- Japan

- /

- Construction

- /

- TSE:5076

INFRONEER Holdings Inc. (TSE:5076) Is Going Strong But Fundamentals Appear To Be Mixed : Is There A Clear Direction For The Stock?

INFRONEER Holdings (TSE:5076) has had a great run on the share market with its stock up by a significant 35% over the last three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Particularly, we will be paying attention to INFRONEER Holdings' ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for INFRONEER Holdings is:

8.5% = JP¥49b ÷ JP¥578b (Based on the trailing twelve months to September 2025).

The 'return' is the income the business earned over the last year. So, this means that for every ¥1 of its shareholder's investments, the company generates a profit of ¥0.09.

Check out our latest analysis for INFRONEER Holdings

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

INFRONEER Holdings' Earnings Growth And 8.5% ROE

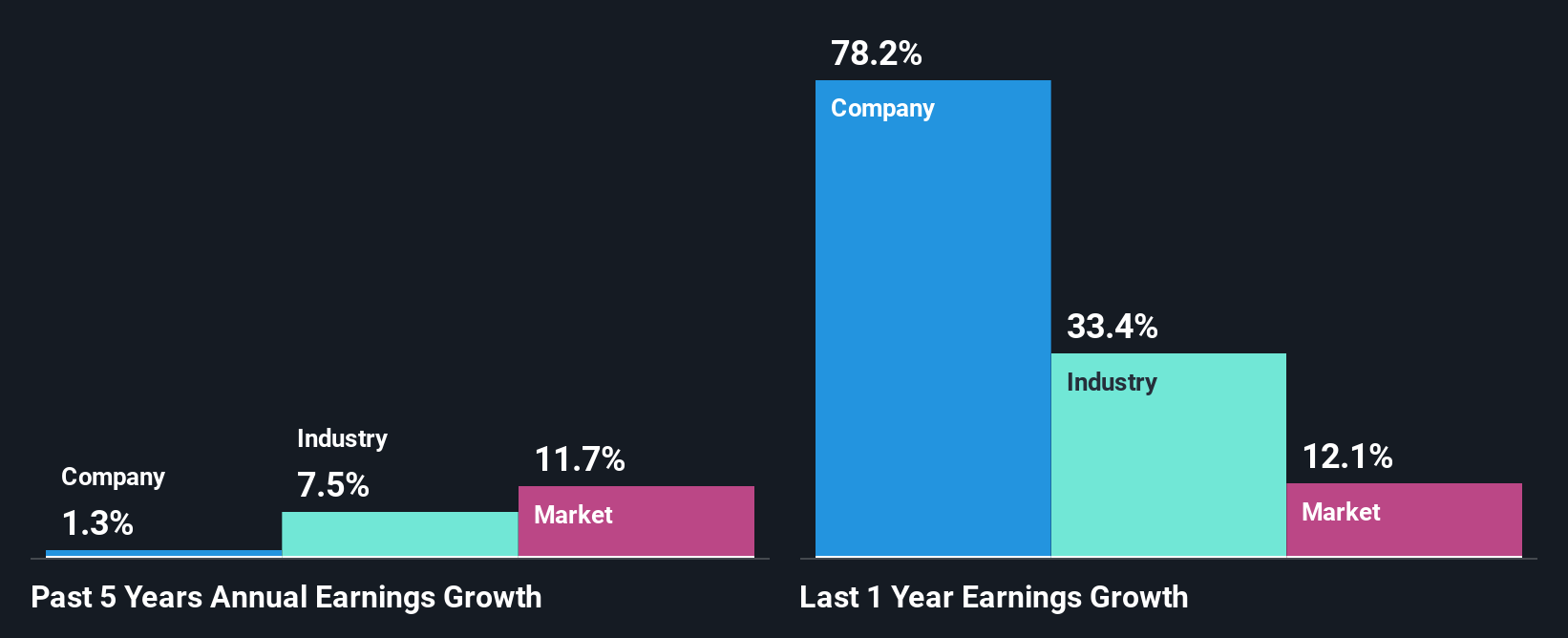

On the face of it, INFRONEER Holdings' ROE is not much to talk about. However, its ROE is similar to the industry average of 9.3%, so we won't completely dismiss the company. However, INFRONEER Holdings has seen a flattish net income growth over the past five years, which is not saying much. Remember, the company's ROE is not particularly great to begin with. Hence, this provides some context to the flat earnings growth seen by the company.

We then compared INFRONEER Holdings' net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 7.5% in the same 5-year period, which is a bit concerning.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about INFRONEER Holdings''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is INFRONEER Holdings Efficiently Re-investing Its Profits?

In spite of a normal three-year median payout ratio of 46% (or a retention ratio of 54%), INFRONEER Holdings hasn't seen much growth in its earnings. So there could be some other explanation in that regard. For instance, the company's business may be deteriorating.

Moreover, INFRONEER Holdings has been paying dividends for four years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Conclusion

In total, we're a bit ambivalent about INFRONEER Holdings' performance. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. We also studied the latest analyst forecasts and found that the company's earnings growth is expected be similar to its current growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5076

Solid track record average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026