Three Undiscovered Japanese Gems Poised For Potential Growth

Reviewed by Simply Wall St

Japan's stock markets have experienced significant volatility recently, driven by a rebounding yen and concerns over global growth. Despite this turbulence, the Nikkei 225 Index and the broader TOPIX Index managed to recoup much of their losses by week's end. In such a dynamic environment, identifying potential growth stocks requires a keen eye for companies that demonstrate resilience and adaptability. Here, we explore three lesser-known Japanese stocks that show promise amid these fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Ogaki Kyoritsu Bank | 130.22% | 1.61% | -0.98% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

| CAC Holdings | 14.97% | -0.57% | 5.02% | ★★★★☆☆ |

| Toyo Kanetsu K.K | 45.07% | 2.00% | 11.94% | ★★★★☆☆ |

| Yukiguni Maitake | 170.63% | -10.20% | -39.66% | ★★★★☆☆ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Noritake (TSE:5331)

Simply Wall St Value Rating: ★★★★★★

Overview: Noritake Co., Limited, with a market cap of ¥105.99 billion, operates through its subsidiaries to provide industrial, ceramic and material, engineering, and tabletop products both in Japan and internationally.

Operations: Noritake Co., Limited generates revenue primarily from industrial, ceramic and material, engineering, and tabletop products. The company has a market cap of ¥105.99 billion.

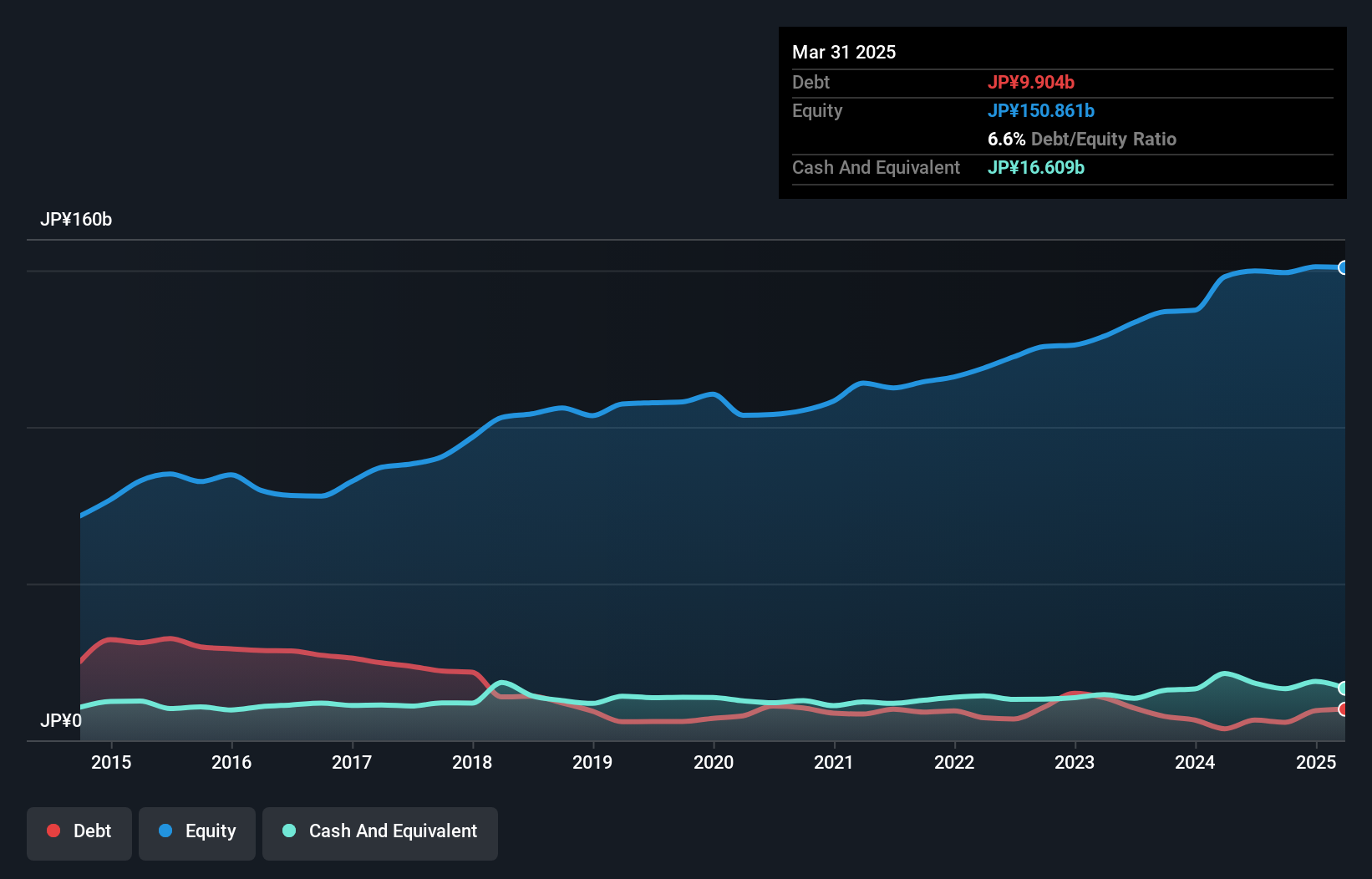

Noritake, a notable player in the ceramics industry, has seen its debt-to-equity ratio improve from 5.6 to 4.3 over five years and earnings grow at an annual rate of 20.5%. Trading at 62.6% below estimated fair value, it presents a compelling case for value investors. The company recently announced a share repurchase program worth ¥2,500 million to enhance shareholder returns and capital efficiency by canceling all repurchased shares.

- Delve into the full analysis health report here for a deeper understanding of Noritake.

Understand Noritake's track record by examining our Past report.

Lifenet Insurance (TSE:7157)

Simply Wall St Value Rating: ★★★★★★

Overview: Lifenet Insurance Company offers life insurance products and services in Japan, North America, and internationally, with a market cap of ¥120.48 billion.

Operations: Lifenet Insurance Company generates revenue primarily from life insurance premiums across Japan, North America, and international markets. The company's net profit margin for the most recent period is 5.23%.

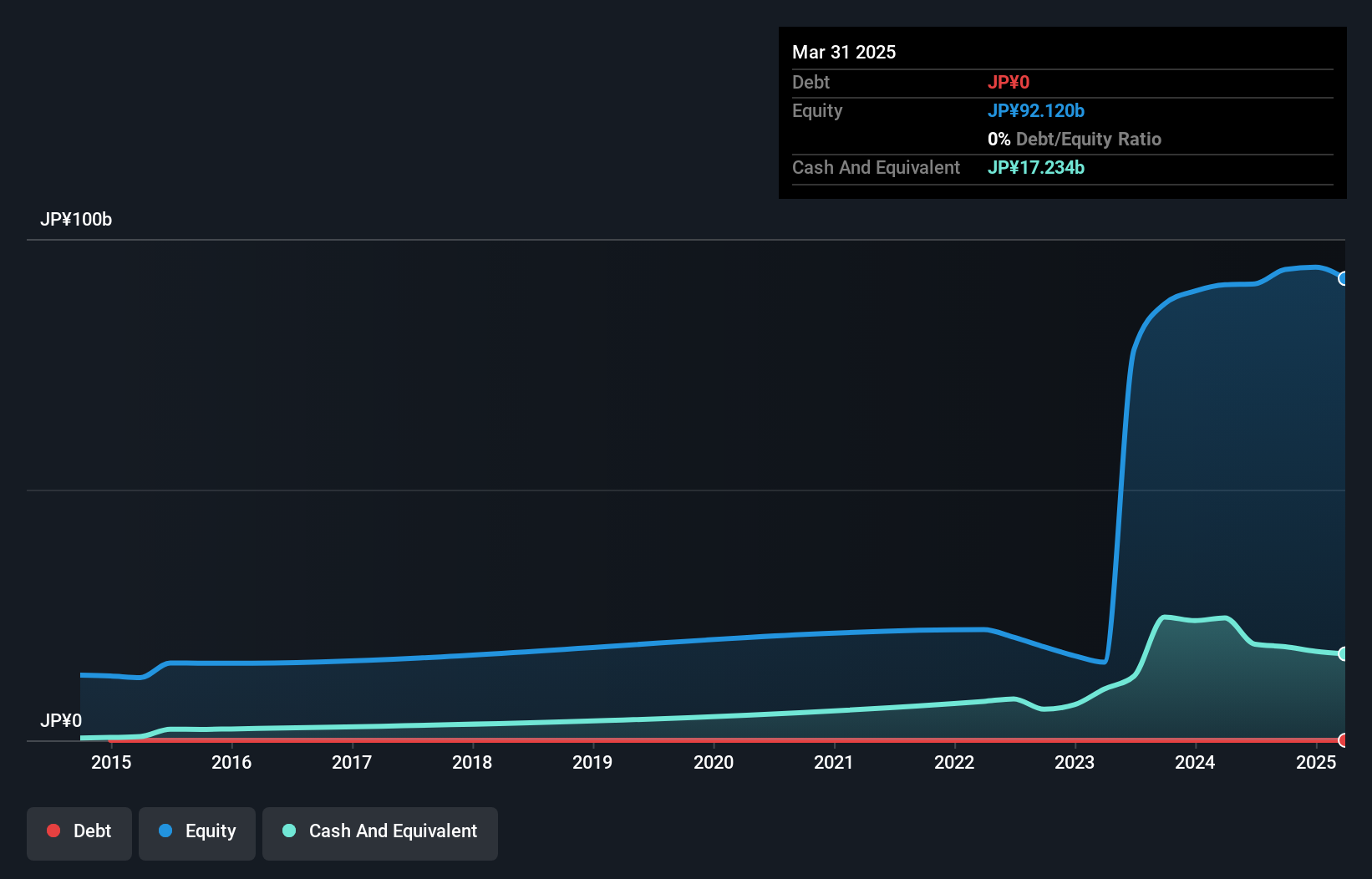

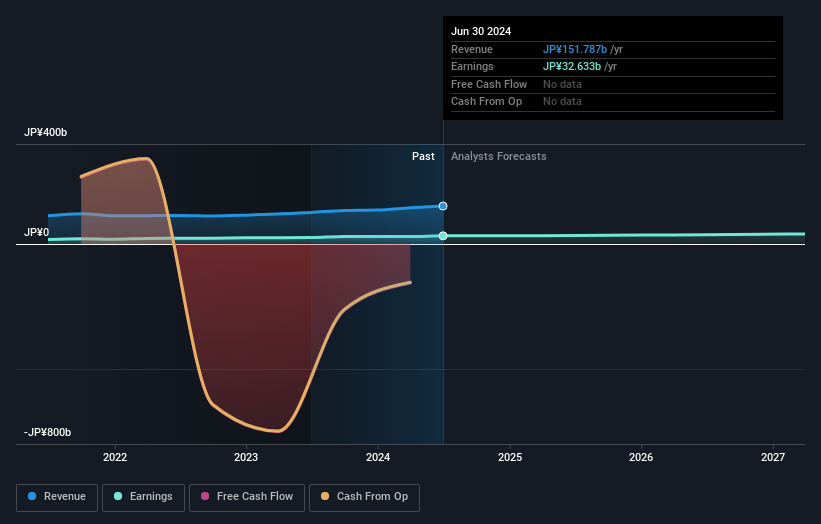

Lifenet Insurance has turned profitable this year, making comparisons to the insurance industry's 43.3% earnings growth challenging. The company is debt-free and boasts high-quality past earnings. However, shareholders experienced dilution over the past year, and its share price has been highly volatile in recent months. Despite these fluctuations, Lifenet's earnings are projected to grow at 7.66% annually. Recent board changes include retirements of key directors and an anticipated net loss of ¥6.2 billion for FY2025.

77 Bank (TSE:8341)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The 77 Bank, Ltd., along with its subsidiaries, offers a range of banking products and services to both corporate and individual clients in Japan, with a market cap of ¥291.74 billion.

Operations: Revenue streams for 77 Bank primarily come from interest income, fees, and commissions. Cost breakdowns include interest expenses, personnel costs, and general administrative expenses. Net profit margin is a key metric to watch, showing variations over recent periods.

With total assets of ¥10,577.6B and equity at ¥595.7B, 77 Bank's deposits stand at ¥8,999.8B while loans are ¥5,866.4B with a net interest margin of 1%. Bad loans are high at 1010.4% of total loans, indicating insufficient allowance for bad debts. Despite these challenges, earnings grew by 27.2% over the past year and exceeded the banking industry's growth rate of 18.3%, suggesting robust performance in a competitive sector.

- Take a closer look at 77 Bank's potential here in our health report.

Gain insights into 77 Bank's past trends and performance with our Past report.

Next Steps

- Click here to access our complete index of 715 Japanese Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7157

Lifenet Insurance

Provides life insurance products and services in Japan, North America, and internationally.

Flawless balance sheet with acceptable track record.