TOTO (TSE:5332): Evaluating the Stock’s Valuation After Recent Performance Trends

Reviewed by Kshitija Bhandaru

See our latest analysis for TOTO.

While TOTO's share price has seen modest recent fluctuations, the bigger picture reveals that momentum has been fading. The 1-year total shareholder return is -21.8%, despite some growth over the last quarter. In short, the stock's performance has lagged peers over the past year, reflecting a more cautious investor outlook even as operational growth continues in the background.

If you’re curious about what else is capturing market attention, now is a great moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading nearly 6% below analyst targets and growth in underlying earnings, is TOTO stock undervalued at current levels, or has the market already priced in any upside from further improvements?

Price-to-Earnings of 66.3x: Is it justified?

TOTO's stock trades at a price-to-earnings (P/E) ratio of 66.3x, nearly double the average of its peer group and broader industry benchmarks. This elevated multiple means investors are paying a significant premium for each unit of reported earnings compared to most competitors.

The P/E ratio measures how much investors are willing to pay for a company's earnings. In TOTO's case, a P/E of 66.3x may imply confidence in future profit growth or could signal the market is currently overvaluing the company's earnings power given recent results.

Despite signs of expected earnings growth, this P/E is much higher than the JP Building industry average of 15.2x and far exceeds the estimated fair price-to-earnings ratio of 26.6x. This sharp disparity suggests the market's expectations are running well ahead of both industry norms and what valuation models would indicate as reasonable.

Explore the SWS fair ratio for TOTO

Result: Price-to-Earnings of 66.3x (OVERVALUED)

However, continued underperformance compared to peers or unexpected slowdowns in earnings growth could quickly challenge the case for TOTO's premium valuation.

Find out about the key risks to this TOTO narrative.

Another View: SWS DCF Model Weighs In

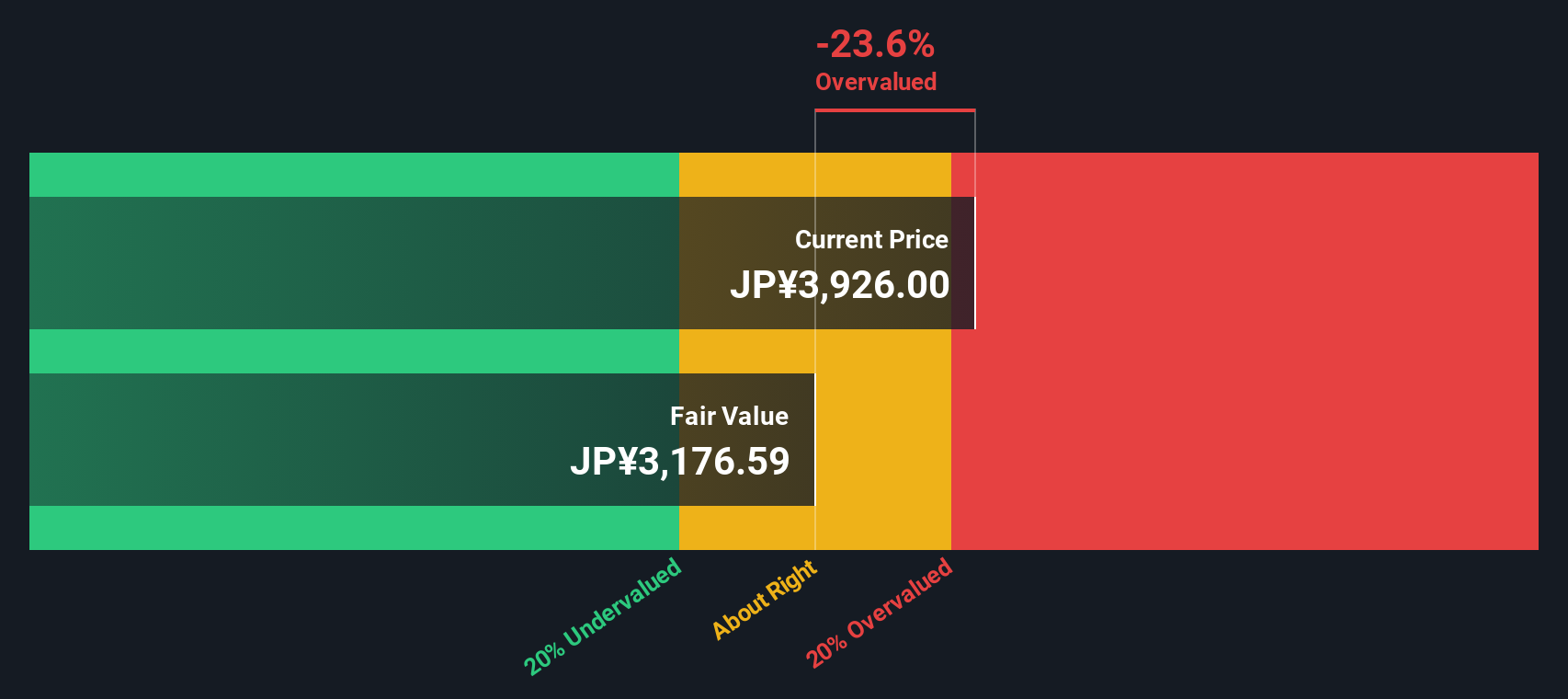

Looking at TOTO through the lens of the SWS DCF model, the picture shifts. The model estimates fair value at ¥3,183 per share, meaning the current price trades notably above what long-term cash flows would justify. This suggests the stock may be overvalued on this basis, even if earnings growth is expected. Which method best captures reality—the market's optimism or a more conservative forecast?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TOTO for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TOTO Narrative

If you have a different perspective or want to analyze the numbers for yourself, you're free to explore the data and build your own story in just minutes, with Do it your way.

A great starting point for your TOTO research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why let great opportunities slip by? Use the Simply Wall Street Screener to confidently spot investments that fit your goals and get ahead of the crowd.

- Boost your portfolio’s income by targeting reliable yields through these 18 dividend stocks with yields > 3% offering above-average returns backed by strong fundamentals.

- Tap into the explosive world of artificial intelligence with these 24 AI penny stocks. Find companies at the forefront of innovation, shaping tomorrow’s technology landscape.

- Seize undervalued gems hidden in plain sight by harnessing these 878 undervalued stocks based on cash flows, where strong cash flows signal potential upside the market has yet to recognize.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOTO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5332

TOTO

Manufactures and sells bathroom and kitchen plumbing fixtures worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives