- Japan

- /

- Electrical

- /

- TSE:5805

Earnings Tell The Story For SWCC Corporation (TSE:5805) As Its Stock Soars 26%

SWCC Corporation (TSE:5805) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. The last 30 days bring the annual gain to a very sharp 52%.

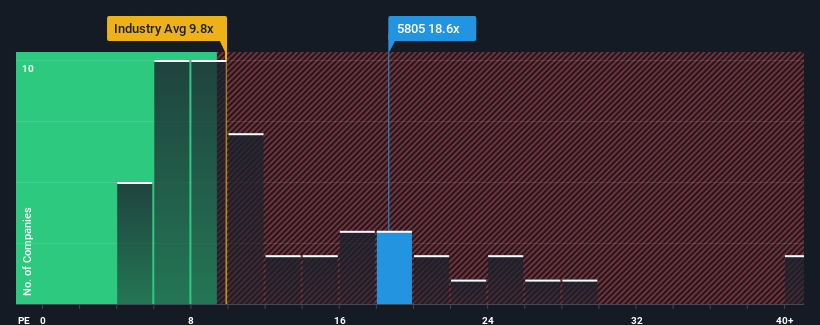

Following the firm bounce in price, SWCC's price-to-earnings (or "P/E") ratio of 18.6x might make it look like a sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 12x and even P/E's below 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

There hasn't been much to differentiate SWCC's and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for SWCC

Is There Enough Growth For SWCC?

There's an inherent assumption that a company should outperform the market for P/E ratios like SWCC's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 11%. This was backed up an excellent period prior to see EPS up by 54% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 21% per year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 9.8% per year, which is noticeably less attractive.

In light of this, it's understandable that SWCC's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in SWCC's shares has lifted the company's P/E to a fairly high level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that SWCC maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for SWCC you should be aware of.

If you're unsure about the strength of SWCC's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5805

SWCC

Operates in the energy systems, communication systems, and device businesses in Japan and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives