A Look at AGC (TSE:5201) Valuation Following New mRNA Therapy Collaboration with Repair Biotechnologies

Reviewed by Simply Wall St

AGC (TSE:5201) saw investor attention this week following news that its Biologics division is partnering with Repair Biotechnologies to co-develop a groundbreaking mRNA therapy for atherosclerotic plaques, which is a significant global health issue.

See our latest analysis for AGC.

AGC’s recent collaboration news arrived as momentum was already building. Its 12.8% 1-month share price return and 20.8% total shareholder return over the past year show investors aren’t just reacting to headlines, but seeing long-term growth potential unfold.

If you’re looking to spot the next fast-moving opportunity, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With this momentum and ambitious new partnership, the big question for investors now is whether AGC’s recent rally leaves the stock undervalued, or if the market has already factored in its bright growth prospects.

Most Popular Narrative: 8.8% Overvalued

Despite AGC’s most popular narrative estimating a fair value below the current share price, the story is powered by ambitious projections for margin expansion and strategic business pivots. This creates a crucial juncture for anyone following the stock’s long-term direction.

Expanded production capacity in Southeast Asia, especially in Chemicals (chlor-alkali, PVC), positions AGC to capture greater market share in regions with structural supply constraints, supporting higher top-line growth and scale-driven margin expansion. Structural reforms and the strategic exit from loss-making U.S. biopharmaceutical operations will eliminate a major drag on profits, while refocusing Life Science on high-growth, single-use bag (SUB) technologies is expected to restore segment profitability and drive new growth from 2026 onward, directly benefitting net income.

What is the secret behind this bold valuation and its significant premium to current prices? The narrative hints at a multi-year turnaround, including aggressive expansion, margin improvements, and a reset of profit drivers. There is a key quantitative assumption that is larger than most anticipate, and it could influence how you evaluate AGC’s future. Dive in to discover what could be powering the next move.

Result: Fair Value of ¥4,965 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand or continued losses in key segments could quickly challenge these optimistic growth expectations and reshape AGC’s value proposition.

Find out about the key risks to this AGC narrative.

Another View: Market-Based Ratios Raise Big Questions

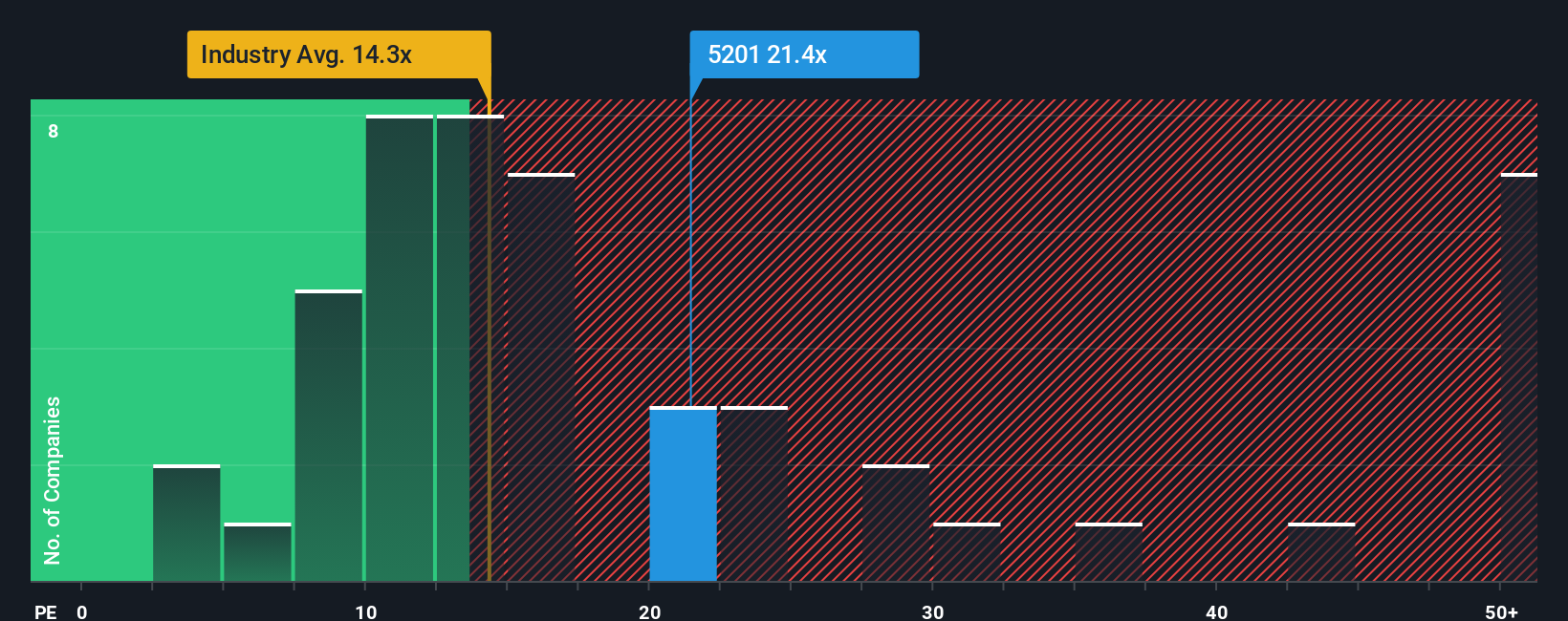

Looking through a market-based lens, AGC trades at a price-to-earnings ratio of 22.1x, notably above the Japanese Building industry average of 14.7x, yet below the peer group average of 63.4x. Compared to the fair ratio, the level markets may shift toward at 23.5x, this reveals both a premium and a potential risk if sentiment changes. Does this gap signal over-optimism, or is the market recognizing AGC’s upcoming growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AGC Narrative

If the narrative here doesn't align with your view or you want to dig deeper into AGC’s story, it takes just a few minutes to shape your own perspective. Do it your way

A great starting point for your AGC research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let fresh opportunities pass you by. Stay ahead with smarter investing choices by using powerful screeners that reveal standout companies and untapped potential before the crowd.

- Recharge your strategy and hunt for steady income by checking out these 15 dividend stocks with yields > 3% with strong yields that can help boost your portfolio’s returns.

- Seize the future of artificial intelligence by tapping into these 25 AI penny stocks, which feature breakthroughs in next-generation automation, data analysis, and real-world applications.

- Position yourself early and uncover tomorrow’s potential leaders with these 921 undervalued stocks based on cash flows, offering compelling value based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5201

AGC

Manufactures and sells architectural glass, electronics, chemicals, automotive, and ceramics worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.