- Japan

- /

- Electrical

- /

- TSE:5803

Will Fujikura's (TSE:5803) Forecast Revisions Reveal a Broader Shift in Tech Sector Strategy?

Reviewed by Sasha Jovanovic

- Fujikura Ltd. recently held a board meeting to discuss revisions to its consolidated financial forecasts for the fiscal year ending March 31, 2026, as well as changes to its year-end dividend projections.

- These internal reviews came as broader market pressures, particularly in Japan’s tech sector, were influenced by global economic uncertainty and geopolitical tensions.

- We'll examine how heightened investor concerns about tech valuations and macroeconomic risks are shaping Fujikura's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Fujikura's Investment Narrative?

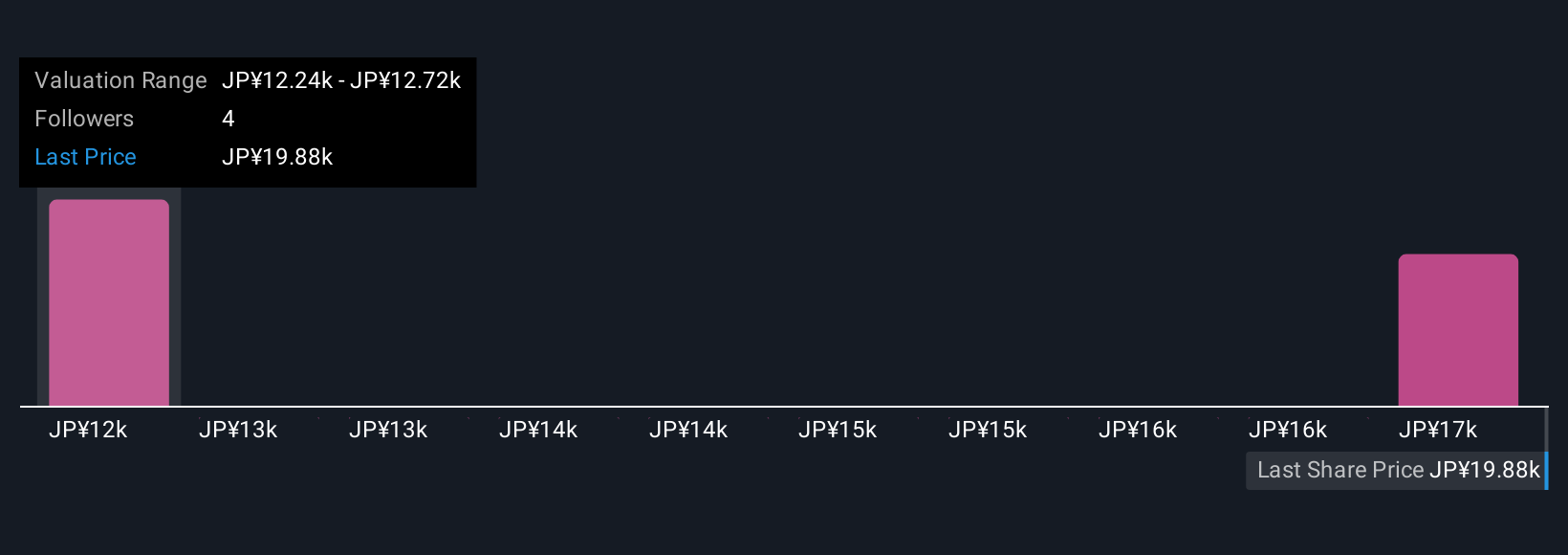

The big picture for Fujikura shareholders means believing in the company’s role at the intersection of technology infrastructure and next-generation communications, especially as AI and data center expansion drive demand for optical fiber. The recent board meeting, focused on revising forecasts and year-end dividends, comes as Japanese tech stocks have been hit by worries over valuations, higher bond yields, and regional diplomatic issues. While the price slid after these pressures, recent earnings and guidance were robust, and the company's solid growth story hasn’t fundamentally shifted. However, the near-term risk has clearly risen: the market’s sharp volatility, paired with board-level reevaluations, means any downward revision to financial targets or dividends could add to uncertainty. That said, if revisions remain minimal, current short-term catalysts like strong sector demand and earnings momentum are mostly intact.

Yet, given recent price swings and board changes, dividend stability is something investors shouldn’t take for granted. Fujikura's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on Fujikura - why the stock might be worth as much as ¥18171!

Build Your Own Fujikura Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fujikura research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fujikura research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fujikura's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5803

Fujikura

Engages in telecommunication and power systems, electronic, and automotive products businesses in Japan, the rest of Asia, North America, Europe, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives