As global markets navigate a complex landscape of economic reports and earnings data, with major indices like the Nasdaq Composite and S&P MidCap 400 experiencing volatility, investors are keenly observing the interplay between growth and value stocks. Amidst this backdrop of cautious optimism and fluctuating market signals, dividend stocks present a compelling option for those seeking steady income streams. A good dividend stock typically offers reliable payouts backed by strong fundamentals, making it an attractive choice in times of economic uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.69% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.50% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.77% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.46% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.33% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.23% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.53% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.94% | ★★★★★★ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Dai Nippon Toryo Company (TSE:4611)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dai Nippon Toryo Company, Limited, along with its subsidiaries, manufactures and sells coatings and jet inks both in Japan and internationally, with a market cap of ¥29.29 billion.

Operations: Dai Nippon Toryo Company's revenue segments include Domestic Coatings at ¥51.44 billion, Overseas Coatings at ¥8.38 billion, Lighting at ¥9.82 billion, and Fluorescent Color Materials at ¥1.28 billion.

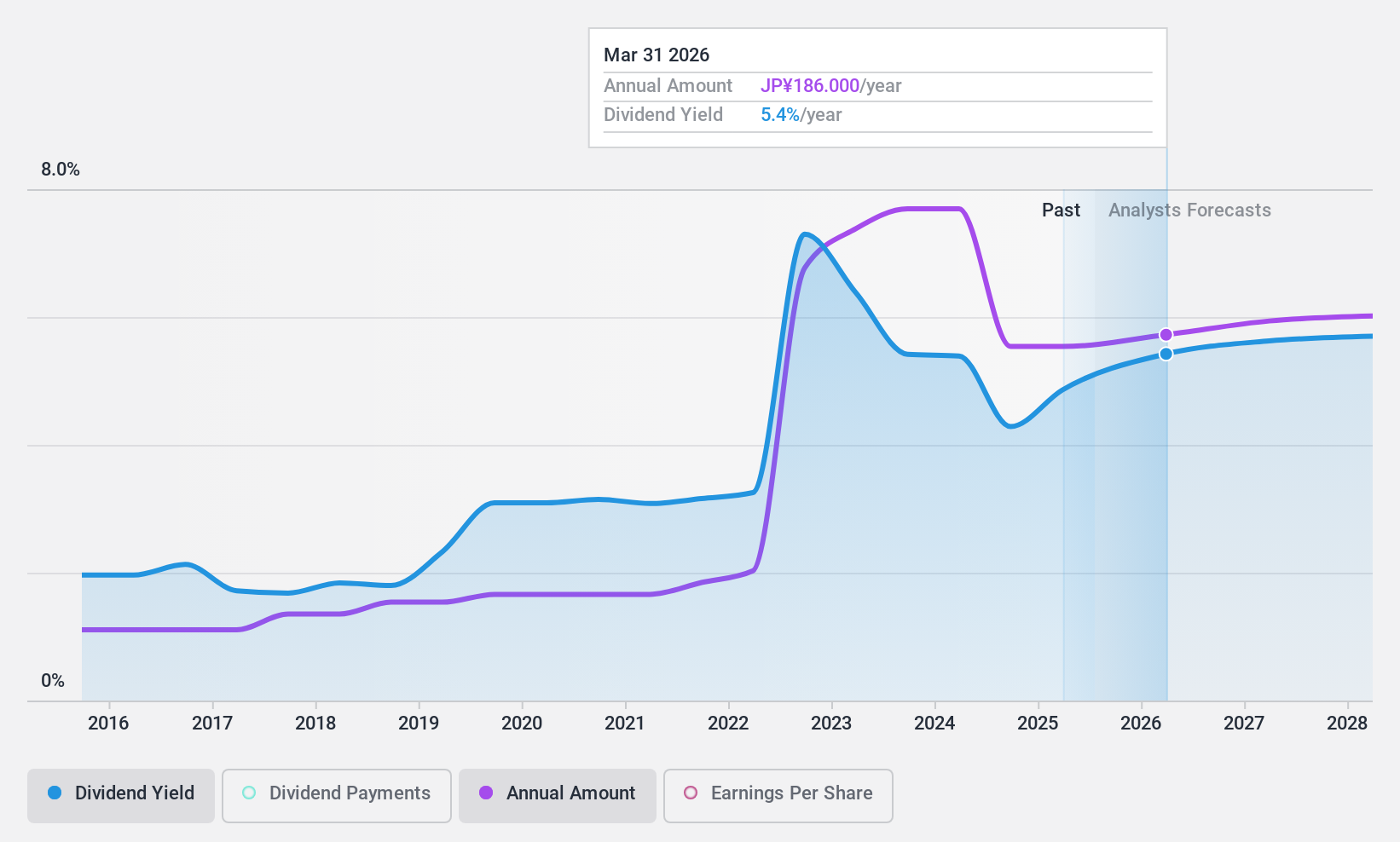

Dividend Yield: 3.7%

Dai Nippon Toryo Company has shown consistent dividend growth over the past decade, with a recent increase to JPY 40 per share for the fiscal year ending March 2025. Despite a low payout ratio of 20.5%, dividends are not covered by free cash flows, indicating potential sustainability concerns. The company's earnings have grown significantly by 28.6% in the past year, and it trades at a favorable price-to-earnings ratio of 6.3x compared to the JP market average.

- Click to explore a detailed breakdown of our findings in Dai Nippon Toryo Company's dividend report.

- Our comprehensive valuation report raises the possibility that Dai Nippon Toryo Company is priced higher than what may be justified by its financials.

Sumitomo Rubber Industries (TSE:5110)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Rubber Industries, Ltd. operates in the tire, sports, and industrial product sectors across Japan, Asia, Europe, North America, and internationally with a market cap of ¥414.93 billion.

Operations: Sumitomo Rubber Industries generates revenue from its Tires segment at ¥1.03 billion, Sports segment at ¥130.22 million, and Industrial and Other Products segment at ¥43.12 million.

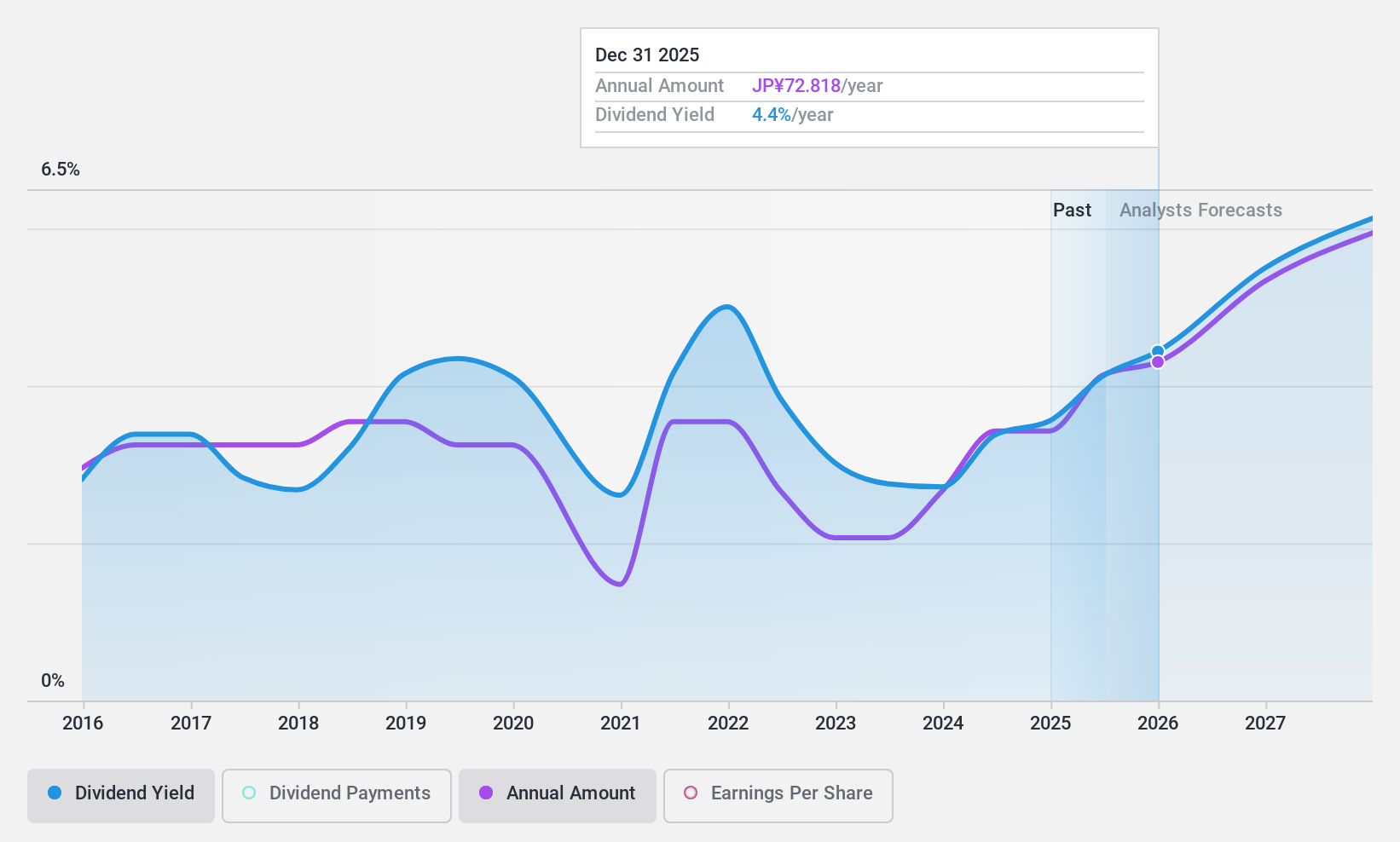

Dividend Yield: 3.5%

Sumitomo Rubber Industries' dividend payments have been volatile over the past decade, with an unstable track record. Despite this, dividends are well-covered by both earnings and cash flows, with a low payout ratio of 31.9% and a cash payout ratio of 14.8%. The company trades at 48% below its estimated fair value, offering good relative value compared to peers. Recent board decisions include terminating production activities at Sumitomo Rubber USA.

- Delve into the full analysis dividend report here for a deeper understanding of Sumitomo Rubber Industries.

- Upon reviewing our latest valuation report, Sumitomo Rubber Industries' share price might be too pessimistic.

Mitsuboshi Belting (TSE:5192)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsuboshi Belting Ltd. manufactures and sells power transmission belts, waterproofing and water shielding sheets, as well as engineering plastics and structural foams in Japan and internationally, with a market cap of ¥115.32 billion.

Operations: Mitsuboshi Belting Ltd.'s revenue segments include power transmission belts, waterproofing and water shielding sheets, and engineering plastics and structural foams.

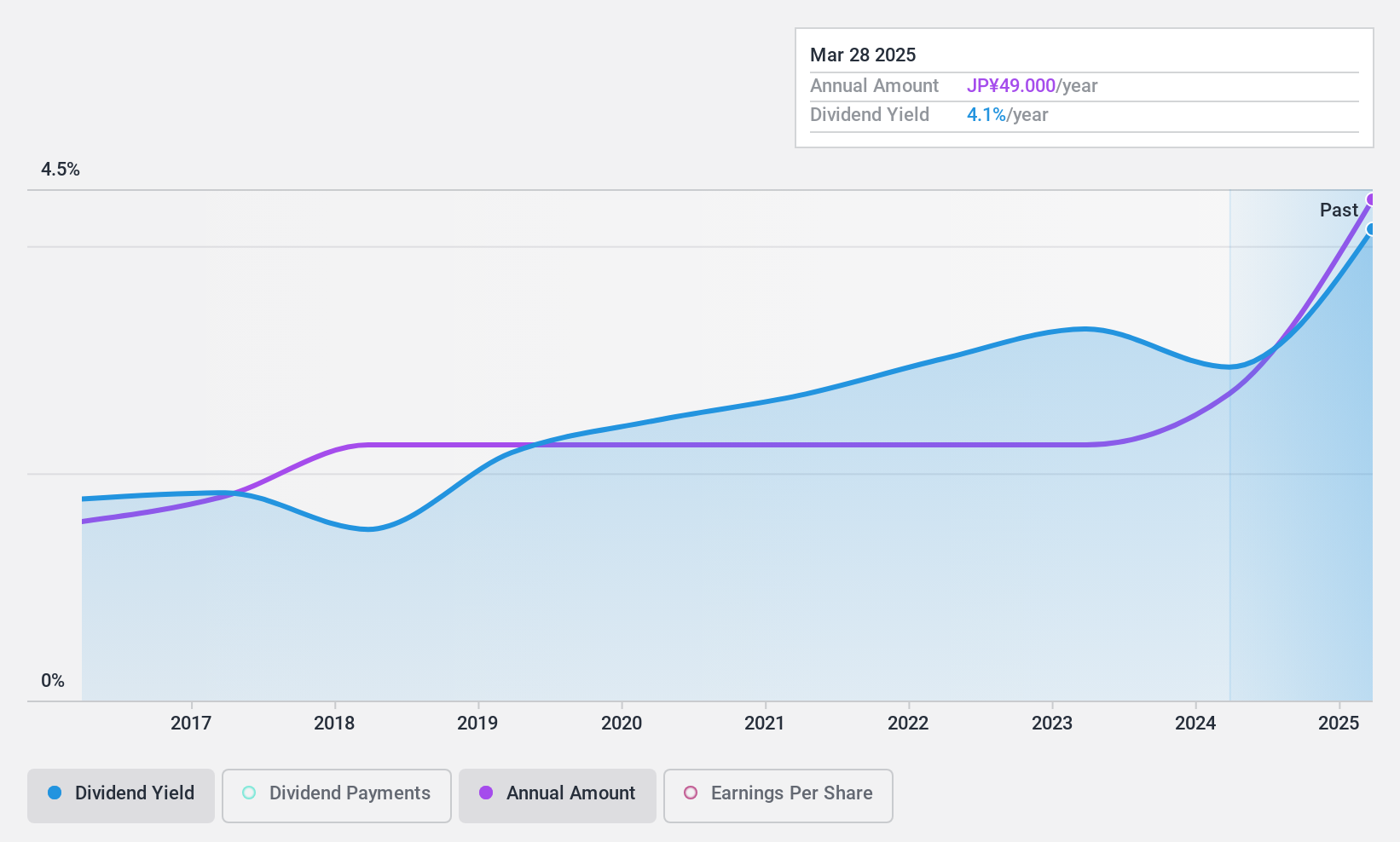

Dividend Yield: 4.3%

Mitsuboshi Belting's dividend yield of 4.31% is among the top 25% in Japan, supported by a payout ratio of 75.9% and cash coverage at 74.2%. Despite past volatility, dividends have grown over the last decade. The company's P/E ratio of 12.7x suggests it is undervalued compared to the market average. A recent share buyback program for ¥1 billion highlights its commitment to shareholder returns amid an evolving business landscape.

- Dive into the specifics of Mitsuboshi Belting here with our thorough dividend report.

- The analysis detailed in our Mitsuboshi Belting valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Click through to start exploring the rest of the 1947 Top Dividend Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5192

Mitsuboshi Belting

Manufactures and sells belts, construction materials, etc.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives