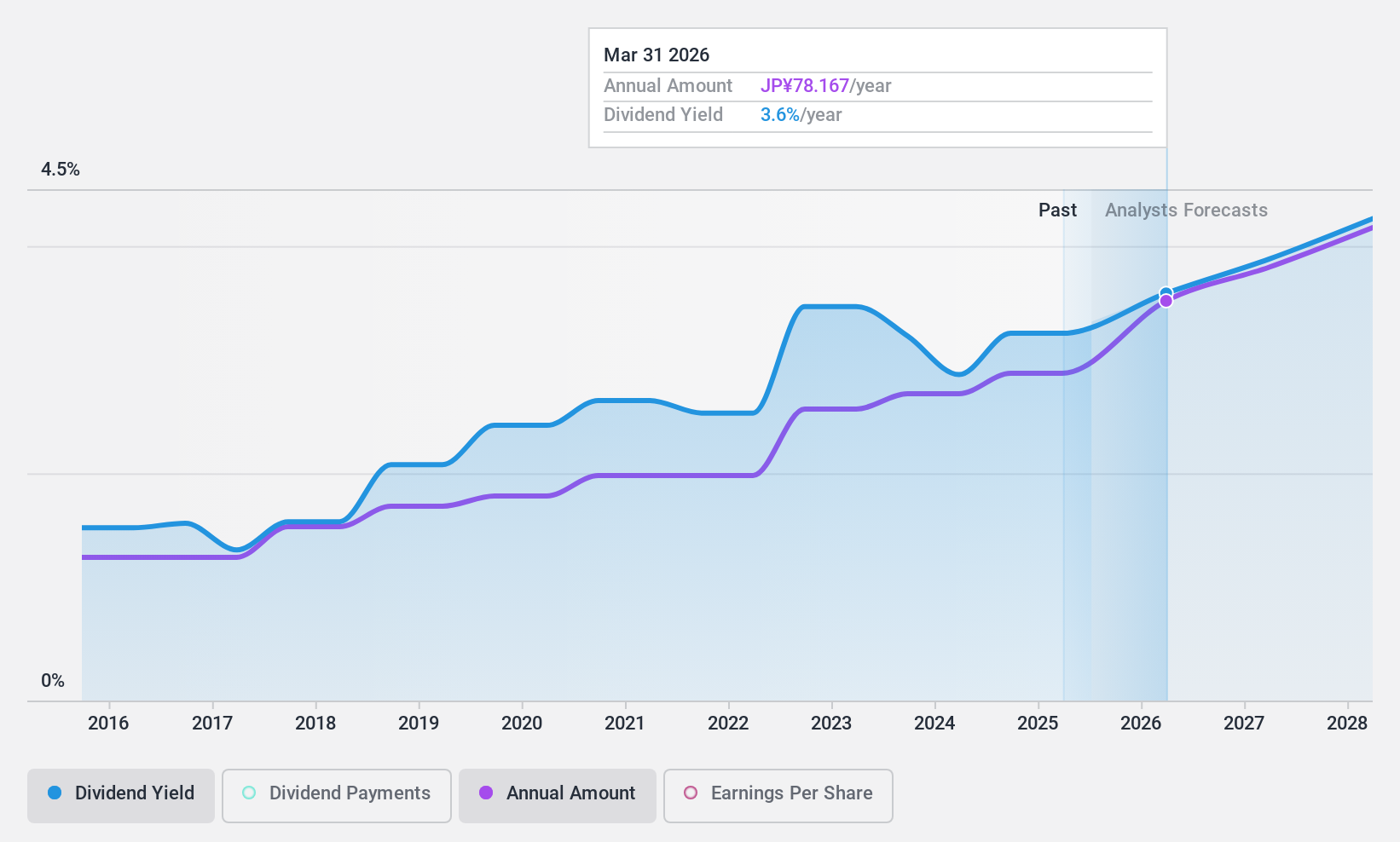

Dividend Yield: 3.4%

Tsugami's dividend reliability is underscored by a decade of stable and growing payments, supported by a manageable payout ratio of 30.2% and cash payout ratio of 51.1%, ensuring coverage by earnings and cash flows. However, its yield of 3.44% falls short of the top quartile in Japan. The company's recent share buyback program, totaling ¥154.14 million for 112,000 shares, highlights strategic capital management amid evolving market conditions while maintaining a favorable price-to-earnings ratio of 9.3x.

- Click here and access our complete dividend analysis report to understand the dynamics of Tsugami.

- In light of our recent valuation report, it seems possible that Tsugami is trading beyond its estimated value.

Make It Happen

- Discover the full array of 1975 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsugami might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6101

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives