Japan Steel Works (TSE:5631): Assessing Valuation After Surge in Defense Spending Optimism

Reviewed by Simply Wall St

The appointment of Sanae Takaichi as Japan’s first female prime minister has fueled optimism in Tokyo’s markets. For Japan Steel Works (TSE:5631), investors are watching closely as expectations rise for defense spending and ongoing easy credit.

See our latest analysis for Japan Steel Works.

Japan Steel Works has seen remarkable momentum lately, with the share price jumping 19% over the past month, helped by enthusiasm around government spending and supportive policies. Looking at the bigger picture, the 1-year total shareholder return stands at an impressive 95%, easily outpacing most market peers and suggesting that optimism could still have room to run.

If the emerging strength in defense and industrials has you scanning for similar opportunities, explore the latest movers in the sector with our See the full list for free..

With momentum and expectations running high, the key question now is whether Japan Steel Works is trading at a bargain or if markets have already factored in all the upside. Could there still be a window for investors to capitalize?

Price-to-Earnings of 39.9x: Is it justified?

Japan Steel Works is trading at a price-to-earnings (P/E) ratio of 39.9x, which is significantly higher than both its industry peers and the broader market, with the last close at ¥10,155.

The price-to-earnings ratio indicates how much investors are willing to pay per yen of earnings. A high P/E can suggest that the market expects robust future growth, or that optimism has pushed prices ahead of fundamentals.

For Japan Steel Works, this P/E is almost double the peer average of 20.5x and nearly triple the machinery industry average of 13.5x. In addition, compared to its estimated fair P/E of 28.7x, the current valuation appears stretched, which may indicate that the market is overestimating near-term earnings potential or factoring in exceptional future growth.

Explore the SWS fair ratio for Japan Steel Works

Result: Price-to-Earnings of 39.9x (OVERVALUED)

However, slower-than-expected earnings growth or a reversal in government spending could quickly challenge the upbeat outlook that is currently priced into Japan Steel Works’ shares.

Find out about the key risks to this Japan Steel Works narrative.

Another View: What Does the DCF Model Say?

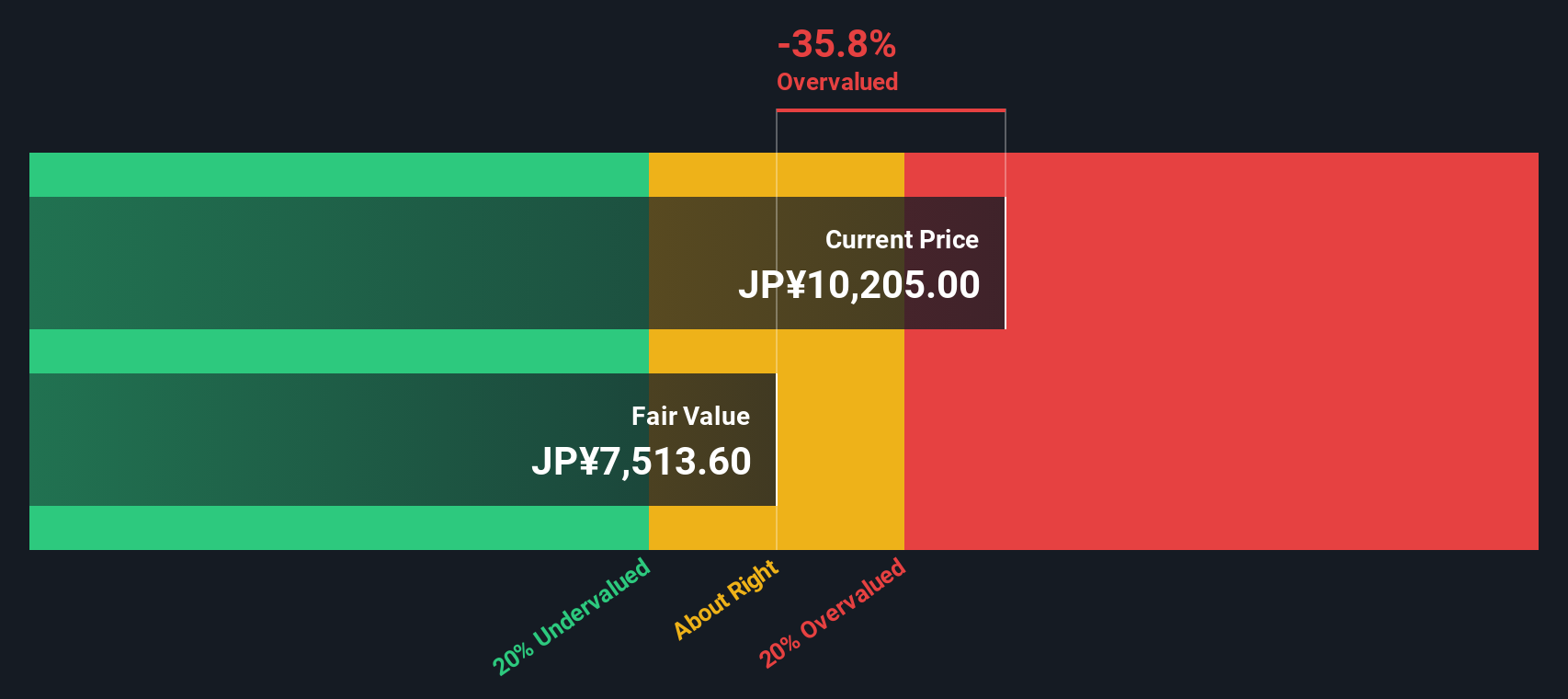

Looking through the lens of the SWS DCF model, Japan Steel Works appears overvalued. The current share price of ¥10,155 is significantly higher than our estimated fair value of ¥7,510, according to the model. This sizable gap challenges the recent market optimism and raises new questions for investors.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Japan Steel Works for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Japan Steel Works Narrative

If you have a different perspective on Japan Steel Works or want to dig deeper into the numbers yourself, it's easy to build your own view in a few minutes. Do it your way.

A great starting point for your Japan Steel Works research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take the next step toward smarter investing by finding unique opportunities you might not see elsewhere. Equip yourself with tools that spotlight high-potential stocks, proven winners, and emerging trends before the crowd catches on.

- Capture the potential of rapid innovation by targeting these 24 AI penny stocks that are set to transform industries with artificial intelligence breakthroughs.

- Boost your income strategy by securing steady cash flow from these 17 dividend stocks with yields > 3% that offer yields above 3%.

- Tap into tomorrow’s financial leaders by identifying these 879 undervalued stocks based on cash flows currently trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5631

Japan Steel Works

Engages in the provision of industrial machinery products, and material and engineering solutions in Japan and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives