As global markets react to the recent U.S. election results, small-cap stocks have shown notable movement, with the Russell 2000 Index leading gains despite not reaching record highs. In this dynamic environment, identifying promising stocks involves looking for companies that can capitalize on growth opportunities and adapt to changing economic policies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Winstek Semiconductor | 11.42% | 9.38% | 24.14% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Fourth Milling | NA | 4.35% | 29.30% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Can-One Berhad | 88.80% | 9.35% | 23.83% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi (IBSE:KLKIM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi operates in the building materials and chemicals sector, serving both Turkish and international markets, with a market capitalization of TRY14.40 billion.

Operations: Kalekim generates revenue primarily from its building materials and chemicals segments, catering to both domestic and international markets. The company's financial performance is highlighted by a focus on controlling costs, which influences its profitability metrics.

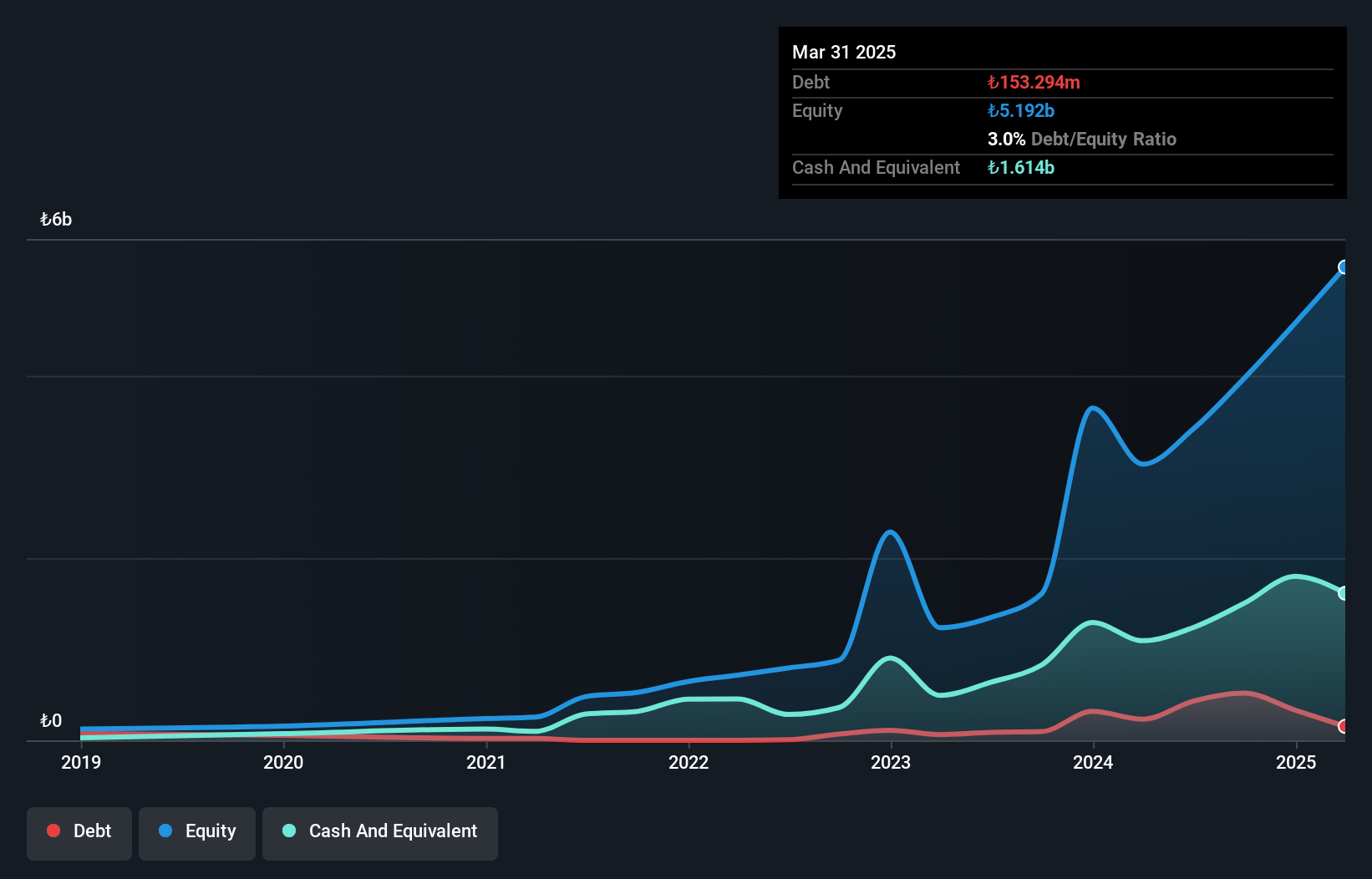

Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi, a dynamic player in the chemicals sector, has shown impressive financial resilience. The company's debt-to-equity ratio improved significantly from 45.6% to 13% over five years, while its earnings grew by a robust 40% last year, outpacing the industry average of -8.3%. Recent earnings results highlight strong performance with third-quarter sales reaching TRY 1.87 billion and net income at TRY 240.98 million compared to a loss previously recorded. Despite not being free cash flow positive recently, Kalekim's price-to-earnings ratio of 18.2x suggests it offers good value relative to industry peers at 19.1x.

HangzhouS MedTech (SHSE:688581)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou AGS MedTech Co., Ltd. focuses on the research, development, production, sale, and service of endoscopic surgery equipment and accessories in China with a market cap of CN¥4.97 billion.

Operations: The company generates revenue primarily from the sale of endoscopic surgery equipment and accessories. It has a market cap of CN¥4.97 billion.

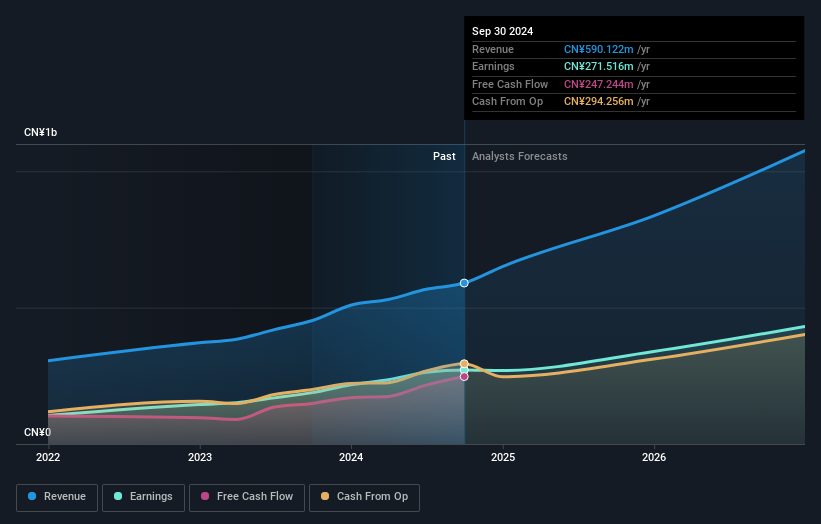

HangzhouS MedTech seems to be a promising player in the medical equipment sector, showing impressive earnings growth of 44% over the past year, outpacing the industry average. It operates debt-free and is trading at about 50% below its estimated fair value, suggesting potential undervaluation. The company reported sales of CNY 427 million for the first nine months of 2024, up from CNY 346 million a year prior. Net income also rose to CNY 197 million compared to CNY 143 million previously. With high-quality earnings and positive free cash flow, it appears well-positioned for future growth.

- Click to explore a detailed breakdown of our findings in HangzhouS MedTech's health report.

Gain insights into HangzhouS MedTech's past trends and performance with our Past report.

Mitsuboshi Belting (TSE:5192)

Simply Wall St Value Rating: ★★★★★★

Overview: Mitsuboshi Belting Ltd. is a company that produces and distributes power transmission belts, waterproofing and water shielding sheets, as well as engineering plastics and structural foams both in Japan and globally, with a market capitalization of ¥118.58 billion.

Operations: The company's revenue streams primarily include sales from power transmission belts, waterproofing and water shielding sheets, and engineering plastics. The net profit margin reflects the company’s efficiency in converting revenue into actual profit after accounting for all expenses.

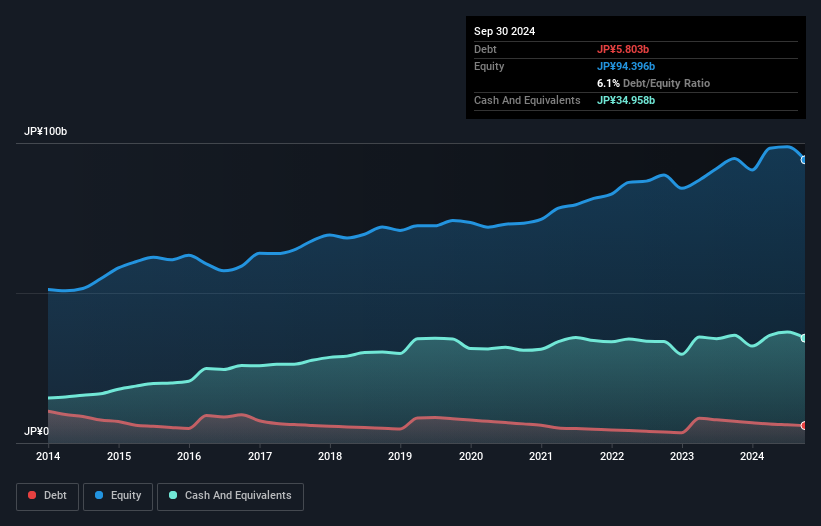

Mitsuboshi Belting, a niche player in the machinery sector, has shown impressive earnings growth of 29.5% over the past year, outpacing the industry's 8.3%. The company boasts a solid debt-to-equity ratio improvement from 11.7% to 6.1% over five years and maintains more cash than its total debt, underscoring financial stability. A recent ¥4.2 billion one-off gain influenced its financials significantly up to June 2024. With a price-to-earnings ratio of 12.7x below Japan's market average of 13.5x, it appears well-valued despite forecasts suggesting an average annual earnings drop of 8.6% for the next three years.

- Click here to discover the nuances of Mitsuboshi Belting with our detailed analytical health report.

Understand Mitsuboshi Belting's track record by examining our Past report.

Turning Ideas Into Actions

- Reveal the 4699 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:KLKIM

Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi

Provides building materials and chemicals in Turkey and internationally.

Excellent balance sheet with proven track record.